Get the free 412(i) Fully Insured Plan

Show details

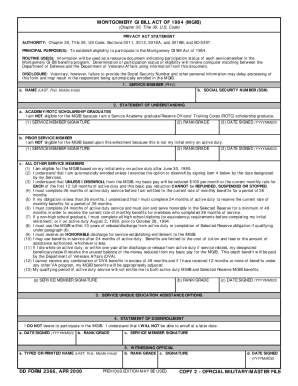

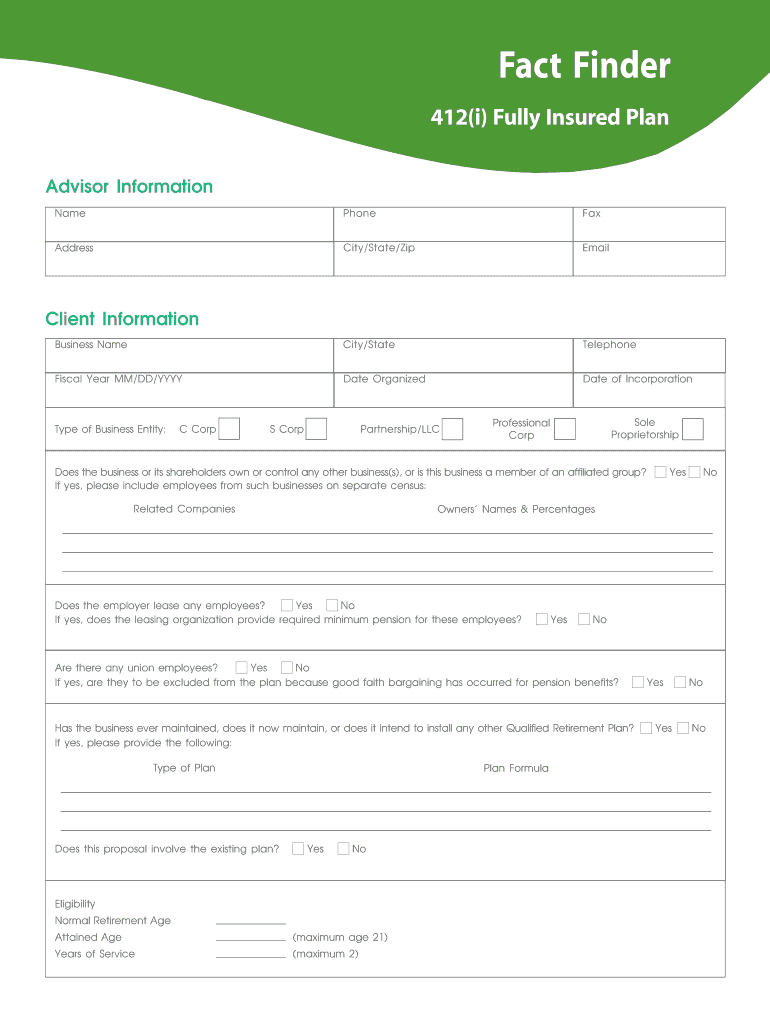

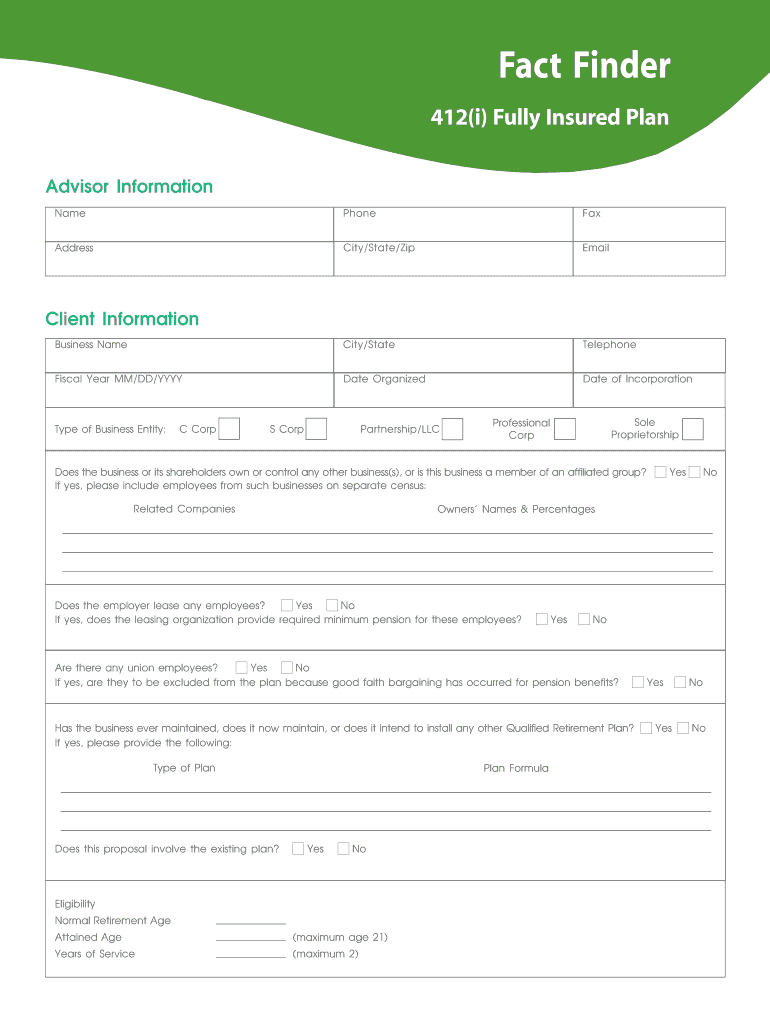

Fact Finder 412(i) Fully Insured Plan Advisor Information Name Phone Fax Address City/State/Zip Email Business Name City/State Telephone Fiscal Year MM/DD/YYY Date Organized Date of Incorporation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 412i fully insured plan

Edit your 412i fully insured plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 412i fully insured plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 412i fully insured plan online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 412i fully insured plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 412i fully insured plan

How to fill out 412i fully insured plan:

01

Research and understand the purpose of a 412i fully insured plan. This plan is a tax-advantaged retirement plan designed for small business owners or self-employed individuals.

02

Gather all the necessary information and documents required to fill out the plan. This may include personal information, financial statements, and any relevant legal or business documents.

03

Determine the contribution limits for the plan based on your income and business structure. Consult with a tax professional or financial advisor to ensure you adhere to the IRS guidelines.

04

Choose an insurance company that offers 412i fully insured plans. Research different providers and compare their offerings, fees, and customer reviews to make an informed decision.

05

Contact the chosen insurance company and request the necessary application forms for a 412i fully insured plan. Fill out the forms accurately and provide all the required information.

06

Review the completed application forms thoroughly to ensure accuracy and completeness. Make sure that all necessary signatures are obtained before submission.

07

Submit the filled-out application forms to the insurance company as per their instructions. Follow up with them to confirm receipt and inquire about any further documentation or steps required.

08

Once your application is processed and approved by the insurance company, carefully review the terms and conditions of the fully insured plan. Understand the features, benefits, and any limitations associated with the plan.

09

Communicate the details of the fully insured plan to any eligible employees or partners if necessary. Provide them with the necessary information regarding contributions, vesting, and any additional requirements.

10

Keep a copy of all the filled-out forms, communication with the insurance company, and any relevant documentation for future reference or audit purposes.

Who needs 412i fully insured plan:

01

Small business owners who want to maximize their tax deductions and contributions towards retirement savings.

02

Self-employed individuals with high incomes who are looking for a tax-advantaged retirement plan to supplement their savings.

03

Business owners who want to provide retirement benefits to their employees while enjoying certain tax advantages.

04

Professionals such as doctors, lawyers, and dentists who have high incomes and seek efficient tax planning strategies for their retirement savings.

05

Individuals looking for a retirement plan with life insurance coverage that can provide additional financial protection to their loved ones in case of death.

Remember, it is always advisable to consult with a qualified tax professional or financial advisor before making any decisions regarding 412i fully insured plans, as individual circumstances may vary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 412i fully insured plan?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 412i fully insured plan and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit 412i fully insured plan online?

With pdfFiller, it's easy to make changes. Open your 412i fully insured plan in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in 412i fully insured plan without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 412i fully insured plan, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is 412i fully insured plan?

412i fully insured plan is a type of retirement plan that provides life insurance as the funding vehicle for the plan.

Who is required to file 412i fully insured plan?

Employers who offer 412i fully insured plans are required to file it with the IRS.

How to fill out 412i fully insured plan?

To fill out 412i fully insured plan, you need to provide detailed information about the plan and its participants.

What is the purpose of 412i fully insured plan?

The purpose of 412i fully insured plan is to provide retirement benefits for employees while also receiving tax benefits for the employer.

What information must be reported on 412i fully insured plan?

Information such as contributions, distributions, and the value of the plan must be reported on 412i fully insured plan.

Fill out your 412i fully insured plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

412i Fully Insured Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.