Get the free FORM NO. 27E

Show details

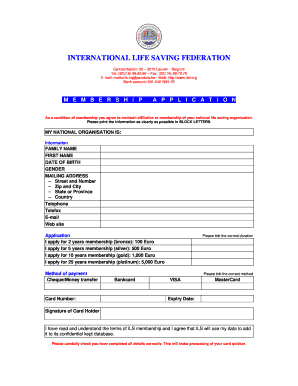

This document serves as an annual return for reporting the collection of tax under section 206C of the Income Tax Act, 1961, including details of seller, collections made, and tax collected and deposited.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form no 27e

Edit your form no 27e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form no 27e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form no 27e online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form no 27e. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form no 27e

How to fill out FORM NO. 27E

01

Obtain FORM NO. 27E from the official website or authorized office.

02

Fill in your personal information such as name, address, and contact details.

03

Provide details related to the income or transaction that the form is intended for.

04

Ensure that you include the total amount for which you need to deduct taxes.

05

Include any relevant identification numbers, such as PAN if applicable.

06

Review the completed form for accuracy.

07

Submit the form to the relevant tax authority or organization as required.

Who needs FORM NO. 27E?

01

Individuals or entities who are required to report income for tax purposes.

02

Businesses or organizations making payments subject to tax deduction at source.

03

Taxpayers who need to provide information on specific transactions related to income.

Fill

form

: Try Risk Free

People Also Ask about

Who should file 27Q?

Form 27Q is the statement of the return for the non-salary payments done to an NRI. The Indian buyer is required to submit the form 27Q every quarter before the due date. Non-resident Indians who do not hold a PAN card are required to pay TDS at a higher rate of 20%.

What is form 27e in TDS?

Form 27EQ TDS is for the Tax Collected at Source (TCS) and is filed quarterly. This Form is governed by Section 206C of the Income Tax Act (ITA) for the respective quarter's end date. TCS involves sellers collecting tax from buyers when settling payments.

What is the meaning of 27 TDS return?

27Q TDS Return Meaning Form 27Q is a TDS return or Statement that has the details of Tax Deducted at Source deducted on the payments other than the salary that is made to Non-resident Indian and foreigners. Form 27Q TDS is needed to furnish on a quarterly basis on or before the due date.

What is Section 206C of Income Tax Act?

Section 206C of the Income Tax Act deals with Tax Collected at Source (TCS) on profits or gains from the sale of specified goods such as alcohol, forest produce, scrap, and minerals. If a seller with turnover exceeding Rs. 10 crores receives over Rs. 50 lakhs from a buyer in a financial year, TCS must be collected.

What is the meaning of 27 EQ?

Form 27EQ contains all details pertaining to tax that is collected at source. According to Section 206C of the Income Tax Act 1961, this form must be filed every quarter. The form has to be submitted by both the corporate and government collectors and deductors.

What is form 27D?

Form 27D is a TCS certificate certifying the amount of TCS collected, Nature of Payments & the TCS Payments deposited with the Income Tax Dept. • Form 27D downloaded from TRACES website are considered as a valid TCS certificates, as per CBDT circular 04/2013 dated.

What is the purpose of form 27EQ?

Form 27EQ is a quarterly tax return that must be filed by entities responsible for collecting Tax Collected at Source (TCS) on specified transactions. The form provides details of the TCS return filing, including the TCS collected, the buyer's PAN details, and the amount deposited with the government.

What is the difference between 26Q and 27Q?

Form 27Q is submitted by the deductor every quarter and is relevant for TDS u/s 200(3) of the Income Tax Act of 1961. Form 26Q is used for TDS on additional income such as interest, bonus or any other sum owed to NRI or foreigners. Note: The government deductors need to specify “PANNOTREQD” on the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM NO. 27E?

FORM NO. 27E is a statement that needs to be filed by those making payments to a non-resident, including specified income such as interest, dividend, or royalty payments.

Who is required to file FORM NO. 27E?

Any person or entity making specified payments to non-residents is required to file FORM NO. 27E.

How to fill out FORM NO. 27E?

To fill out FORM NO. 27E, one must provide details such as the nature of income, details of the payer, payee, and the amounts paid. Specific instructions can be found in the accompanying guidelines.

What is the purpose of FORM NO. 27E?

The purpose of FORM NO. 27E is to ensure proper reporting of payments to non-residents for tax compliance to avoid double taxation and ensure transparency.

What information must be reported on FORM NO. 27E?

FORM NO. 27E must report information such as the payer's details, payee's details, nature and amount of income, and tax deducted at source.

Fill out your form no 27e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form No 27e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.