Get the free 4 Annual Fraud Prevention amp Detection Summit - akoladecomau

Show details

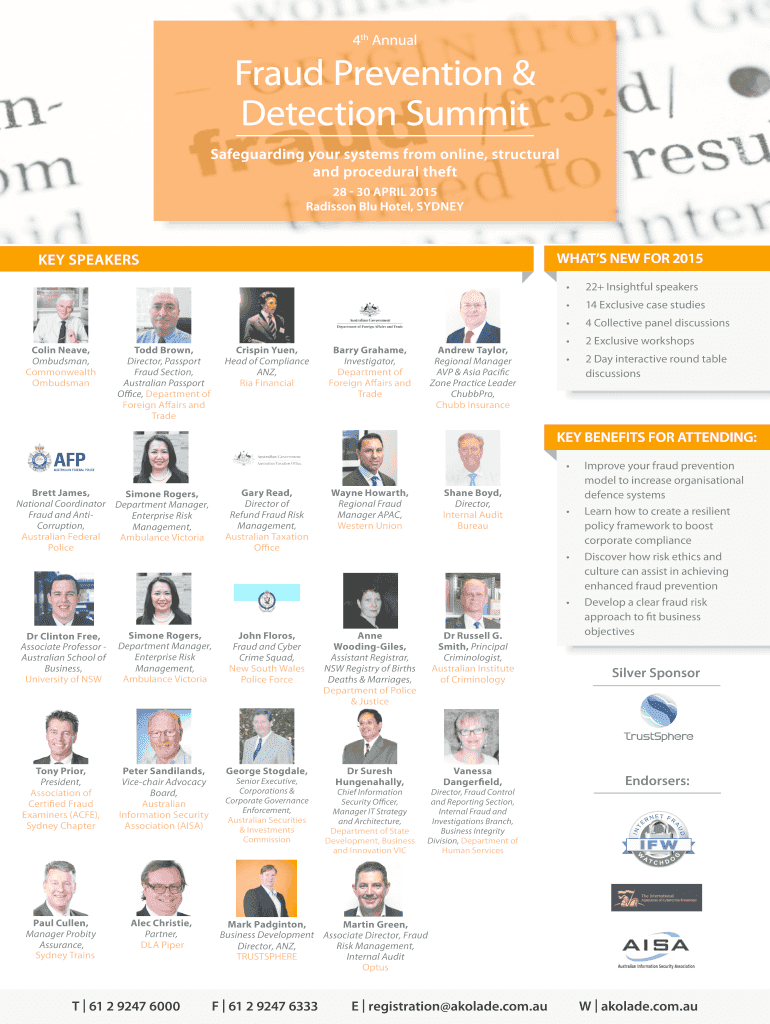

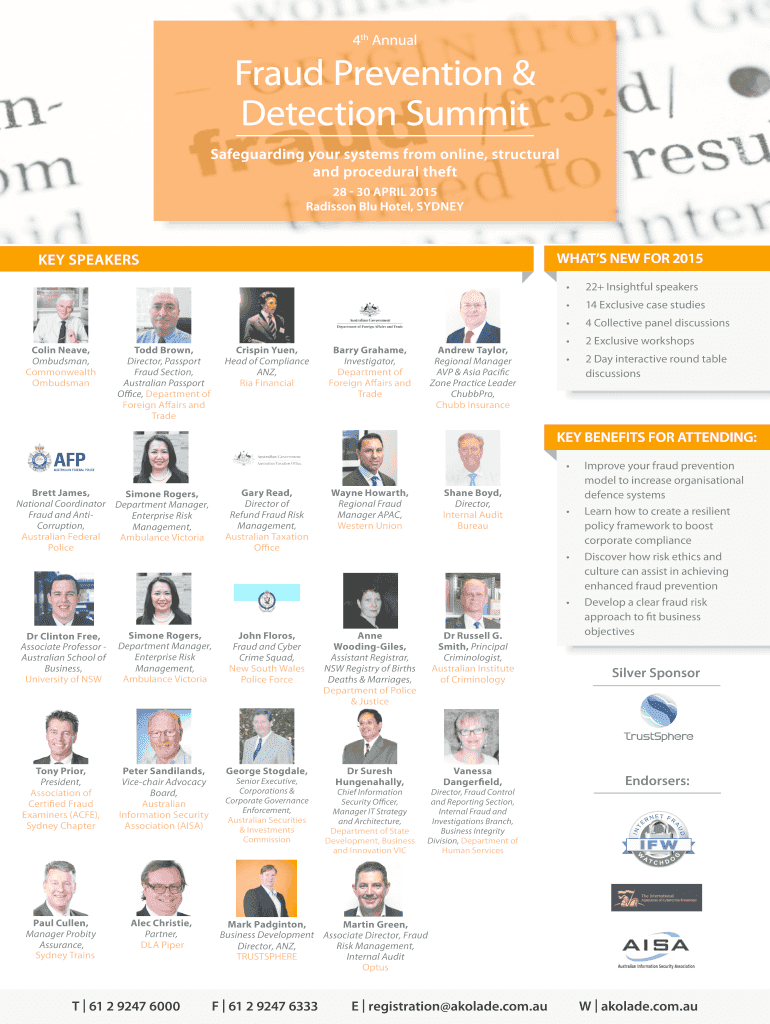

4th Annual Fraud Prevention & Detection Summit Safeguarding your systems from online, structural and procedural theft 28 30 APRIL 2015 Radisson Blu Hotel, SYDNEY WHAT'S NEW FOR 2015 KEY SPEAKERS Todd

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 4 annual fraud prevention

Edit your 4 annual fraud prevention form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 4 annual fraud prevention form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 4 annual fraud prevention online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 4 annual fraud prevention. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 4 annual fraud prevention

How to fill out 4 annual fraud prevention:

01

Start by gathering all necessary information and documentation related to your business or personal finances. This may include bank statements, transaction records, identification documents, and any other relevant paperwork.

02

Carefully review the instructions provided with the fraud prevention form. Familiarize yourself with the specific requirements and guidelines for completing the form correctly.

03

Begin filling out the form by entering your personal or business information in the designated sections. This may include your name, address, contact details, and any other requested details.

04

Follow the form's prompts to provide information about your financial activities or transactions. Be thorough and accurate in your responses, ensuring that all necessary information is provided.

05

If the form includes any sections for explaining suspicious or potentially fraudulent activity, be sure to provide detailed and specific information. Include dates, amounts, and any supporting documentation or evidence that may be relevant.

06

Double-check all the information you have entered on the form to ensure accuracy and completeness. Review each section carefully to make sure nothing has been overlooked or omitted.

07

Once you are satisfied with the information provided, sign and date the form as required. If applicable, have the form witnessed or notarized according to the specific instructions provided.

08

Make a copy of the completed form for your records before submitting it. If submitting online, save a digital copy to your computer for future reference.

Who needs 4 annual fraud prevention:

01

Businesses: Companies that handle large amounts of financial transactions, sensitive customer information, or valuable assets are highly encouraged to engage in annual fraud prevention measures. This helps protect their operations, finances, and reputation from fraudulent activities.

02

Financial Institutions: Banks, credit unions, and other financial institutions need to implement annual fraud prevention strategies to safeguard their clients' accounts and ensure the integrity of their services. Detecting and preventing fraud is crucial in maintaining customer trust and complying with industry regulations.

03

Individuals: While not as common as for businesses, individuals can also benefit from annual fraud prevention measures. This is especially important for those who regularly engage in financial transactions, such as managing investments, owning multiple credit cards, or using online banking platforms. Preventive actions can help individuals detect and mitigate potential fraud attempts, protecting their personal finances and identities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 4 annual fraud prevention for eSignature?

Once your 4 annual fraud prevention is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find 4 annual fraud prevention?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 4 annual fraud prevention and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the 4 annual fraud prevention in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 4 annual fraud prevention in seconds.

What is 4 annual fraud prevention?

The 4 annual fraud prevention is a yearly process or set of actions implemented to prevent fraud within an organization.

Who is required to file 4 annual fraud prevention?

All organizations, regardless of size or industry, are required to conduct and file 4 annual fraud prevention.

How to fill out 4 annual fraud prevention?

To fill out 4 annual fraud prevention, organizations should review their fraud prevention policies, assess risks, implement controls, and document processes.

What is the purpose of 4 annual fraud prevention?

The purpose of 4 annual fraud prevention is to protect organizations from financial losses, reputational damage, and legal implications resulting from fraud.

What information must be reported on 4 annual fraud prevention?

Information such as fraud risks, control measures, incident reporting procedures, and training programs must be reported on 4 annual fraud prevention.

Fill out your 4 annual fraud prevention online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

4 Annual Fraud Prevention is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.