Get the free Cosigner w application accepted in the office Date Time

Show details

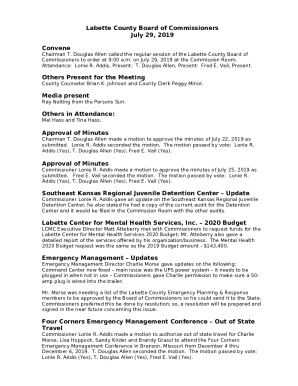

APP Fee: $50 per applicant, $25 per cosigner Credit cards are not accepted in the office. Cosigner w/ application CASH App: $ Cosigner app within 48 hours CHECK Cosigner:$ No cosigner needed Total:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cosigner w application accepted

Edit your cosigner w application accepted form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cosigner w application accepted form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cosigner w application accepted online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cosigner w application accepted. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cosigner w application accepted

How to Fill Out Cosigner w Application Accepted:

01

Start by reading and understanding the requirements and terms of the cosigner application. Make sure you meet all the necessary qualifications and have the necessary documents ready.

02

Gather all the required documents, such as proof of income, identification, and financial statements. Make sure you have all the necessary information to fill out the application accurately.

03

Carefully and accurately fill out the application form. Pay close attention to details such as personal information, contact details, and financial information. Double-check your entries to avoid any errors or missing information.

04

If there are any sections or questions that you are unsure about, do not hesitate to seek clarification from the institution or company you are applying to. It's important to have a clear understanding of what is being asked in order to provide accurate information.

05

Once you have completed the application form, review it one more time to make sure all the information provided is accurate and up-to-date. Any discrepancies or inaccuracies could affect the approval process.

06

If required, provide any additional supporting documents that may be requested by the institution or company. This may include proof of address, employment verification, or additional financial statements.

07

Submit the completed application form and supporting documents to the appropriate department or representative. Keep copies of all the documents for your records.

Who Needs Cosigner w Application Accepted:

01

Individuals with a limited credit history or poor credit score may need a cosigner when applying for loans, mortgages, or rental agreements. A cosigner acts as a guarantor and provides additional security for the lender or landlord.

02

Students who have little to no credit history and are applying for student loans or private student housing may require a cosigner to increase their chances of getting approved.

03

Young adults who have recently entered the workforce and have not built a strong credit history yet may need a cosigner when applying for their first credit card, car loan, or rental agreement.

04

Individuals with a low income or inconsistent income may need a cosigner to help strengthen their application and increase their chances of approval.

05

Applicants with a high debt-to-income ratio may require a cosigner to help offset the risk for lenders or landlords.

Overall, individuals who are considered high-risk borrowers or have limited financial stability may need a cosigner w application accepted to help improve their chances of approval and secure the financial assistance they are seeking.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cosigner w application accepted for eSignature?

To distribute your cosigner w application accepted, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I fill out cosigner w application accepted on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your cosigner w application accepted, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out cosigner w application accepted on an Android device?

Use the pdfFiller Android app to finish your cosigner w application accepted and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is cosigner w application accepted?

Cosigner w application accepted is a formality in which a third party agrees to take on the financial responsibility for a loan if the primary borrower fails to fulfill their obligations.

Who is required to file cosigner w application accepted?

A cosigner is typically required when the primary borrower does not meet the lender's credit requirements or has insufficient income to qualify for the loan on their own.

How to fill out cosigner w application accepted?

To fill out a cosigner w application accepted, the cosigner will need to provide their personal information, financial details, and consent to be responsible for the loan in case the primary borrower defaults.

What is the purpose of cosigner w application accepted?

The purpose of having a cosigner w application accepted is to provide additional security to the lender by having a financially stable individual guarantee the loan repayment in case the primary borrower is unable to do so.

What information must be reported on cosigner w application accepted?

The cosigner will typically need to report their personal information, employment status, income details, credit history, and any existing financial obligations on the cosigner w application accepted.

Fill out your cosigner w application accepted online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cosigner W Application Accepted is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.