Get the free Retirement Savings Plan Agreement

Show details

Agreement under the New Brunswick Pension Benefits Act for Locked-in Pension Transfers to a Locked-In Retirement Account (LIRA). This document outlines the terms and conditions related to the management

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement savings plan agreement

Edit your retirement savings plan agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement savings plan agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement savings plan agreement online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit retirement savings plan agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

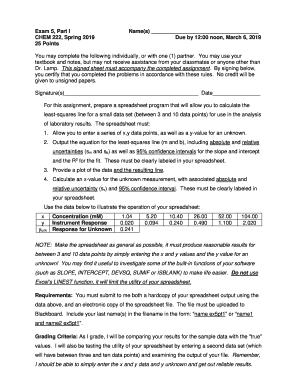

How to fill out retirement savings plan agreement

How to fill out Retirement Savings Plan Agreement

01

Obtain the Retirement Savings Plan Agreement form from your employer or financial institution.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information including your name, address, and social security number.

04

Specify your contribution percentage or amount that you wish to save.

05

Choose your investment options as outlined in the plan.

06

Indicate any beneficiaries for the account.

07

Review all the information for accuracy.

08

Sign and date the agreement.

09

Submit the completed agreement to your employer or plan administrator.

Who needs Retirement Savings Plan Agreement?

01

Individuals who are looking to save for retirement.

02

Employees of companies that offer Retirement Savings Plans.

03

Self-employed individuals seeking to establish a retirement savings strategy.

04

Anyone wanting to take advantage of tax-advantaged retirement savings.

Fill

form

: Try Risk Free

People Also Ask about

How does a retirement savings plan work?

A 401(k) is an employer-sponsored retirement plan that comes with tax benefits. Basically, you put money into the 401(k) where it can be invested and potentially grow tax free over time. In most cases, you choose how much money you want to contribute to your 401(k) based on a percentage of your income.

What is an example of a retirement savings plan?

Examples of defined contribution plans include 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans. A Simplified Employee Pension Plan (SEP) is a relatively uncomplicated retirement savings vehicle.

What is the difference between a 401k and a retirement savings plan?

IRAs and 401(k)s are retirement accounts with tax benefits to help people save more for their future. The most crucial difference between an IRA and a 401(k) is that a 401(k) is a workplace retirement plan. An IRA is something you typically get on your own working with financial institution.

How does the RRSP work?

An RRSP is a retirement savings plan that you establish, that the CRA registers, and to which you or your spouse or common-law partner contribute. Deductible RRSP contributions can be used to reduce your tax. Any income you earn in the RRSP is usually exempt from tax as long as the funds remain in the plan.

What is a retirement savings plan?

The Retirement Savings Plan is an optional, voluntary plan, funded by employee and/or employer contributions. You may contribute a portion of your taxable salary, excluding housing allowance, subject to the IRS annual contribution limit. Contributions may be made on a pretax basis, Roth (after-tax) basis, or both.

Is a 401k the same as a retirement savings plan?

A 401(k) is a retirement savings program sponsored by your employer and may have benefits like an employer match and plan loans. Both IRAs and 401(k)s come as traditional and Roth versions. Traditional versions are better for saving on taxes today while Roth versions lower your taxes in retirement.

What is the meaning of retirement savings?

Retirement savings accounts are specialized investment vehicles, usually with unique tax benefits, designed to help individuals reach the long-term goal of funding their retirement.

Which is better, RRSP or RSP?

There's no significant difference between the two. At Tangerine, an RRSP and an RSP are essentially the same thing. “RSP” is just a catch-all term used to describe the account before it's registered with the CRA, while “RRSP” is the term for the registered version.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Retirement Savings Plan Agreement?

A Retirement Savings Plan Agreement is a legally binding document outlining the terms and conditions for contributing to a retirement savings plan, which helps individuals save for retirement in a tax-advantaged manner.

Who is required to file Retirement Savings Plan Agreement?

Typically, individuals who wish to enroll in a retirement savings plan, such as an employer-sponsored plan or an individual retirement account (IRA), are required to file a Retirement Savings Plan Agreement.

How to fill out Retirement Savings Plan Agreement?

To fill out a Retirement Savings Plan Agreement, gather necessary personal and financial information, follow the instructions provided in the form carefully, fill in the required sections accurately, and submit it to the responsible party or organization.

What is the purpose of Retirement Savings Plan Agreement?

The purpose of a Retirement Savings Plan Agreement is to establish a formal arrangement for saving funds toward retirement, ensuring contributions are made and managed according to specified guidelines.

What information must be reported on Retirement Savings Plan Agreement?

The information typically reported on a Retirement Savings Plan Agreement includes personal identification details, contribution amounts, beneficiary designations, investment choices, and any specific terms regarding withdrawals or fund management.

Fill out your retirement savings plan agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Savings Plan Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.