Get the free Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Prog...

Show details

This document serves to provide information regarding tenant household data, compliance reporting, and the status of units in a low-income housing project for the Maryland Department of Housing and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low income housing tax

Edit your low income housing tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low income housing tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing low income housing tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit low income housing tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out low income housing tax

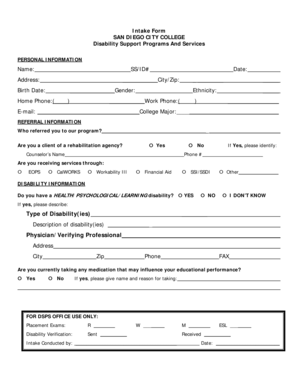

How to fill out Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Program Compliance (AOCCPC)

01

Gather necessary documentation including income information, resident data, and compliance records.

02

Obtain the Low Income Housing Tax Credit (LIHTC) program guidelines to ensure compliance requirements are understood.

03

Complete the property identification section by providing the name and address of the property.

04

Fill out the owner’s information including name, title, and contact information.

05

Review the tenant information to confirm it aligns with LIHTC requirements and regulations.

06

Complete the certification section by confirming that the property continues to meet program requirements.

07

Sign and date the certification, ensuring all information is accurate and complete.

08

Submit the AOCCPC to the appropriate housing authority or agency as required.

Who needs Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Program Compliance (AOCCPC)?

01

Property owners managing properties that benefit from the Low Income Housing Tax Credit program.

02

Developers seeking to maintain compliance with LIHTC program requirements.

03

Housing authorities overseeing the enforcement of LIHTC program compliance.

04

Tenants living in LIHTC properties to ensure their rights and compliance of the property.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for the NYS property tax relief credit?

The real property tax credit may be available to New York State residents who have household gross incomes of $18,000 or less, and pay either real property taxes or rent for their residences. The amount of the credit for each household will vary depending on income and real property taxes paid (see table to the right).

What is the NYS low income housing tax credit?

SLIHC provides a dollar-for-dollar reduction in state taxes to investors in qualified low-income housing which meet the requirements of Article 2-A of the Public Housing Law. The SLIHC Credit allocation is not calendar year-specific. The SLIHC program has selection criteria which are set forth in the SLIHC regulations.

How do you qualify for low-income housing in NY?

In order to be eligible, you must be 18 years old, and your household income needs to be in a specific range for each affordable housing opportunity. Applicants will be required to meet additional guidelines, including asset limits, and tenant selection criteria to qualify.

Who qualifies for this credit, the New York City school tax credit?

School Tax Credit (Rate Reduction Amount): You are eligible for this credit if you: were a full-year or part-year resident of New York City, cannot be claimed as a dependent on another taxpayer's federal return, and. had taxable New York City income of $500,000 or less.

What is the NYS low income housing tax credit program?

SLIHC provides a dollar-for-dollar reduction in state taxes to investors in qualified low-income housing which meet the requirements of Article 2-A of the Public Housing Law. The SLIHC Credit allocation is not calendar year-specific.

What is the meaning of section 42?

Renters living in Low Income Housing Tax Credit (LIHTC - Section 42) units pay a fixed rent amount. The rent amounts are often similar to other market rate units in the area. However, the LIHTC buildings often have much nicer amenities than market rate units renting for a similar price.

What is the low income housing tax credit in DC?

The Low Income Housing Tax Credit (LIHTC) program provides non-competitive 4 percent or competitive 9 percent Low Income Housing Tax Credits to developers of new or rehabilitated rental housing for the production of housing affordable to low- and moderate-income persons at or below 60 percent of Area Median Income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Program Compliance (AOCCPC)?

The Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Program Compliance (AOCCPC) is a document that ensures compliance with the regulations governing the Low Income Housing Tax Credit program. It is used by owners to certify that they are adhering to the requirements of the program.

Who is required to file Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Program Compliance (AOCCPC)?

Owners of properties that are receiving Low Income Housing Tax Credits are required to file the AOCCPC. This includes both individual property owners and property management companies overseeing such properties.

How to fill out Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Program Compliance (AOCCPC)?

To fill out the AOCCPC, the owner must provide information regarding tenant occupancy, income levels, and other compliance issues related to the Low Income Housing Tax Credit program. This often involves detailing the number of qualified tenants and confirming adherence to income limits and reporting requirements.

What is the purpose of Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Program Compliance (AOCCPC)?

The purpose of the AOCCPC is to provide a formal certification by property owners that they are complying with the requirements of the Low Income Housing Tax Credit program. This ensures that the properties are properly serving low-income tenants and that the tax credits are being utilized correctly.

What information must be reported on Low Income Housing Tax Credit Attachment to Owner's Certification of Continuing Program Compliance (AOCCPC)?

The AOCCPC requires reporting information such as tenant income levels, the number of tenants in compliance, any changes in the property’s status regarding eligibility, and a statement of compliance with program guidelines and requirements.

Fill out your low income housing tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low Income Housing Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.