Get the free The M&A Tax Report Subscription

Show details

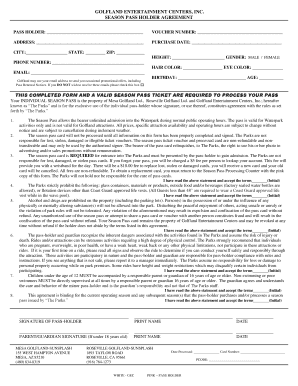

This document outlines the subscription details for The M&A Tax Report, including information about proposed roll-up legislation and tax implications for investors in limited partnerships.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form ma tax report

Edit your form ma tax report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ma tax report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form ma tax report online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form ma tax report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form ma tax report

How to fill out The M&A Tax Report Subscription

01

Gather all necessary financial documents related to your M&A activities.

02

Access the M&A Tax Report Subscription portal online.

03

Create an account or log in with your existing credentials.

04

Select the relevant reporting period for the M&A activities.

05

Fill out the required fields with accurate financial data, ensuring all information is up to date.

06

Review your entries for any errors or missing information.

07

Submit the form for processing and save a copy for your records.

Who needs The M&A Tax Report Subscription?

01

Corporate finance professionals involved in mergers and acquisitions.

02

Tax advisors and accountants handling M&A transactions.

03

Legal firms requiring tax reports for compliance and due diligence.

04

Investors or stakeholders seeking insights on tax implications of M&A.

05

Companies planning to engage in M&A activities and need comprehensive reports.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of M&A?

Some of the most famous and successful examples of M&A transactions that have occurred over the last few decades include: Google's acquisition of Android. Disney's acquisition of Pixar and Marvel. Exxon and Mobile merger (a great example of a successful horizontal merger).

Is deferred tax a debt-like item?

Deferred Tax Liabilities and M&A Transactions The liability will in essence be treated like a “debt” - but with nuances. The size of the debt is based on the present value of the remaining tax payment differential over the life of the assets.

What is M&A tax due diligence?

Tax due diligence involves a comprehensive review of a target company's tax position, potential liabilities and opportunities during an M&A transaction. This process helps identify any tax-related risks, outstanding obligations and areas where tax efficiency can be improved.

What does M&A stand for?

Mergers and acquisitions (M&A) are business transactions in which the ownership of a company, business organization, or one of their operating units is transferred to or consolidated with another entity.

What is M&A tax?

Mergers and acquisitions (M&A) is a term that refers to the management, financing and strategy involved with buying, selling and combining companies. Every M&A deal has tax implications; M&A tax professionals assist with deal negotiations and help manage the entire process from a tax perspective.

What is an M&A expense?

M&A expense funds are often arranged in contracts to allow the shareholder representative to pay for any third-party expenses that may arise after closing, such as engaging attorneys or accountants for any post-closing disputes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is The M&A Tax Report Subscription?

The M&A Tax Report Subscription is a service that provides access to comprehensive reports related to mergers and acquisitions, focusing on their tax implications.

Who is required to file The M&A Tax Report Subscription?

Entities involved in mergers and acquisitions, including corporations and partnerships, are typically required to file The M&A Tax Report Subscription.

How to fill out The M&A Tax Report Subscription?

To fill out The M&A Tax Report Subscription, required information should be gathered and entered into the designated fields on the form, ensuring accuracy and completeness before submission.

What is the purpose of The M&A Tax Report Subscription?

The purpose of The M&A Tax Report Subscription is to ensure compliance with tax regulations and provide transparency regarding the tax implications of transactions.

What information must be reported on The M&A Tax Report Subscription?

The information that must be reported includes details of the transaction, parties involved, valuation, and any tax attributes affected by the merger or acquisition.

Fill out your form ma tax report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ma Tax Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.