USDT Form II-RC-159 2001 free printable template

Show details

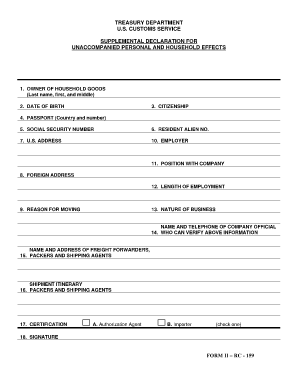

TREASURY DEPARTMENT U.S.CUSTOMS SERVICE SUPPLEMENTAL DECLARATION FOR UNACCOMPANIED PERSONAL AND HOUSEHOLD EFFECTS 1. OWNER OF HOUSEHOLD GOODS (Last name, first and middle) 2. DATE OF BIRTH: 3. CITIZENSHIP

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign USDT Form II-RC-159

Edit your USDT Form II-RC-159 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your USDT Form II-RC-159 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit USDT Form II-RC-159 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit USDT Form II-RC-159. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

USDT Form II-RC-159 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out USDT Form II-RC-159

How to fill out USDT Form II-RC-159

01

Begin by downloading the USDT Form II-RC-159 from the official website.

02

Carefully read the instructions provided at the top of the form.

03

Fill out your personal information including your name, address, and contact details in the designated fields.

04

Provide information regarding the purpose of the form as required.

05

Include any relevant financial or income details asked in the form.

06

Double-check all entries for completeness and accuracy.

07

Sign and date the form at the bottom.

08

Submit the filled form according to the instructions given, either by mail or electronically.

Who needs USDT Form II-RC-159?

01

Individuals or entities applying for certain financial benefits or services.

02

People needing to report specific financial statuses to the relevant authorities.

03

Anyone who falls under the regulations requiring the completion of Form II-RC-159.

Fill

form

: Try Risk Free

People Also Ask about

What do I put on my customs declaration form?

To correctly fill out your customs declaration, you will need the following information: Name and complete address of the sender. Complete address and name of receiver. Item description (if there are several different products in the same package, note them all separately) Quantity of items. Value of each item.

How do I fill out a U.S. customs declaration?

2:22 6:12 How to fill out US Customs Forms | Arriving in USA in 2021 - YouTube YouTube Start of suggested clip End of suggested clip Number. Then give your current street address in the united. States. At the same time if you don'tMoreNumber. Then give your current street address in the united. States. At the same time if you don't have an actual address and you're staying at a hotel it is important to mention. That.

Do I need to fill U.S. customs declaration form?

Each individual arriving into the United States must complete the CBP Declaration Form 6059B. Explanations and a sample declaration form can be found on the Sample Customs Declaration Form.

Do you still have to fill out customs declaration form?

Who are exempted from completing a customs form? The only people who do not have to fill out this form are citizens of the United States, those who use the APC (Automated Passport Control Process), green card holders, and individuals who have an ESTA or D Visa.

Can you fill out a U.S. customs form online?

Filling Out Customs Forms Online You can print just a customs form or use Click-N-Ship® service to pay for postage and print an international shipping label and a customs form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit USDT Form II-RC-159 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your USDT Form II-RC-159 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send USDT Form II-RC-159 for eSignature?

USDT Form II-RC-159 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit USDT Form II-RC-159 online?

The editing procedure is simple with pdfFiller. Open your USDT Form II-RC-159 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is USDT Form II-RC-159?

USDT Form II-RC-159 is a reporting form used for disclosing certain financial transactions and holdings related to cryptocurrency, particularly focusing on USDT (Tether) transactions.

Who is required to file USDT Form II-RC-159?

Individuals and entities that engage in significant USDT transactions or hold substantial USDT assets are required to file USDT Form II-RC-159.

How to fill out USDT Form II-RC-159?

To fill out USDT Form II-RC-159, provide accurate details regarding your identity, the nature of your USDT transactions, and the amounts involved, following the guidelines provided by the regulatory authority.

What is the purpose of USDT Form II-RC-159?

The purpose of USDT Form II-RC-159 is to ensure transparency and compliance regarding financial activities involving USDT, aiding in the regulation and monitoring of cryptocurrency transactions.

What information must be reported on USDT Form II-RC-159?

The information that must be reported includes personal identification details, transaction dates, amounts of USDT involved, the purpose of transactions, and any related financial information as specified by the reporting requirements.

Fill out your USDT Form II-RC-159 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

USDT Form II-RC-159 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.