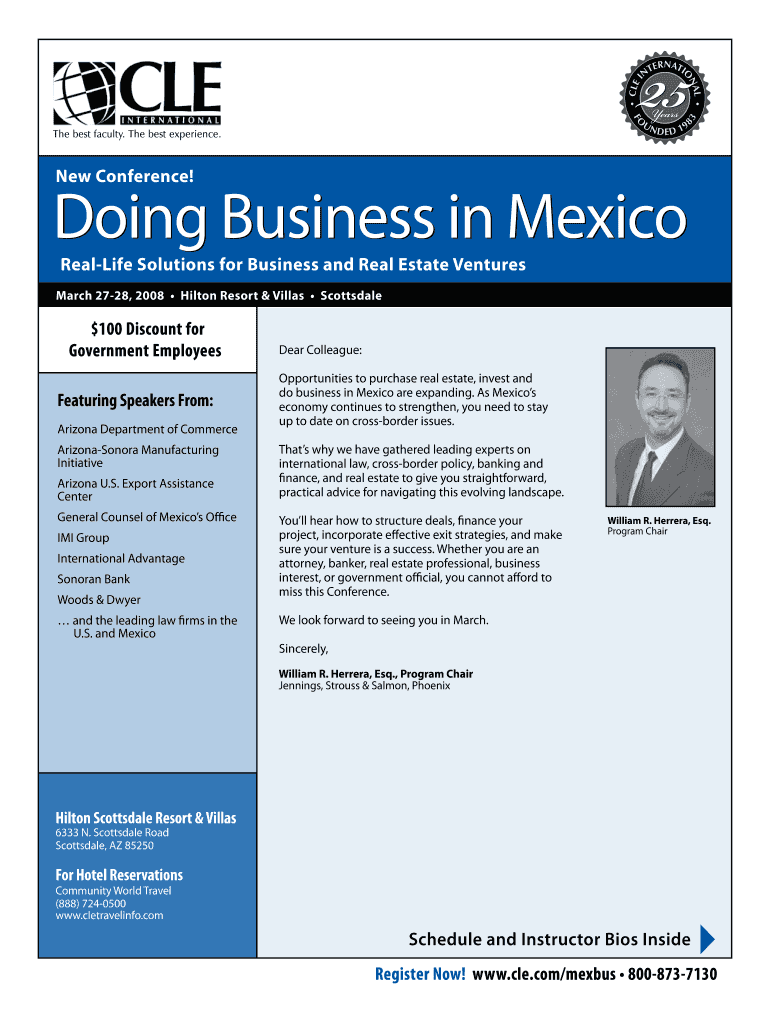

Get the free Doing Business in Mexico

Show details

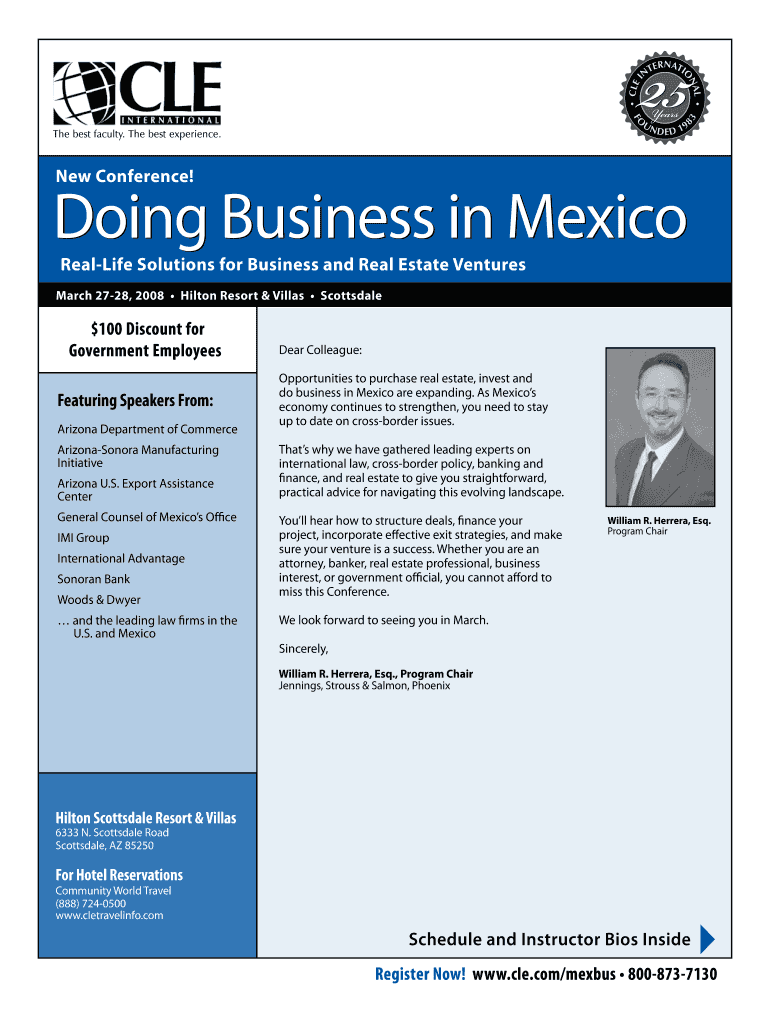

This document provides details about a conference focused on business and real estate opportunities in Mexico, including scheduling, speakers, and registration information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign doing business in mexico

Edit your doing business in mexico form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your doing business in mexico form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit doing business in mexico online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit doing business in mexico. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out doing business in mexico

How to fill out Doing Business in Mexico

01

Gather necessary business information, including your business structure (e.g., LLC, corporation).

02

Research legal requirements for foreign businesses in Mexico, including permits and licenses.

03

Identify the appropriate location for your business based on target market and regulations.

04

Register your business name with the Mexican authorities.

05

Obtain a tax identification number (RFC) from the Mexican tax authority.

06

Open a local bank account for your business transactions.

07

Acquire any necessary operational permits based on your industry.

08

Hire legal and financial advisors to ensure compliance with local laws.

09

Understand labor laws for hiring employees in Mexico, including contracts and benefits.

10

Develop a marketing strategy tailored to the Mexican market while considering cultural nuances.

Who needs Doing Business in Mexico?

01

Foreign entrepreneurs looking to expand their business operations into Mexico.

02

Companies seeking to establish a branch or subsidiary in Mexico.

03

Investors interested in the Mexican market for profit opportunities.

04

Businesses wanting to collaborate with local companies for joint ventures.

05

Organizations aiming to understand the legal landscape and tax implications of doing business in Mexico.

Fill

form

: Try Risk Free

People Also Ask about

Is it difficult to open a business in Mexico?

It is also advisable to have a team of local advisors, including a lawyer and an accountant, to assist in the establishment process and make important decisions. In short, opening a company in Mexico as a foreigner requires planning and knowledge, but it is not impossible.

What do I need to do business in Mexico?

How to Start a Business in Mexico Spot Business Opportunities. Pick Entity Type. Decide Your Industry. Submit a Request to the Ministry of Foreign Affairs. Draft the Deed of Incorporation. Signing the Deed of Incorporation. Register Company Address. Register for Tax.

What kind of business can I do in Mexico?

Key Small Business Opportunities in Mexico IndustryOpportunity Food and Beverage Restaurants, cafes, specialty food shops Tourism Ecotourism, adventure tourism, boutique hotels E-commerce Online retail, digital marketplaces Technology Software development, digital solutions3 more rows

How easy is it to do business in Mexico?

It's not difficult to open a company in Mexico: it's extremely simple since they eliminated the requirement of having a minimum initial capital of 50 thousand pesos. The difficult part is maintaining it: many companies don't survive their first year (that's why they have many tax benefits that first year).

Can foreigners do business in Mexico?

In short, yes — you can start a business in Mexico as a foreigner. In fact, you can own 100% of your business, without needing to partner with a local. You can even start a business without ever stepping foot in Mexico, through power of attorney. That said, there are some industries that exclude foreigners.

What is the reputation of doing business in Mexico?

Mexico is ranked in 60th place overall, out of 190 economies, and is one of the top business-friendly environments in Latin America, only behind Chile that ranks in the 59th position. Mexico's top three topics or indicators are getting credit (11th), resolving insolvency (33), and contract enforcement (43rd).

Can foreigners own a business in Mexico?

In short, yes — you can start a business in Mexico as a foreigner. In fact, you can own 100% of your business, without needing to partner with a local. You can even start a business without ever stepping foot in Mexico, through power of attorney. That said, there are some industries that exclude foreigners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Doing Business in Mexico?

Doing Business in Mexico refers to the legal and regulatory framework that foreign and domestic companies must navigate to operate successfully within the country. It encompasses the economic environment, business registration process, taxation, labor laws, and compliance with local regulations.

Who is required to file Doing Business in Mexico?

All foreign companies that are conducting business activities in Mexico, as well as Mexican entities engaging in specific commercial operations, are required to file for Doing Business in Mexico. This includes organizations involved in sales, services, or any form of permanent establishment in the country.

How to fill out Doing Business in Mexico?

To fill out Doing Business in Mexico, companies must complete specific forms provided by the Mexican authorities, which typically include details about the business structure, financial projections, and operational plans. It is advised to consult with local legal or accounting experts to ensure compliance and accuracy in the documentation.

What is the purpose of Doing Business in Mexico?

The purpose of Doing Business in Mexico is to ensure that both foreign and domestic companies comply with the legal standards established by the Mexican government. It aims to provide a formal recognition of business operations, facilitate taxation, and ensure adherence to local labor practices and other regulatory requirements.

What information must be reported on Doing Business in Mexico?

The information that must be reported includes the company’s legal name, business address, type of business activities, the identity of key stakeholders or directors, financial data, tax identification numbers, and any relevant permits or licenses necessary for operation in Mexico.

Fill out your doing business in mexico online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Doing Business In Mexico is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.