Get the free Third Party Guarantee

Show details

This document serves as a guarantee by a third party to take on financial obligations related to a lease agreement should the lessee fail to meet those obligations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign third party guarantee

Edit your third party guarantee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your third party guarantee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing third party guarantee online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit third party guarantee. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out third party guarantee

How to fill out Third Party Guarantee

01

Obtain a copy of the Third Party Guarantee form.

02

Fill in the name and contact information of the third party.

03

Provide details of the principal debtor (the person whose obligation is being guaranteed).

04

Include the specific obligation or debt being guaranteed.

05

Indicate the duration of the guarantee.

06

Sign and date the document in the designated areas.

07

Have the third party sign the form as the guarantor.

08

Consult a legal advisor if needed before submission.

Who needs Third Party Guarantee?

01

Individuals or businesses seeking to secure a loan or credit.

02

Landlords requiring assurance for lease agreements.

03

Financial institutions needing guarantees for loans.

04

Anyone entering into contracts where a guarantee is beneficial.

Fill

form

: Try Risk Free

People Also Ask about

What are the different types of guarantees?

Types of Guarantees Personal Guarantee. Someone states that they will pay for someone else's debt or obligation. Bank Guarantee. The bank guarantees that they will pay a certain amount if the customer doesn't pay. Corporate Guarantee. Performance Guarantee. Financial Guarantee.

What are the three types of guarantees?

Traditionally, a distinction is made between: Real guarantees relating to assets having an intrinsic value. Personal guarantees involving a debt obligation for one or more people. Moral guarantees that do not provide the lender with any real legal security.

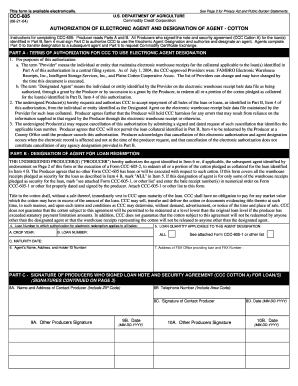

What is a third party guarantee?

A third-party guarantee means that someone other than the borrower, usually a family member or a friend, agrees to take responsibility for repaying the loan if the borrower cannot.

What is third party Oxford English Dictionary?

Broadly, any person who is not intimately involved in a relationship, transaction, contract or legal proceeding (a stranger to it).

What are the different types of signature guarantees?

The Bottom Line There are three Medallion signature guarantee programs: STAMP (the Securities Transfer Agents Medallion Program), SEMP (the Stock Exchange Medallion Program), and MSP (the New York Stock Exchange Medallion Signature Program).

What are the different types of guarantors?

Types of guarantors Individual guarantor: This is the most common type, typically a close friend, family member, or someone with a strong financial standing. Corporate guarantor: In some cases, a company might guarantee the loan of another company, usually a subsidiary or a business partner.

What are the three main types of banking?

These are the most common types of banks and include public sector banks, private sector banks, and foreign banks. They provide various services like savings and current accounts, loans, and investments.

What is a bank guarantee on behalf of a third party?

A bank guarantee is a guarantee given by the bank on behalf of the applicant to cover a payment obligation to a third party. In other words, the bank becomes a guarantor and is answerable for the person requesting the guarantee in the event that they are unable to make the payment they have agreed with a third party.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Third Party Guarantee?

A Third Party Guarantee is a legal promise made by a third party to assume the financial obligations of a primary party, ensuring that a debt or commitment will be fulfilled if the primary party fails to do so.

Who is required to file Third Party Guarantee?

Any party seeking to secure a loan, mortgage, or other forms of credit may be required to file a Third Party Guarantee, especially if their creditworthiness is deemed insufficient by the lender.

How to fill out Third Party Guarantee?

To fill out a Third Party Guarantee, the guarantor must provide their personal details, including name, contact information, and financial information, along with a declaration of their intent to guarantee the obligations of the primary party.

What is the purpose of Third Party Guarantee?

The purpose of a Third Party Guarantee is to reduce the risk for lenders by having a third party assure them that the loan or obligation will be repaid, enhancing the creditworthiness of the primary borrower.

What information must be reported on Third Party Guarantee?

The information that must be reported includes the names and contact details of the guarantor and borrower, the amount of the guarantee, the terms of the obligation, and the nature of the debt or commitment being guaranteed.

Fill out your third party guarantee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Third Party Guarantee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.