Get the free Chart Of Accounts Detail List Report

Show details

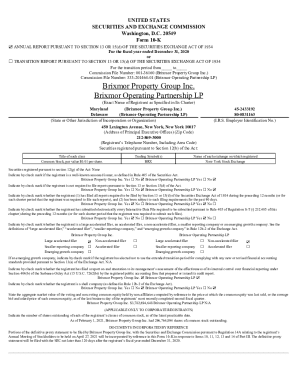

Chart Of Accounts Detail List Report Company: 7789 Name: Church and School Funds and Departments Fiscal Year Beginning: 1×1/2013 Active Account Only TypeAccount×DescriptionClosing Accounted Name:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chart of accounts detail

Edit your chart of accounts detail form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chart of accounts detail form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chart of accounts detail online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chart of accounts detail. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chart of accounts detail

How to fill out chart of accounts detail:

01

Organize your business's financial transactions into categories: Start by identifying the different types of financial transactions that occur in your business, such as sales, expenses, assets, and liabilities. These categories will become the main accounts in your chart of accounts.

02

Set up account numbers: Assign a unique number to each account in your chart of accounts. This helps in organizing and categorizing the accounts systematically. For example, you could use a numbering system where assets start with "1," liabilities with "2," equity with "3," income with "4," and expenses with "5."

03

Name the accounts: Give each account a clear and descriptive name that accurately represents the type of transaction it covers. This ensures that anyone reviewing the chart of accounts can easily understand what each account represents.

04

Determine the account type: Classify each account as an asset, liability, equity, income, or expense account. This classification is crucial for financial reporting and analysis.

05

Consider sub-accounts and sub-categories: If needed, create sub-accounts or sub-categories to further define and categorize specific transactions within each main account. This provides additional detail and helps with accurate financial reporting.

06

Determine the account balance: Assign the appropriate balance type to each account, either a debit or credit balance. This ensures that all transactions are recorded correctly and the financial statements are accurate.

07

Review and refine: Regularly review and refine your chart of accounts to ensure it remains relevant and updated based on your business's changing needs. Add or remove accounts as necessary to accommodate any new types of transactions.

Who needs chart of accounts detail?

01

Business owners: The chart of accounts provides an organized and structured overview of the financial transactions occurring in the business. This allows business owners to have a clear understanding of the financial health and performance of their company.

02

Accountants and bookkeepers: Accountants and bookkeepers rely on the chart of accounts to properly record and classify financial transactions. It helps them accurately prepare financial statements, tax returns, and other important financial documents.

03

Auditors and tax authorities: Auditors and tax authorities may request access to a business's chart of accounts to verify the accuracy of financial statements, ensure compliance with accounting standards, and assess the amount of tax owed.

04

Investors and lenders: Investors and lenders often require access to a business's chart of accounts to assess its financial stability and make informed decisions about investing or lending money.

05

Financial analysts: Financial analysts use the chart of accounts to analyze and interpret financial data, identify trends, and make forecasts. It helps them determine the financial performance and potential risks of a business.

In short, a chart of accounts detail is necessary for business owners, accountants, auditors, tax authorities, investors, lenders, and financial analysts to effectively manage, analyze, and make decisions based on financial information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send chart of accounts detail to be eSigned by others?

Once your chart of accounts detail is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit chart of accounts detail online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your chart of accounts detail to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit chart of accounts detail on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share chart of accounts detail from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is chart of accounts detail?

The chart of accounts detail is a complete listing of every account in a company's general ledger, where it categorizes financial transactions and displays the balances and journal entries associated with each account.

Who is required to file chart of accounts detail?

Companies, businesses, and organizations are required to file chart of accounts detail in order to accurately track and report their financial transactions.

How to fill out chart of accounts detail?

To fill out the chart of accounts detail, companies must list each account with its corresponding account number, description, and financial information such as balances and transactions.

What is the purpose of chart of accounts detail?

The purpose of the chart of accounts detail is to provide a structured system for organizing financial information, allowing companies to track their transactions, prepare financial statements, and make informed business decisions.

What information must be reported on chart of accounts detail?

The chart of accounts detail must include a listing of all accounts, their corresponding account numbers, descriptions, and financial information such as balances and transaction details.

Fill out your chart of accounts detail online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chart Of Accounts Detail is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.