PH Bank of Commerce Personal Loan Application Form 2012-2026 free printable template

Show details

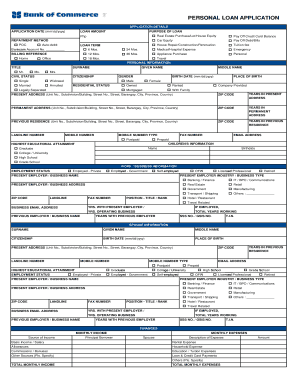

PERSONAL LOAN APPLICATION FORM APPLICATION DETAILS APPLICATION DATE (mm×dd/YYY) LOAN AMOUNT PHP Real Estate Purchase×Lot×House Equity REPAYMENT METHOD LOAN TERM 6 Mos. Car Equity Pay Off Credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign PH Bank of Commerce Personal Loan Application

Edit your PH Bank of Commerce Personal Loan Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PH Bank of Commerce Personal Loan Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PH Bank of Commerce Personal Loan Application online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PH Bank of Commerce Personal Loan Application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH Bank of Commerce Personal Loan Application Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PH Bank of Commerce Personal Loan Application

How to fill out PH Bank of Commerce Personal Loan Application Form

01

Gather required documents: Personal identification, proof of income, and any additional required documentation.

02

Visit the official PH Bank of Commerce website or local branch to access the Personal Loan Application Form.

03

Fill out your personal information: Name, address, contact details, and Social Security Number.

04

Provide employment details: Employer's name, position, duration of employment, and income information.

05

Indicate the loan amount you are requesting and the purpose of the loan.

06

Review the terms and conditions of the loan carefully.

07

Sign the application form and any necessary consent forms.

08

Submit the completed application form along with all required documents either online or in person at a branch.

Who needs PH Bank of Commerce Personal Loan Application Form?

01

Individuals seeking financial assistance for personal needs such as home improvement, medical expenses, education fees, or debt consolidation.

02

People who may want to buy a new vehicle or fund a major purchase and require additional financial resources.

03

Anyone looking to consolidate existing debts into a single loan for easier management.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 documents required for loan?

Documents required Identity proof / address proof (copy of passport/voter ID card/driving license/Aadhaar Card) Bank statement of previous 3 months (Passbook of previous 6 months) Two latest salary slip/current dated salary certificate with the latest Form 16.

How do you start a loan application letter?

Heading and Greeting Your name and contact information. The date of your letter. The name, title and contact information of your loan agent. A subject line stating that you're writing about a loan and specifying the dollar amount you're requesting. A greeting.

How to write a loan?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What 6 things are needed for a loan application?

To receive a Loan Estimate, you need to submit only six key pieces of information: Your name. Your income. Your Social Security number (so the lender can check your credit) The address of the home you plan to purchase or refinance. An estimate of the home's value. The loan amount you want to borrow.

What are the 4 documents generally used in real estate loans?

Depending on your unique financial situation, there are several documents you might need when you apply for a home loan, including your tax returns, pay stubs, bank statements and credit history.

What are the 4 steps to processing a loan?

Below are the stages that are critical components of Loan Origination process : Pre-Qualification Process. This is the first step in the Loan origination process. Loan Application. Application Processing. Underwriting Process. Credit Decision. Quality Check. Loan Funding.

What documents are needed to process a loan?

Most of the documents can be submitted electronically. Loan application. Each lender will have an application to initiate the loan process, and this application can look different from lender to lender. Proof of identity. Employer and income verification. Proof of address. Credit score. Loan purpose. Monthly expenses.

What is the most common loan application form?

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

What are the 4 types of loans?

The lender decides a fixed rate of interest that you must pay on the money you borrow, along with the principal amount borrowed.Types of secured loans Home loan. Loan against property (LAP) Loans against insurance policies. Gold loans. Loans against mutual funds and shares. Loans against fixed deposits.

How do I write a loan application form?

Things To Remember in Writing a Loan Application Letter Observe the proper rules for writing formal letters. State your intent to borrow a specific amount of money. Explain in detail the reason for borrowing money. Enumerate your assets and liabilities.

What is loan application process?

Personal loan application offline Visit the branch of the financial lender. Procure the personal loan application form and enter all the required details. Submit relevant documents that prove one's income, age, address and identity. The lender will then verify the documents and check the eligibility of the applicant.

What are the 4 steps in the loan application process?

Personal Loan Process Step1: Check the Eligibility Criteria. Step 2: Check Interest Rates and Other Charges. Step 3: Calculate your EMI. Step 4: Check Required Documents. Step 5: Fill Application Form Online. Step 6: Wait for Loan Approval.

What are the 4 C's of lending?

Standards may differ from lender to lender, but there are four core components — the four C's — that lender will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

How do I make sure I get approved for a loan?

Here are five tips to boost your chances of qualifying for a personal loan. Clean up your credit. Credit scores are major considerations on personal loan applications. Rebalance your debts and income. Don't ask for too much cash. Consider a co-signer. Find the right lender.

What are 5 things you need to get approved for a loan?

Here are five common requirements that financial institutions look at when evaluating loan applications. Credit Score and History. An applicant's credit score is one of the most important factors a lender considers when evaluating a loan application. Income. Debt-to-income Ratio. Collateral. Origination Fee.

What is standard loan application form?

Loan Application Form means the application form and any related materials submitted by the Borrower to the Initial Lender in connection with an application for the Loans under Division A, Title IV, Subtitle A of the CARES Act.

What are the loan application requirements?

Personal loan documents your lender may require Loan application. Each lender will have an application to initiate the loan process, and this application can look different from lender to lender. Proof of identity. Employer and income verification. Proof of address. Credit score. Loan purpose. Monthly expenses.

What do I put on a loan application?

This initial application will often ask for your personal information, such as your name, address, phone number, date of birth, and Social Security Number. You may also be required to state your desired loan amount and purpose, as well as additional financial details like your gross monthly income or mortgage payment.

What is the loan application form?

A loan application form is a document used by banks to collect the relevant information from a potential borrower when applying for a loan.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get PH Bank of Commerce Personal Loan Application?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the PH Bank of Commerce Personal Loan Application in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit PH Bank of Commerce Personal Loan Application in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your PH Bank of Commerce Personal Loan Application, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out PH Bank of Commerce Personal Loan Application using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign PH Bank of Commerce Personal Loan Application and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is PH Bank of Commerce Personal Loan Application Form?

The PH Bank of Commerce Personal Loan Application Form is a document that individuals must complete to apply for a personal loan from the bank. It collects essential information about the applicant and their financial situation.

Who is required to file PH Bank of Commerce Personal Loan Application Form?

Anyone wishing to obtain a personal loan from PH Bank of Commerce is required to file the application form. This includes both new customers and existing account holders.

How to fill out PH Bank of Commerce Personal Loan Application Form?

To fill out the PH Bank of Commerce Personal Loan Application Form, applicants should provide personal details, such as name, address, employment information, financial details, and the desired loan amount. It's important to ensure all information is accurate and complete.

What is the purpose of PH Bank of Commerce Personal Loan Application Form?

The purpose of the PH Bank of Commerce Personal Loan Application Form is to assess the applicant's creditworthiness and financial situation to determine eligibility for a personal loan.

What information must be reported on PH Bank of Commerce Personal Loan Application Form?

The information required on the PH Bank of Commerce Personal Loan Application Form includes the applicant's personal identification details, income, employment status, credit history, and the purpose for which the loan is needed.

Fill out your PH Bank of Commerce Personal Loan Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PH Bank Of Commerce Personal Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.