Get the free A GEORGIA NONPROFIT CORPORATION CONSTITUTION ARTICLE I NAME

Show details

HIRAM BASKETBALL BOOSTER CLUB, INC.

A GEORGIA NONPROFIT CORPORATION

CONSTITUTION

ARTICLE I

NAME

The Articles of Incorporation of this Corporation fix its name as HIRAM BASKETBALL

BOOSTER CLUB, INC.,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a georgia nonprofit corporation

Edit your a georgia nonprofit corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a georgia nonprofit corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

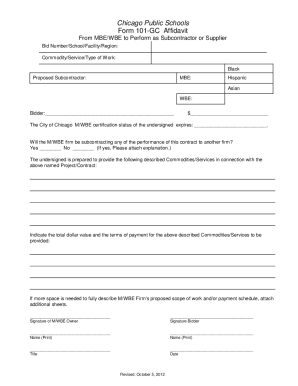

Editing a georgia nonprofit corporation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit a georgia nonprofit corporation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a georgia nonprofit corporation

How to fill out a Georgia nonprofit corporation:

01

Research and understand the requirements: Start by familiarizing yourself with the Georgia Secretary of State's website and reviewing the specific requirements for forming a nonprofit corporation in Georgia. This will include understanding the necessary documents, fees, and any additional steps involved in the process.

02

Choose a name for your nonprofit: Select a unique and distinguishable name for your nonprofit corporation. Ensure that the name complies with Georgia's naming guidelines and is not already in use by another business or organization.

03

Prepare and organize the required documentation: Gather the necessary documents for filing your nonprofit corporation, which typically includes drafting and filing articles of incorporation. The articles of incorporation typically contain important information about the nonprofit's purpose, registered agent, board of directors, and any specific provisions you may want to include.

04

Appoint a registered agent: A registered agent is an individual or entity that will receive important legal and official documents on behalf of the nonprofit corporation. Ensure that the registered agent meets the necessary qualifications and is willing to take on this responsibility.

05

File the necessary paperwork: Complete and file the required documents with the Georgia Secretary of State. This may include submitting the articles of incorporation, paying any applicable fees, and providing any additional information required.

06

Establish bylaws and governing documents: Create and adopt bylaws, which serve as the internal rules and regulations for your nonprofit corporation. These bylaws typically outline how the organization operates, how decisions are made, and the roles and responsibilities of the board of directors and officers.

07

Obtain necessary licenses and permits: Depending on the nature of your nonprofit corporation's activities, you may need to obtain specific licenses or permits to comply with state and federal laws. Research the requirements and obtain the necessary approvals if applicable.

08

Register for tax-exempt status: If your nonprofit corporation intends to seek tax-exempt status, you will need to apply for recognition as a tax-exempt organization with the Internal Revenue Service (IRS). This typically involves completing and submitting Form 1023 or Form 1023-EZ and providing detailed information about your organization's activities and purpose.

Who needs a Georgia nonprofit corporation?

01

Individuals looking to engage in charitable or public service activities: Nonprofit corporations are commonly formed to pursue charitable, religious, educational, scientific, or art-related purposes. If you have a mission to make a positive impact and conduct activities that benefit the community, forming a nonprofit corporation may be appropriate.

02

Groups or associations seeking legal recognition: Nonprofit corporations provide legal recognition and protection for organizations working towards a common cause. By forming a nonprofit corporation, you can establish a legal entity separate from its members, ensuring transparency, accountability, and limited personal liability for the organization's actions.

03

Organizations looking to access grants and other funding opportunities: Many grant-making organizations and public funding sources require applicants to have nonprofit status. By forming a nonprofit corporation, you may have increased access to funding opportunities and resources to support your organization's mission and activities.

04

Those seeking tax-exempt status: Nonprofit corporations can qualify for tax-exempt status, meaning the organization is exempt from paying federal and state income taxes on its generated revenue. This can significantly benefit the organization's financial resources and allow for increased allocation of funds towards its mission.

05

Individuals or groups wanting to establish a long-lasting legacy: Nonprofit corporations can provide a lasting legacy for individuals or groups aiming to create an enduring institution that continues their work beyond their lifetime. Forming a nonprofit corporation ensures that the organization can continue its charitable activities and impact for years to come.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute a georgia nonprofit corporation online?

Filling out and eSigning a georgia nonprofit corporation is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the a georgia nonprofit corporation form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign a georgia nonprofit corporation and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out a georgia nonprofit corporation on an Android device?

Complete your a georgia nonprofit corporation and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is a georgia nonprofit corporation?

A Georgia nonprofit corporation is a legal entity formed under Georgia law for purposes other than generating profit.

Who is required to file a georgia nonprofit corporation?

Any organization in Georgia that wants to operate as a nonprofit and receive tax-exempt status must file as a nonprofit corporation.

How to fill out a georgia nonprofit corporation?

To fill out a Georgia nonprofit corporation, you must gather the necessary information, complete the required forms, pay the filing fee, and submit the forms to the Georgia Secretary of State.

What is the purpose of a georgia nonprofit corporation?

The purpose of a Georgia nonprofit corporation is to serve charitable, educational, religious, scientific, or other beneficial purposes to the community without generating profits for its members or shareholders.

What information must be reported on a georgia nonprofit corporation?

Information such as the organization's name, purpose, registered agent, board of directors, and financial statements must be reported on a Georgia nonprofit corporation.

Fill out your a georgia nonprofit corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Georgia Nonprofit Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.