Get the free Gift Form

Show details

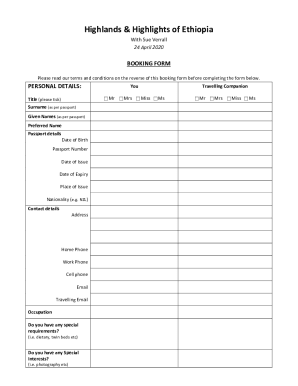

This form is used for making donations to Haileybury, providing options for single or multiple gifts, payment details, and fund preferences.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift form

Edit your gift form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift form online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift form

How to fill out Gift Form

01

Gather necessary information such as the recipient's name and address.

02

Choose the type of gift you want to give.

03

Fill in the details of the gift, including any specific item description.

04

Specify the value of the gift.

05

Include your name and contact information.

06

Review the form for accuracy.

07

Sign and date the form, if required.

08

Submit the form according to the instructions provided.

Who needs Gift Form?

01

Anyone who is giving a gift that requires documentation.

02

Individuals or organizations that need to report gift giving for tax purposes.

03

Donors contributing to charities or foundations.

Fill

form

: Try Risk Free

People Also Ask about

Which of the following situations would require the filing of Form 709?

You must file Form 709 if any of the following situations apply to you: You made gifts to individuals exceeding the annual exclusion amount (currently $15,000 per recipient in 2023). You and your spouse are "splitting gifts" (gifts made by one spouse are treated as made equally by both).

What triggers a gift tax audit?

What Can Trigger a Gift or Estate Tax Audit? Here are some of the common factors that can lead to gift or estate tax audits: Total estate and gift value: Generally speaking, gift and estate tax returns are more likely to be audited when there are taxes owed and the size of the transaction or estate is relatively large.

What is a gift form?

Taxpayers use IRS Form 709 to report gifts. Filing the form with the IRS is the responsibility of the giver, but it's only required in certain gift giving situations. Take for instance the check Grandma writes for your birthday each year.

Do people actually file gift tax returns?

Do you need to file a gift tax return? If you make a taxable gift (one in excess of the annual exclusion), you are required to file Form 709: US Gift (and Generation-Skipping Transfer) Tax Return.

What form do I use to declare a gift?

Use Form 709 to report: Transfers subject to the federal gift and certain generation-skipping transfer (GST) taxes.

How much does it cost to prepare a form 709?

The Cost of Tax Preparation Tax FormCost per FormAverage Hourly Fees Form 709 (Gift Tax) $421 $178.29 Form 1041 (Fiduciary) $576 $172.66 Form 1065 (Partnership) $733 $177.29 Form 990 (Exempt Organization) $735 $171.4810 more rows

What happens if I don't file Form 709?

Avoid a filing penalty Failing to file a required gift tax return may result in a penalty of 5% per month of the tax due, up to 25%.

Do I really need to file form 709?

Each individual is responsible to file a Form 709. You must file a gift tax return to split gifts with your spouse (regardless of their amount) as described in Part III Spouse's Consent on Gifts to Third Parties, later. If a gift is of community property, it is considered made one-half by each spouse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Gift Form?

The Gift Form is a legal document used to report the transfer of gifts or gifts made by an individual to another individual or entity, typically for tax purposes.

Who is required to file Gift Form?

Generally, individuals who make gifts exceeding the annual exclusion amount to another person or entity are required to file a Gift Form.

How to fill out Gift Form?

To fill out a Gift Form, you need to provide the recipient's information, the description of the gift, its fair market value, and any other required details as specified by the tax authority.

What is the purpose of Gift Form?

The purpose of the Gift Form is to report any gifts that exceed the allowable annual exclusion amount to ensure compliance with tax regulations and to determine potential gift tax liabilities.

What information must be reported on Gift Form?

Information that must be reported includes the names and addresses of the donor and recipient, description of the gift, date of transfer, fair market value, and any exemptions claimed.

Fill out your gift form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.