Get the free NonProfit Washington State, Corporation

Show details

Polio Outreach Of Washington Nonprofit Washington State, Corporation MISSION STATEMENT W To minimize the impact and increase awareness of Polio×PostSyndrome by providing education and support to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit washington state corporation

Edit your nonprofit washington state corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit washington state corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonprofit washington state corporation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nonprofit washington state corporation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprofit washington state corporation

To fill out a nonprofit Washington state corporation, follow these steps:

01

Research the requirements: Familiarize yourself with the rules and regulations for forming a nonprofit corporation in Washington state. Visit the Washington Secretary of State website for detailed information and guidance.

02

Choose a name: Select a unique and distinctive name for your nonprofit organization. Make sure the name complies with the state's naming requirements and is not already in use by another entity.

03

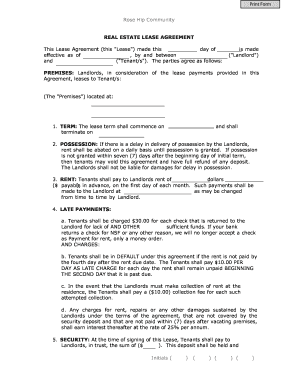

Prepare the Articles of Incorporation: Draft the Articles of Incorporation, which is a legal document that officially establishes your nonprofit corporation. Include information such as the organization's name, purpose, registered agent, initial directors, and any specific provisions or restrictions.

04

File the Articles of Incorporation: Submit the completed Articles of Incorporation to the Washington Secretary of State along with the required filing fee. You can file online or by mail, following the instructions provided on the Secretary of State website.

05

Obtain an Employment Identification Number (EIN): Apply for an EIN from the Internal Revenue Service (IRS) if your nonprofit corporation will have employees, engage in certain financial transactions, or apply for tax-exempt status. You can apply online through the IRS website.

06

Register for state taxes: If your nonprofit intends to conduct activities that require paying sales tax or employ staff, you may need to register with the Washington State Department of Revenue for tax purposes. Review the state's tax requirements and obligations.

07

Create bylaws: Establish a set of bylaws that outline the internal rules and procedures of your nonprofit corporation. Bylaws typically cover topics such as governance, membership, meetings, and decision-making processes.

08

Hold an organizational meeting: Once the nonprofit corporation is officially formed, conduct an initial organizational meeting with the initial directors and any other necessary participants. During this meeting, important decisions and appointments can be made, such as approving the bylaws, electing officers, and discussing the organization's activities.

Who needs a nonprofit Washington state corporation?

01

Individuals or groups wanting to provide charitable, educational, religious, scientific, or other beneficial services to the community.

02

Organizations seeking to operate under a separate legal entity, protecting their members or directors from personal liability.

03

Nonprofits aiming to obtain tax-exempt status and enjoy certain financial benefits available to charitable organizations.

04

Those who wish to solicit donations, apply for grants, or access specific resources that are commonly available to registered nonprofits.

05

Entities looking to establish a formal structure that ensures longevity and stability for their nonprofit activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nonprofit washington state corporation from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your nonprofit washington state corporation into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send nonprofit washington state corporation for eSignature?

Once your nonprofit washington state corporation is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit nonprofit washington state corporation on an iOS device?

Create, modify, and share nonprofit washington state corporation using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is nonprofit washington state corporation?

A nonprofit Washington state corporation is a legal entity that operates for charitable, educational, religious, scientific, or other similar purposes, rather than generating profit for owners or shareholders.

Who is required to file nonprofit washington state corporation?

Nonprofit organizations in Washington state are required to file for nonprofit corporation status with the Secretary of State's office.

How to fill out nonprofit washington state corporation?

To fill out nonprofit Washington state corporation forms, organizations must provide information about their purpose, board of directors, registered agent, and other key details.

What is the purpose of nonprofit washington state corporation?

The purpose of a nonprofit Washington state corporation is to fulfill charitable, educational, religious, scientific, or other similar purposes for the benefit of the community.

What information must be reported on nonprofit washington state corporation?

Information that must be reported on nonprofit Washington state corporation forms includes organization name, purpose, address, board of directors, and registered agent.

Fill out your nonprofit washington state corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Washington State Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.