Get the free DWELLING FIRE APPLICATION

Show details

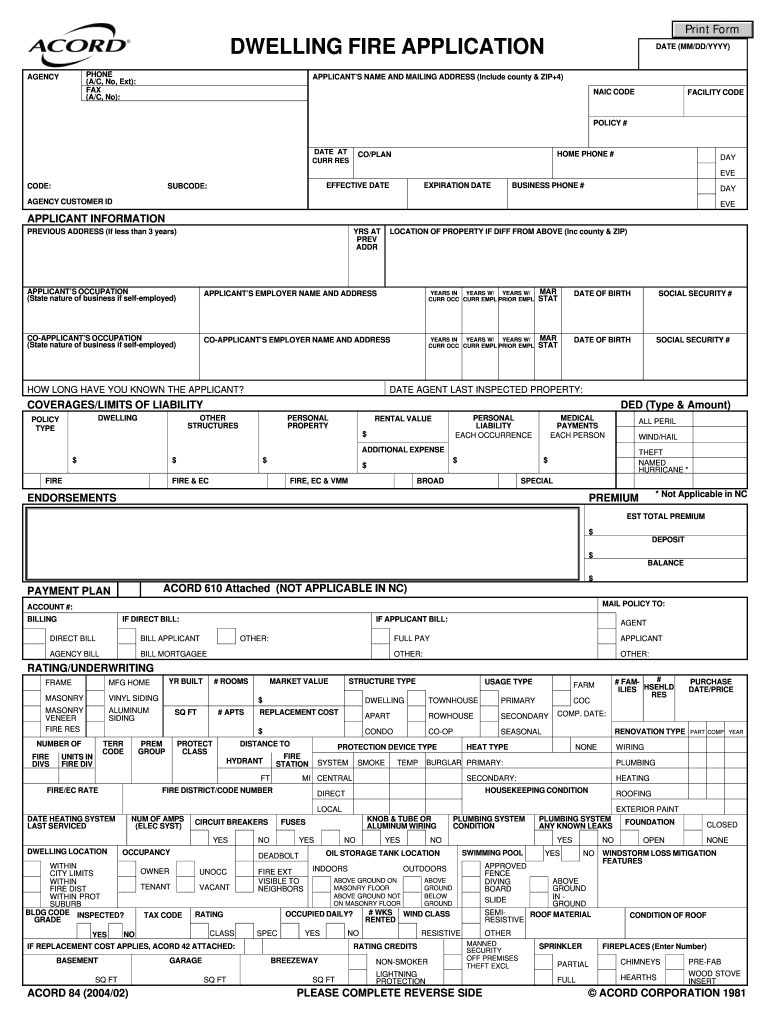

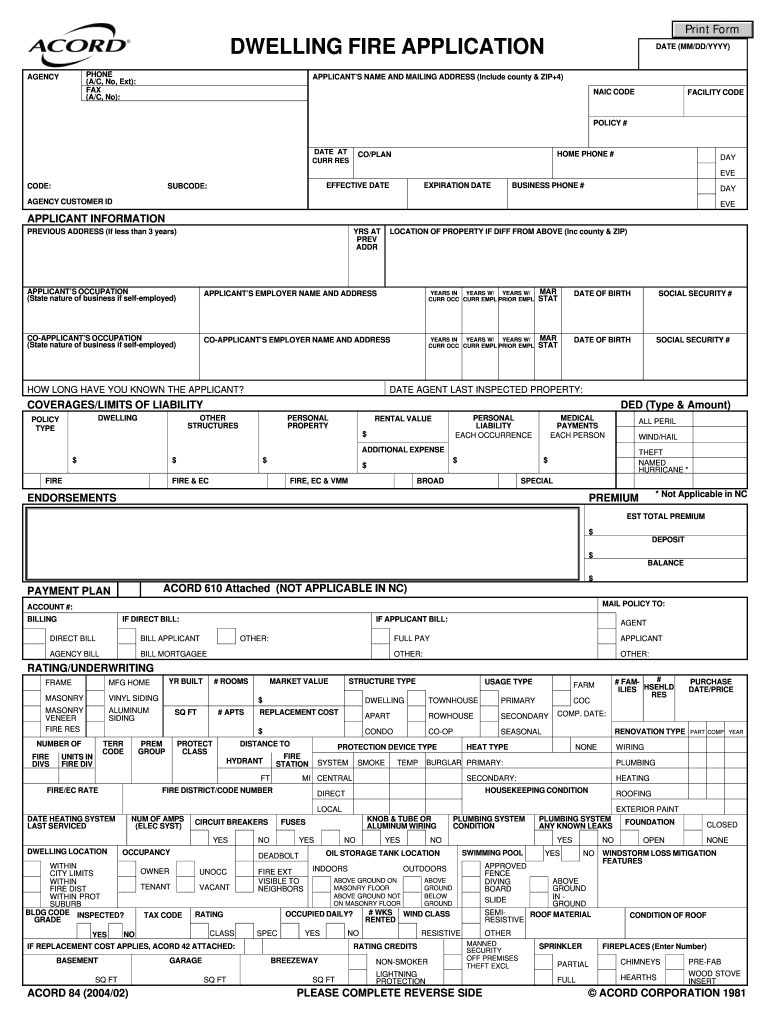

This document serves as an application form for dwelling fire insurance, capturing necessary applicant details, property information, coverage options, and additional disclosures for underwriting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dwelling fire application

Edit your dwelling fire application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dwelling fire application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dwelling fire application online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dwelling fire application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dwelling fire application

How to fill out DWELLING FIRE APPLICATION

01

Begin by gathering all necessary documents related to the property.

02

Enter the property owner's name and contact information.

03

Provide the property address including street number, city, and zip code.

04

Specify the type of dwelling (e.g., single-family home, duplex, etc.).

05

Indicate the construction type and year built.

06

Fill in details about the occupancy status (owner-occupied, rented, vacant).

07

List any prior insurance claims related to the property.

08

Answer questions related to safety features, such as smoke detectors and alarms.

09

Review the coverage options and select appropriate limits.

10

Sign and date the application confirming the information is accurate.

Who needs DWELLING FIRE APPLICATION?

01

Property owners seeking insurance coverage for fire damages to their homes.

02

Landlords who rent out properties to tenants.

03

Homeowners with second homes or vacation properties.

04

Individuals who own vacant or seasonal properties.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between dwelling fire 1 and 3?

There are three main forms of dwelling fire policies - DP1, DP2, and DP3. The DP1 and DP3 represent the two ends of the coverage spectrum, with the DP1 being the most basic and limited policy, while the DP3 offers the highest level of comprehensive protection.

Is dwelling fire the same as landlord insurance?

What is landlord insurance called? Rental dwelling or dwelling fire is what most insurance companies call the insurance policy they provide for properties you own and rent out to others. So, when you are shopping for your landlord insurance, you will likely be referred to a rental dwelling or dwelling fire policy.

Is dwelling fire same as renters insurance?

A traditional homeowners policy typically won't cover homes being rented out or any lawsuits incurred due to renting out the property. Dwelling coverage on a landlord policy may cover damage to the structure itself. Renters Insurance CoveragesCoverage does not apply to renters.

What is the difference between dwelling fire 1 and dwelling fire 3?

Let's review: DP1 vs DP3 When choosing landlord insurance, you might be stumped on which dwelling policy to choose. DP1 insurance provides the least coverage and is cheaper. DP3 insurance provides comprehensive coverage with the option to add additional coverage.

Is DP3 insurance more expensive?

DP1 is cheaper as it covers fewer perils, while DP3 is the most expensive. DP2 insurance is in the middle, a more affordable option than DP3 that covers more risks than DP1. A DP3 policy generally covers everything a DP2 policy does, plus extra coverage.

What is a dwelling fire form?

Kin's editorial team of home insurance experts have been featured in The New York Times, The Wall Street Journal, CNN, USA Today, and elsewhere. Updated Nov 12 2024. A DP1 policy, also called Dwelling Fire Form 1, is a type of home insurance policy that protects a house from nine named perils – most notably fire.

What does a dwelling fire 3 cover?

A DP-3 offers “open” peril coverage. A peril is any type of event or occurrence that may affect your home like fire, theft, wind, or hail. Some policies are “named” peril which means the peril is not covered unless it is specifically listed in the policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DWELLING FIRE APPLICATION?

A Dwelling Fire Application is a form used to apply for insurance coverage for non-owner-occupied residential properties, such as rental homes, vacation homes, or properties being renovated.

Who is required to file DWELLING FIRE APPLICATION?

Landlords or property owners who have rental or investment properties that require insurance coverage must file a Dwelling Fire Application.

How to fill out DWELLING FIRE APPLICATION?

To fill out a Dwelling Fire Application, provide personal information, details about the property, coverage amounts desired, and any relevant underwriting information. It may be completed online or through a paper form, depending on the insurance provider.

What is the purpose of DWELLING FIRE APPLICATION?

The purpose of the Dwelling Fire Application is to obtain insurance that protects the property against risks such as fire, vandalism, and other perils, ensuring financial security for property owners.

What information must be reported on DWELLING FIRE APPLICATION?

The information that must be reported on a Dwelling Fire Application includes the property address, ownership details, occupancy status, property size, construction type, safety features, and any previous claims or damages.

Fill out your dwelling fire application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dwelling Fire Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.