Get the free WEST BENGAL VALUE ADDED TAX RETURN FORM – 14

Show details

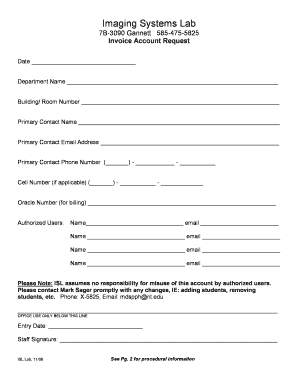

This document is a return form for dealers not paying tax under specific sections of the West Bengal Value Added Tax rules, documenting sales, purchases, tax payable, and deductions applicable during

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign west bengal value added

Edit your west bengal value added form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your west bengal value added form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit west bengal value added online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit west bengal value added. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out west bengal value added

How to fill out WEST BENGAL VALUE ADDED TAX RETURN FORM – 14

01

Obtain the WEST BENGAL VALUE ADDED TAX RETURN FORM – 14 from the official website or tax office.

02

Fill in your VAT registration number in the specified field.

03

Enter the tax period for which you are filing the return.

04

Provide details of sales and purchases as required in the respective sections.

05

Calculate the total VAT payable based on your sales and purchases.

06

Fill in any additional information as required, such as input tax credit.

07

Review the form for accuracy and completeness.

08

Sign and date the form.

09

Submit the completed form to the appropriate tax authority or online through the designated portal.

Who needs WEST BENGAL VALUE ADDED TAX RETURN FORM – 14?

01

Registered VAT dealers in West Bengal who are required to report their tax liabilities.

02

Businesses that engage in the sale of goods and need to comply with VAT regulations.

03

Individuals or entities that meet the turnover threshold set by the West Bengal VAT Act.

Fill

form

: Try Risk Free

People Also Ask about

How do I download my VAT return?

How to check your VAT returns Step 1: Log in to HMRC. To get started, visit the HMRC website and log in to your online account using the Government Gateway credentials you received when registering. Step 2: Access your VAT account. Step 3: View past VAT returns. Step 4: Print your VAT returns.

How to download VAT receipt?

Request a VAT invoice or receipt Sign in to Settings. Check that you've entered your tax ID number. If you haven't, enter it now. Click Activity. Click on the transaction you want an invoice for. At the bottom of the transaction details, click Download VAT invoice or Download VAT receipt. Click Save.

Is VAT applicable in West Bengal?

Sales Tax and Value Added Tax (VAT) comprise receipts under the West Bengal Sales Tax (WBST) Act, 1994 (effective from May 1995), the Central Sales Tax (CST) Act, 1956 (effective from January 1957) and the Value Added Tax Act, 2003 (effective from April 2005).

How to fill a value-added tax return?

(i) Total value of Imports, imported under deferred or upfront basis should be declared in cage H (ii) VAT deferred on imports should be declared in cage 4 (iii) VAT paid on upfront basis should be declared in cage 5 (iv) Value of local purchases should be declared in cage I and relevant input VAT should be declared in

How to download VAT statement pdf?

Login to the EmaraTax Platform using Emirates ID UAE Pass or your taxpayer account. In the Dashboard, the VAT registration certificate can be found in the "My Correspondences section of your Taxable Person account. Click the certificate and download it as Pdf.

What is the form for quarterly value added tax return?

What is this form? BIR Form 2550Q, also known as Quarterly Value-Added Tax Return is a form of sales tax imposed on sales or exchange of goods and services in the Philippines. Serving as a form of indirect tax, VAT is passed on to the buyer which consumes the product/service.

How to download VAT return?

Step-by-Step Guide to File VAT Return Online Log in to the Portal. Visit the Commercial Taxes portal for your state and log in using your VAT credentials. Password Change (First Time Users) Download Form 14D. Fill the Form. Generate XML File. Upload the Files. Rectify Mistakes. Download Acknowledgment.

How do I get my VAT return?

How to get paid a VAT refund. By completing your VAT Return online, HMRC will automatically calculate if you're due a VAT repayment for that accounting period. Once you submit your VAT Return, HMRC usually repays any VAT within 30 days. For more information, see HMRC's VAT Notice 700 guide.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WEST BENGAL VALUE ADDED TAX RETURN FORM – 14?

The WEST BENGAL VALUE ADDED TAX RETURN FORM – 14 is a specific form used by registered dealers in West Bengal to report their value-added tax (VAT) liabilities and other relevant financial information to the state tax authorities.

Who is required to file WEST BENGAL VALUE ADDED TAX RETURN FORM – 14?

All registered dealers in West Bengal who are liable to pay value-added tax as per the state's tax regulations are required to file the WEST BENGAL VALUE ADDED TAX RETURN FORM – 14.

How to fill out WEST BENGAL VALUE ADDED TAX RETURN FORM – 14?

To fill out the WEST BENGAL VALUE ADDED TAX RETURN FORM – 14, dealers must enter their GSTIN, details of sales and purchases, VAT payable, any input tax credit claimed, and other required financial data. It is advisable to follow the guidelines provided by the West Bengal tax department while filling out the form.

What is the purpose of WEST BENGAL VALUE ADDED TAX RETURN FORM – 14?

The purpose of the WEST BENGAL VALUE ADDED TAX RETURN FORM – 14 is to maintain transparency in the businesses' taxation process, ensure compliance with tax laws, and facilitate the calculation and payment of value-added tax by registered dealers.

What information must be reported on WEST BENGAL VALUE ADDED TAX RETURN FORM – 14?

The information reported on the WEST BENGAL VALUE ADDED TAX RETURN FORM – 14 includes details such as dealer's GSTIN, sales and purchase amounts, VAT payable, input tax credit availed, and other financial transactions during the tax period.

Fill out your west bengal value added online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

West Bengal Value Added is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.