Get the free BUSINESS INCOMEEXPENSE REPORT - DaleTaxcom

Show details

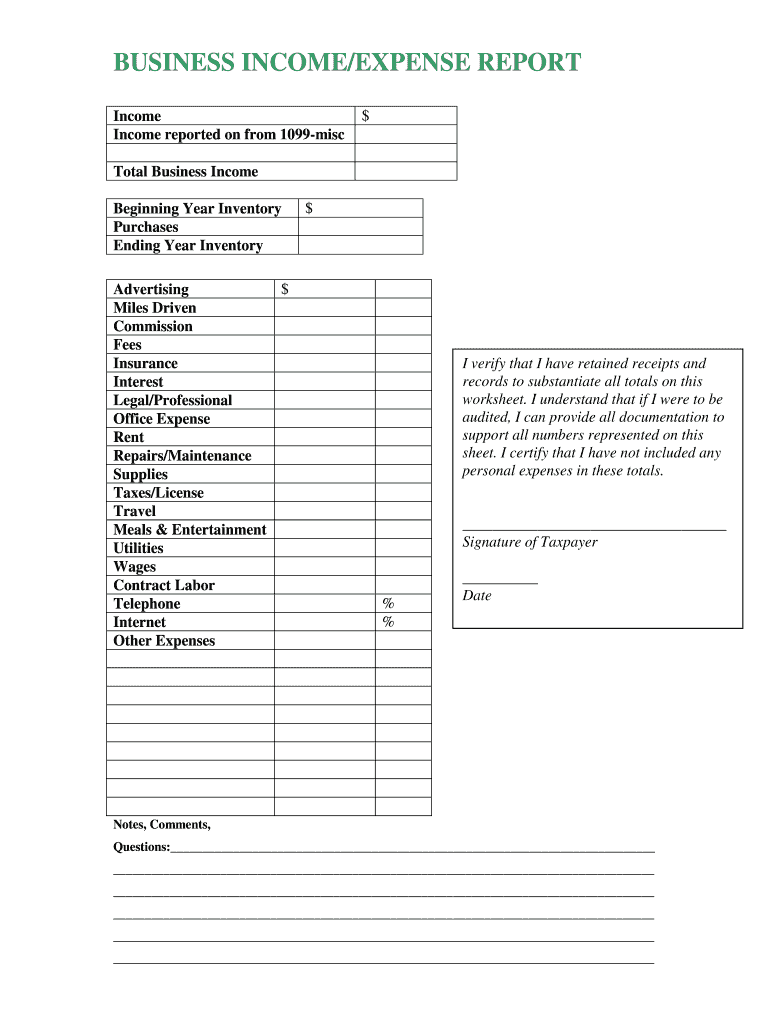

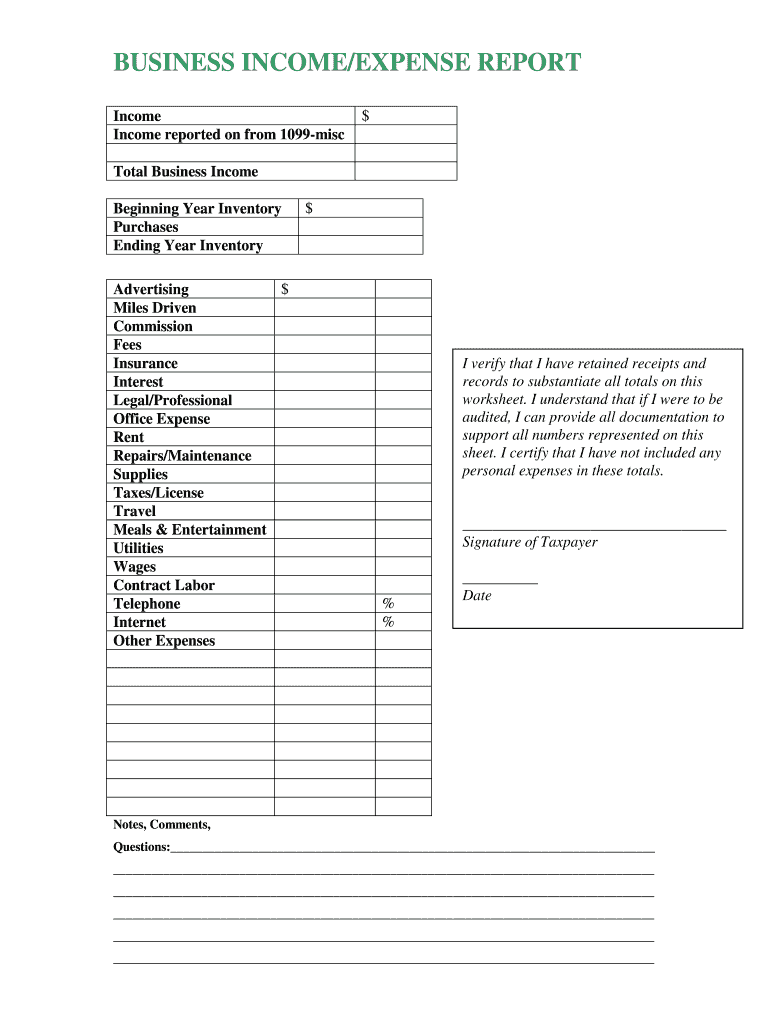

BUSINESS INCOME/EXPENSE REPORT

Income reported on from 1099misc

$

Total Business Income

Beginning Year Inventory

Purchases

Ending Year Inventory

$

Advertising

Miles Driven

Commission

Fees

Insurance

Interest

Legal/Professional

Office

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business incomeexpense report

Edit your business incomeexpense report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business incomeexpense report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business incomeexpense report online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business incomeexpense report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business incomeexpense report

How to fill out a business income/expense report:

01

Start by gathering all relevant financial documents, such as income statements, receipts, invoices, and bank statements. These will help you accurately report your business's income and expenses.

02

Begin with the income section of the report. Record all sources of income your business has generated during the specified time period. This can include sales revenue, rental income, interest earned, or any other form of income. Be sure to provide detailed descriptions and specify the amounts earned for each source.

03

Next, move on to the expense section. Categorize and record all business expenses incurred during the given timeframe. Common expense categories may include rent, utilities, office supplies, advertising costs, employee salaries, and any other business-related expenses. It is important to provide clear descriptions and specify the amounts spent for each expense.

04

Carefully review all calculations and ensure they are accurate. Double-check that each entry is in the correct column and corresponds with the appropriate category. Any discrepancies or errors should be corrected before submitting the report.

05

Consider consulting a tax professional or accountant if you are unsure about any aspect of the income/expense report. They can provide guidance on correctly categorizing expenses, understanding tax implications, and complying with any specific reporting requirements.

Who needs a business income/expense report?

01

Business owners: A business income/expense report is essential for business owners as it provides a comprehensive overview of the financial health of their business. It helps track income and expenses, identify potential areas for improvement or cost-cutting, and aids in making informed financial decisions.

02

Investors and shareholders: Investors and shareholders often require accurate financial reports, including income/expense reports, to assess the profitability and stability of a business. This information helps them gauge the potential return on their investment and make informed decisions regarding future investments or divestments.

03

Tax authorities: Business income/expense reports are essential for tax purposes. Tax authorities use these reports to verify the accuracy of reported income, track deductible expenses, and determine the business's tax liability. Filing accurate reports ensures compliance with tax laws and avoids potential penalties or audits.

04

Lenders and creditors: When applying for business loans or seeking credit from suppliers, a business income/expense report helps demonstrate the financial stability and creditworthiness of the business. Lenders and creditors often require these reports to assess the business's ability to repay loans or fulfill financial obligations.

In summary, filling out a business income/expense report involves accurately recording all sources of income and categorizing and documenting all business expenses. This report is vital for business owners, investors, tax authorities, lenders, and creditors as it provides a comprehensive financial overview and aids in decision making and compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my business incomeexpense report in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your business incomeexpense report directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit business incomeexpense report straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing business incomeexpense report right away.

How do I fill out business incomeexpense report on an Android device?

On an Android device, use the pdfFiller mobile app to finish your business incomeexpense report. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is business incomeexpense report?

The business incomeexpense report is a document that details a business's income and expenses over a specific period of time.

Who is required to file business incomeexpense report?

Business owners, self-employed individuals, and corporations are typically required to file a business incomeexpense report.

How to fill out business incomeexpense report?

To fill out a business incomeexpense report, you will need to gather all income and expense records for the specified period and accurately input the information into the report form.

What is the purpose of business incomeexpense report?

The purpose of a business incomeexpense report is to track and analyze a business's financial performance, identify areas of strength and weakness, and make informed business decisions based on the data.

What information must be reported on business incomeexpense report?

On a business incomeexpense report, you must report all sources of income, including sales revenue and investments, as well as all expenses, such as operating costs and salaries.

Fill out your business incomeexpense report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Incomeexpense Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.