Get the free Credit Constraints, Firms[Precautionary Investment ... - eea - esem .com

Show details

Credit Constraints, Firms'Precautionary Investment, and the Business Cycle Under Party University Pompey Sabra January 2009 Abstract This paper studies the macroeconomic implications of ...RMS'precautionary

We are not affiliated with any brand or entity on this form

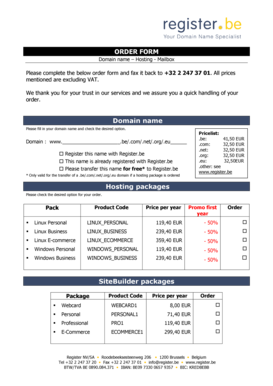

Get, Create, Make and Sign credit constraints firmsprecautionary investment

Edit your credit constraints firmsprecautionary investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit constraints firmsprecautionary investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit constraints firmsprecautionary investment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit constraints firmsprecautionary investment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

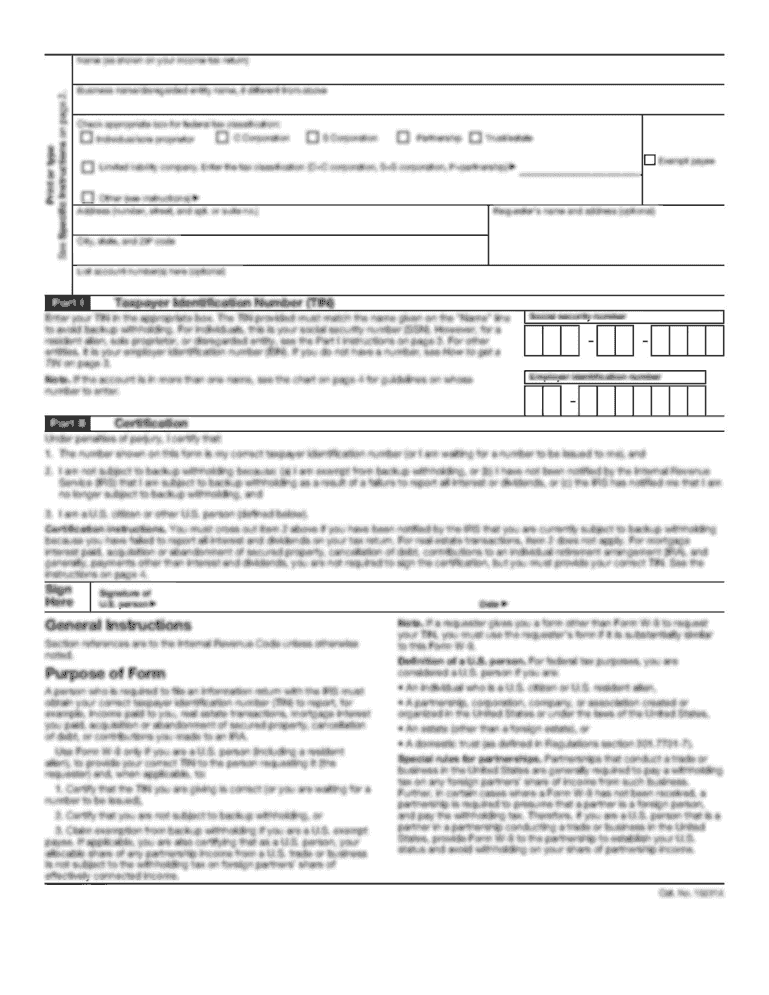

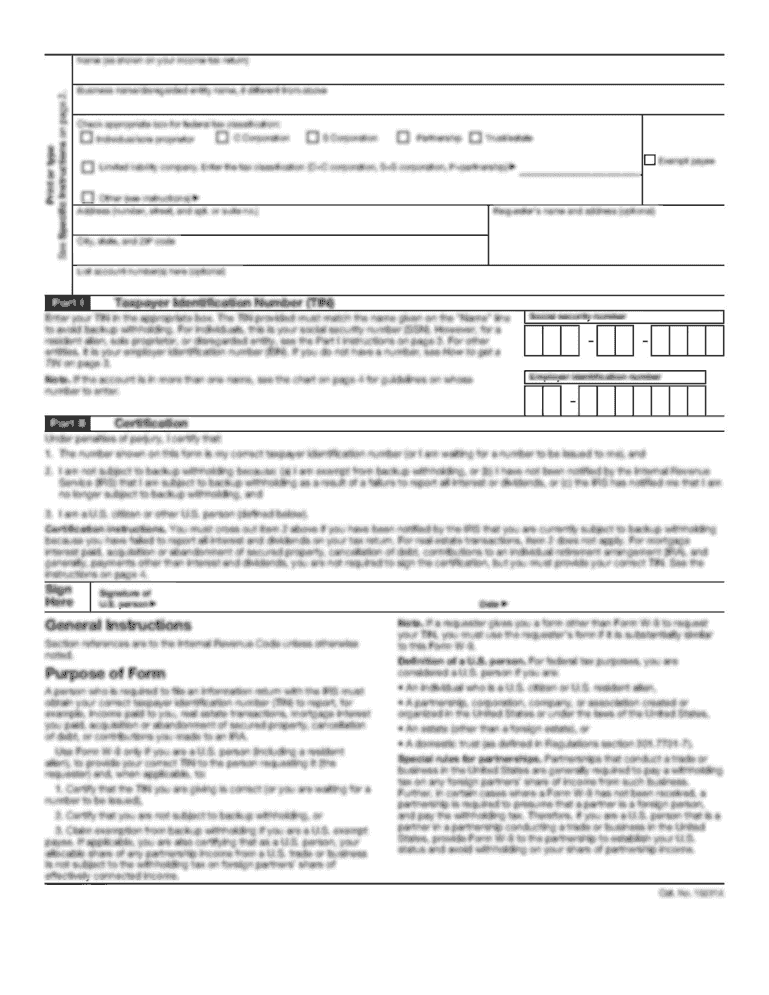

How to fill out credit constraints firmsprecautionary investment

How to fill out credit constraints firmsprecautionary investment?

01

Identify the specific credit constraints that the firm is facing. This could be a lack of access to affordable credit or limited borrowing capacity.

02

Assess the potential risks and uncertainties that the firm may face in the future. This could include economic downturns, unexpected expenses, or industry-specific challenges.

03

Determine the amount of precautionary investment that the firm needs to mitigate these risks and uncertainties. This could involve estimating the necessary cash reserves, developing contingency plans, or exploring alternative financing options.

04

Evaluate the available resources and financial capabilities of the firm. This includes analyzing the firm's existing assets, revenue streams, and profitability.

05

Develop a strategic plan for filling out the credit constraints through precautionary investment. This may involve seeking additional funding sources, improving cash flow management, or implementing cost-cutting measures.

06

Monitor and regularly reassess the firm's financial situation to ensure that the credit constraints are adequately addressed. This could involve reviewing financial statements, conducting regular budget reviews, and adjusting investment strategies as necessary.

Who needs credit constraints firmsprecautionary investment?

01

Small and medium-sized enterprises (SMEs) that often face limited access to credit due to their size and lack of established credit history.

02

Start-up companies that may require precautionary investment to mitigate uncertainties during their initial stages of operation.

03

Businesses operating in industries with high volatility or cyclicality, where unforeseen market downturns can significantly impact their financial stability.

04

Companies that operate in countries or regions with unstable economic conditions or unreliable financial systems, leading to heightened credit constraints.

05

Firms that rely heavily on external financing for their operations and expansion plans, as they are more vulnerable to credit constraints during economic downturns or changes in the lending environment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit constraints firmsprecautionary investment directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign credit constraints firmsprecautionary investment and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit credit constraints firmsprecautionary investment from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including credit constraints firmsprecautionary investment, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit credit constraints firmsprecautionary investment on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing credit constraints firmsprecautionary investment right away.

What is credit constraints firmsprecautionary investment?

Credit constraints firmsprecautionary investment refers to the practice of firms taking precautionary measures to mitigate risks associated with credit constraints. This involves setting aside funds or investing in assets that can be easily liquidated in the event of financial difficulties.

Who is required to file credit constraints firmsprecautionary investment?

Firms operating in certain industries or sectors may be required to file information about their credit constraints and precautionary investment. This requirement may vary depending on the jurisdiction and regulations governing the industry.

How to fill out credit constraints firmsprecautionary investment?

The process for filling out credit constraints firmsprecautionary investment may depend on the specific requirements set by the regulatory authorities. Typically, firms need to provide information about their current credit position, any measures they have taken to address credit constraints, and details about their precautionary investment strategies.

What is the purpose of credit constraints firmsprecautionary investment?

The purpose of credit constraints firmsprecautionary investment is to ensure financial stability and mitigate risks associated with credit constraints. By setting aside funds or investing in liquid assets, firms can improve their ability to handle unexpected financial challenges and maintain their operations effectively.

What information must be reported on credit constraints firmsprecautionary investment?

The specific information that must be reported on credit constraints firmsprecautionary investment may vary depending on the regulatory requirements. However, typically, firms need to provide details about their current credit position, any measures taken to address credit constraints, and information about their precautionary investment strategies.

Fill out your credit constraints firmsprecautionary investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Constraints Firmsprecautionary Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.