Get the free Gift Processing Form - University of San Diego - sandiego

Show details

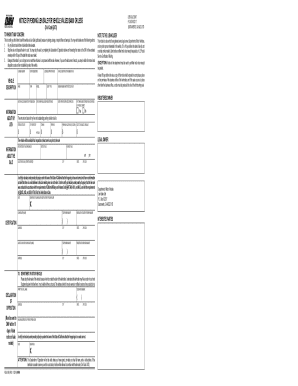

Send To: Advancement Services Defer Alumni Center 312 Extension 4639 Gift Processing Form All information on this form must be completed before we are able to process this gift. A. Donor Advance ID:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift processing form

Edit your gift processing form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift processing form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift processing form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift processing form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift processing form

How to fill out a gift processing form:

01

Begin by providing your personal information, including your full name, address, and contact details. This information is crucial for processing and acknowledging the gift.

02

Specify the type of gift you are submitting. This could be a monetary donation, a physical item, or any other form of gift. Be clear and concise in describing the nature of your gift.

03

Indicate the purpose or designation of your gift. If you have a specific intention for how you would like your gift to be used, mention it in this section. Otherwise, you can leave it blank or specify that it is a general gift to be used at the organization's discretion.

04

If applicable, provide any additional details or instructions related to your gift. For example, if you are donating a physical item, you may need to mention its condition, size, or any special handling requirements.

05

Check if your gift is eligible for any matching gift programs. Many companies offer programs where they match their employees' donations, multiplying the impact of your gift. If applicable, include the necessary documentation or indicate that you will provide it separately.

06

Finally, review the information you have provided before submitting the form. Ensure that all the details are accurate and complete. If required, sign and date the form.

07

Once you have filled out the gift processing form, submit it according to the instructions provided. This may involve sending it by mail, email, or submitting it online through a secure portal.

08

Keep a copy of the completed form for your records. This will serve as proof of your gift and may be necessary for tax purposes or future reference.

Who needs a gift processing form?

01

Organizations or institutions that accept donations or gifts typically require a gift processing form. This includes nonprofit organizations, educational institutions, religious organizations, and any other entities that rely on charitable contributions.

02

Donors who want to contribute to a cause or support an organization with their gifts may need to fill out a gift processing form. This form allows the donor to provide the necessary information and instructions regarding their donation, ensuring that it is processed and utilized correctly.

03

Employers who offer matching gift programs may also require their employees to fill out a gift processing form to initiate the matching process. This helps the employer verify the employee's donation and initiate the matching contribution process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the gift processing form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your gift processing form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit gift processing form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share gift processing form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I fill out gift processing form on an Android device?

Complete your gift processing form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is gift processing form?

The gift processing form is a document used to record and track gifts received by an organization.

Who is required to file gift processing form?

Any individual or organization receiving gifts must file a gift processing form.

How to fill out gift processing form?

The gift processing form should be filled out with details of the gift, including the donor's information, the gift amount, and any restrictions.

What is the purpose of gift processing form?

The purpose of the gift processing form is to ensure proper documentation and tracking of gifts received.

What information must be reported on gift processing form?

The gift processing form should include details such as the donor's name, contact information, gift amount, and any specific restrictions on the use of the gift.

Fill out your gift processing form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Processing Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.