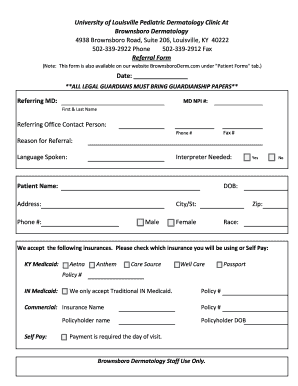

IL Certificate of Non Foreign Status free printable template

Show details

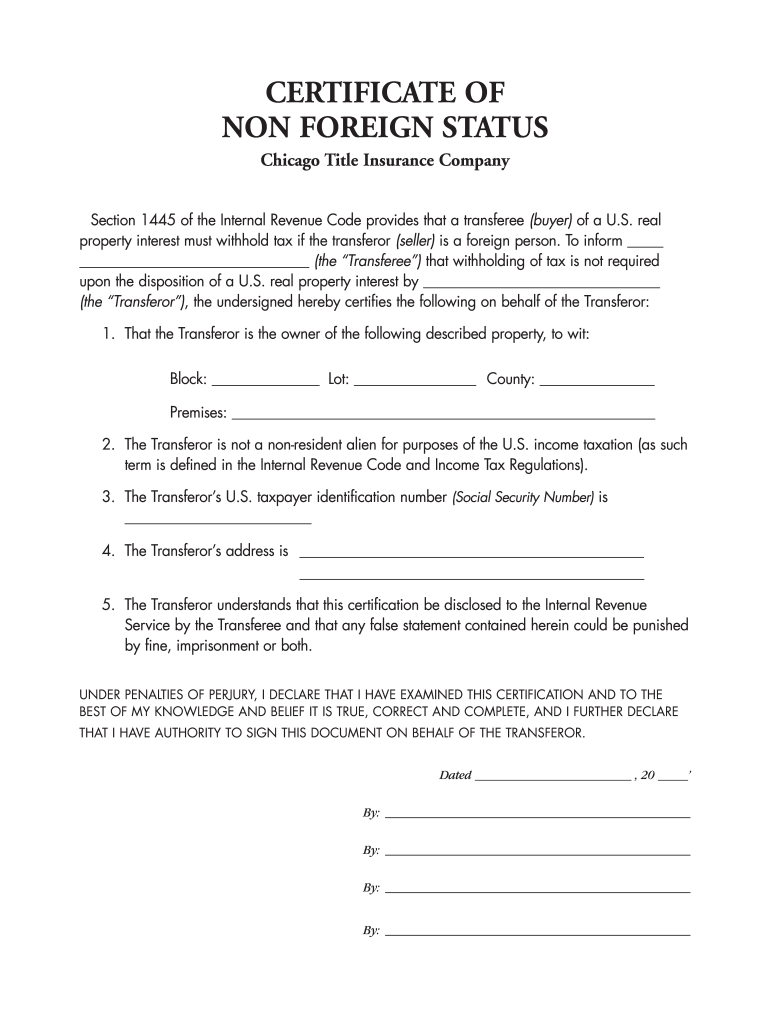

CERTIFICATE OF NON-FOREIGN STATUS Chicago Title Insurance Company Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL Certificate of Non Foreign Status

Edit your IL Certificate of Non Foreign Status form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL Certificate of Non Foreign Status form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL Certificate of Non Foreign Status online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL Certificate of Non Foreign Status. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out IL Certificate of Non Foreign Status

How to fill out IL Certificate of Non Foreign Status

01

Begin by obtaining the IL Certificate of Non Foreign Status form from the appropriate tax authority or website.

02

Fill in your name and address at the top of the form.

03

Indicate your taxpayer identification number (TIN) or Social Security Number (SSN).

04

Provide the name and address of the buyer or lessee involved in the transaction.

05

Clearly state the reason for claiming non-foreign status in the designated section.

06

Sign and date the form to certify that all information provided is accurate.

07

Submit the completed form to the relevant party or maintain it for your records as needed.

Who needs IL Certificate of Non Foreign Status?

01

Any individual or entity that is involved in a real estate transaction in Illinois and wishes to certify that they are not classified as a foreign person or entity.

02

Buyers and sellers in real estate transactions that require documentation to confirm the non-foreign status for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Why is a foreign person Affidavit important to a purchaser?

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are “not a non-resident alien for purposes of United States income taxation.” A Seller unable to complete this affidavit may be subject to withholding up to 15%.

Is a green card holder a foreign person under FIRPTA?

My seller is a resident alien, does that mean FIRPTA applies? A resident alien, for purposes of FIRPTA, is not a foreign person. FIRPTA defines a foreign seller as a non-resident alien individual, a foreign corporation not treated as a domestic corporation, or a foreign partnership, trust or estate.

Who is a foreign person under FIRPTA?

A Foreign Person is a nonresident alien individual or foreign corporation that has not made an election under section 897(i) of the Internal Revenue Code to be treated as a domestic corporation, foreign partnership, foreign trust, or foreign estate. It does not include a resident alien individual.

What is a seller's certification of non-foreign status?

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

Who is considered a foreign person in the US?

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

What is a certificate of non-foreign status for a trust?

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an authorized officer of Borrower, stating (a) that Borrower is not a “foreign corporation,” “foreign partnership,” “foreign trust,” or “foreign estate,” as those terms are defined in the Code and the regulations promulgated

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IL Certificate of Non Foreign Status?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific IL Certificate of Non Foreign Status and other forms. Find the template you need and change it using powerful tools.

How can I edit IL Certificate of Non Foreign Status on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing IL Certificate of Non Foreign Status, you need to install and log in to the app.

How do I edit IL Certificate of Non Foreign Status on an Android device?

The pdfFiller app for Android allows you to edit PDF files like IL Certificate of Non Foreign Status. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is IL Certificate of Non Foreign Status?

The IL Certificate of Non Foreign Status is a document used to certify that an individual or entity does not meet the definition of a foreign person or entity for tax purposes in Illinois.

Who is required to file IL Certificate of Non Foreign Status?

Individuals or entities that are engaged in certain transactions in Illinois where they need to certify their non-foreign status, typically when receiving payments that would otherwise be subject to withholding.

How to fill out IL Certificate of Non Foreign Status?

To fill out the IL Certificate of Non Foreign Status, individuals or entities must provide their name, address, taxpayer identification number, and a declaration stating that they are not a foreign person or entity.

What is the purpose of IL Certificate of Non Foreign Status?

The purpose of the IL Certificate of Non Foreign Status is to exempt the recipient from withholding taxes on payments received in Illinois by certifying their status as a non-foreign person or entity.

What information must be reported on IL Certificate of Non Foreign Status?

The information that must be reported includes the name, address, taxpayer identification number, and a signed declaration of non-foreign status.

Fill out your IL Certificate of Non Foreign Status online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL Certificate Of Non Foreign Status is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.