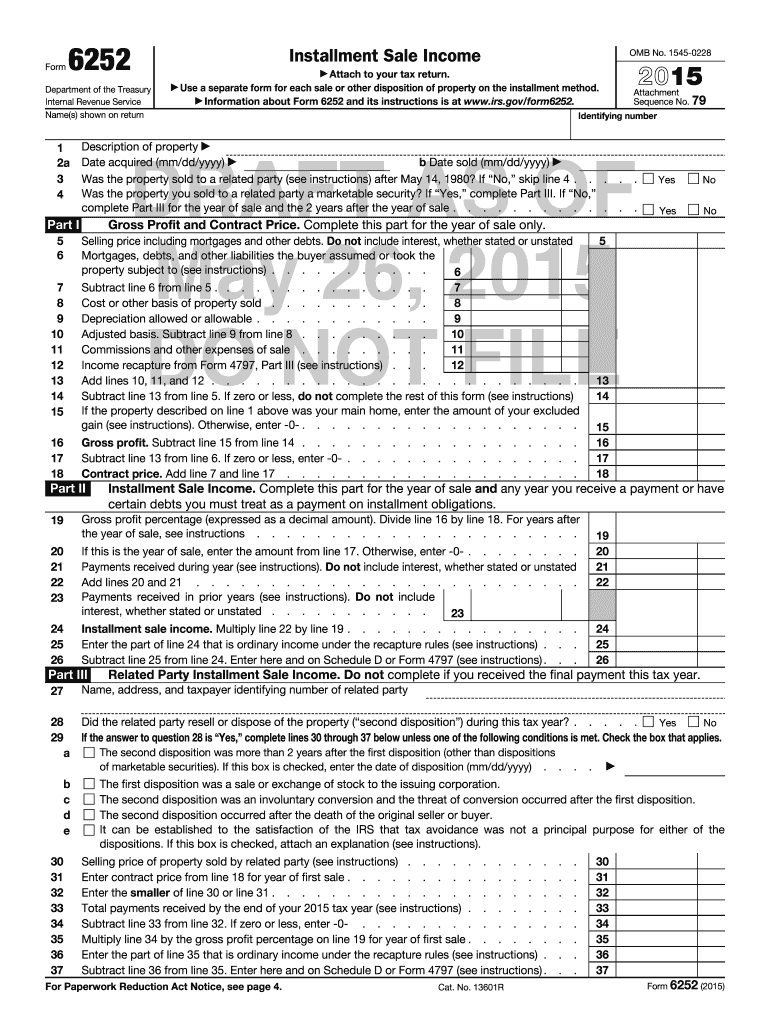

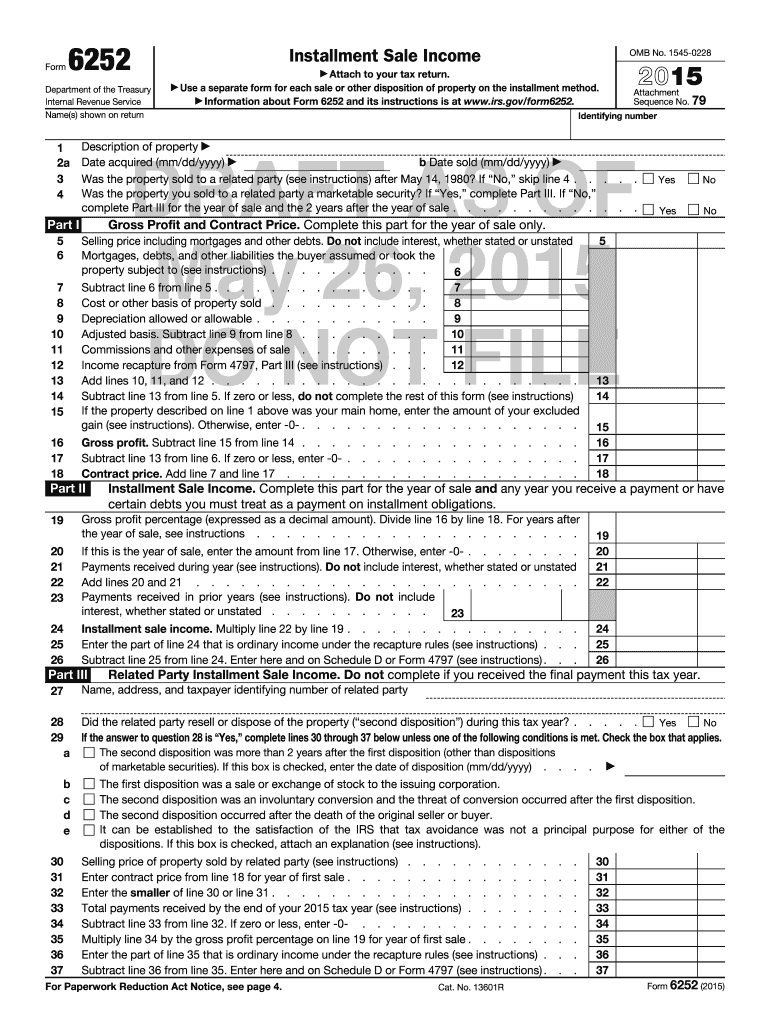

Get the free Gross Profit and Contract Price - 63 150 153

Show details

Caution: DRIFTNET FOR FILING

This is an early release draft of an IRS tax form, instructions, or publication,

which the IRS is providing for your information as a courtesy. Do not file

draft forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gross profit and contract

Edit your gross profit and contract form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gross profit and contract form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gross profit and contract online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gross profit and contract. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gross profit and contract

How to Fill Out Gross Profit and Contract:

01

Begin by gathering all necessary information and documentation related to the project or contract. This may include invoices, receipts, financial statements, and any other relevant financial data.

02

Identify the total revenue or sales generated from the project or contract. This can typically be found on the invoices or income statements.

03

Calculate the cost of goods sold (COGS), which refers to the expenses directly associated with producing or delivering the goods or services. This may include materials, labor, and other direct costs.

04

Subtract the COGS from the total revenue to determine the gross profit. This represents the amount of revenue left after accounting for the direct costs of producing goods or services.

05

Record the gross profit in the appropriate section of the document or form you are filling out. It is often labeled as "Gross Profit" or "Gross Income."

Who Needs Gross Profit and Contract:

01

Business Owners: Gross profit is a crucial metric for business owners as it helps assess the profitability and performance of specific projects or contracts. It provides insights into the effectiveness of the company's pricing, cost management, and overall financial health.

02

Accountants and Financial Analysts: These professionals rely on gross profit figures to prepare accurate financial statements, analyze financial performance, and provide recommendations for improving profitability. Gross profit is a key component in calculating other important measures such as gross profit margin.

03

Investors and Lenders: Gross profit is an essential indicator of a company's ability to generate profits before considering other operating expenses. Investors and lenders use this information to assess the financial viability and stability of a business when making investment or lending decisions.

04

Government Agencies and Tax Authorities: Gross profit figures are often required for regulatory and compliance purposes, including tax reporting and audits. They help determine the taxable income of a business and ensure compliance with applicable laws and regulations.

In summary, filling out gross profit and contract involves gathering financial information, calculating the gross profit, and recording it accurately. Various stakeholders, including business owners, accountants, investors, and government agencies, rely on gross profit figures for decision-making, analysis, and compliance purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gross profit and contract in Gmail?

gross profit and contract and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send gross profit and contract for eSignature?

When your gross profit and contract is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find gross profit and contract?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the gross profit and contract in seconds. Open it immediately and begin modifying it with powerful editing options.

What is gross profit and contract?

Gross profit is the income a company makes after deducting the cost of goods sold. A contract is a legally binding agreement between two or more parties.

Who is required to file gross profit and contract?

Businesses and individuals who have income from sales of goods or services are required to file gross profit and contract.

How to fill out gross profit and contract?

Gross profit and contract can be filled out by detailing the income from sales, cost of goods sold, and calculating the gross profit.

What is the purpose of gross profit and contract?

The purpose of gross profit and contract is to accurately report the income generated from sales and calculate the profit margin.

What information must be reported on gross profit and contract?

Information such as sales revenue, cost of goods sold, and gross profit margin must be reported on gross profit and contract.

Fill out your gross profit and contract online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gross Profit And Contract is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.