Get the free Collection Advantage Strategy

Show details

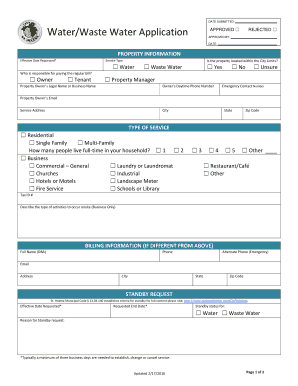

The document outlines the features and benefits of Collection Advantage Strategy, an automated decisioning platform designed to optimize resource allocation in collections by utilizing consumer data.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign collection advantage strategy

Edit your collection advantage strategy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your collection advantage strategy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing collection advantage strategy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit collection advantage strategy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out collection advantage strategy

How to fill out Collection Advantage Strategy

01

Gather all necessary financial data related to collections.

02

Identify key performance indicators (KPIs) relevant to collection success.

03

Analyze current collection processes and identify areas for improvement.

04

Set specific, measurable goals for collection efficiency and effectiveness.

05

Develop strategies for communication with debtors, including tone and frequency.

06

Implement a technology solution to track collections progress.

07

Monitor performance metrics regularly and adjust strategies as needed.

08

Train staff on best practices and incorporate feedback into the strategy.

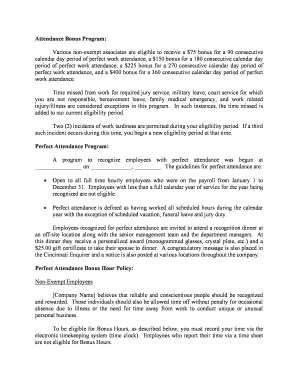

Who needs Collection Advantage Strategy?

01

Businesses with outstanding receivables needing effective collection.

02

Finance and accounting teams responsible for managing collections.

03

Collections agencies aiming to optimize their strategies.

04

Credit managers overseeing customer credit and payment policies.

Fill

form

: Try Risk Free

People Also Ask about

What is a data collection strategy?

The term “data collection” refers to the act of collecting consumer information for the sake of analysis, interpretation, and usage in a variety of commercial contexts. A data collection strategy is the collection of methods that will be utilized to get accurate and reliable data from different data sources.

What is a collection strategy?

A collections strategy is a vital tool for any business that offers goods or services on credit. It's essentially a plan that helps businesses efficiently collect payments from their customers.

What is the 7 7 7 rule for collections?

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

What are the three C's of a successful collection strategy?

The three C's of a successful collections strategy are: Communication - Keep communication with your consumers clear and consistent. Choice - Provide a variety of payment methods to suit their preferences. Control - Offer consumers more ways to manage their payments for better recovery rates and improved satisfaction.

What is the most effective collection technique?

Successful debt collection techniques include proactive communication, setting clear payment terms, offering flexible payment options, prioritizing overdue accounts, and leveraging automation for timely reminders.

What is the collection advantage of Experian?

Collection Advantage helps you: Track debtors and locate skips more efficiently by obtaining up-to-date background information on debtors. Combine comprehensive contact data on more than 140 million households and 19 million businesses.

What is strategic collection?

Strategic Collections is an Australian company specialising in a suite of Debt Collection and Debt Management services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Collection Advantage Strategy?

Collection Advantage Strategy refers to a systematic approach used by organizations to optimize the management and collection of outstanding debts, ensuring efficient cash flow and minimizing bad debts.

Who is required to file Collection Advantage Strategy?

Typically, businesses and financial institutions that engage in credit and collection activities are required to file a Collection Advantage Strategy to demonstrate compliance with industry regulations.

How to fill out Collection Advantage Strategy?

Filling out a Collection Advantage Strategy involves gathering necessary financial data, documenting collection processes, outlining risk management practices, and often submitting forms that detail collections metrics and techniques used.

What is the purpose of Collection Advantage Strategy?

The purpose of Collection Advantage Strategy is to improve the efficiency of debt recovery processes, minimize losses, and ensure that organizations have structured methods for managing collections while remaining compliant with relevant laws.

What information must be reported on Collection Advantage Strategy?

Information typically reported on Collection Advantage Strategy includes collection performance metrics, strategies employed, risk assessments, compliance measures, and any relevant financial data concerning outstanding debts.

Fill out your collection advantage strategy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Collection Advantage Strategy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.