Get the free uconnect universal life

Show details

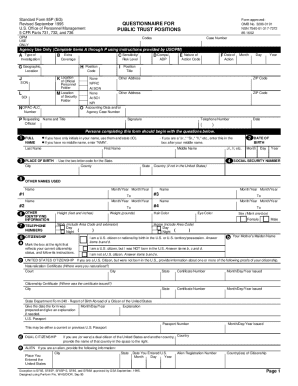

Destiny* Universal Life Initial Investment Allocation Application Number: Policy Number: Life Insureds Name: Policy owner: Life Insureds Name: Policy owner: Planned Deposits: Please invest my planned

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uconnect universal life

Edit your uconnect universal life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uconnect universal life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uconnect universal life online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit uconnect universal life. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uconnect universal life

How to fill out uconnect universal life:

01

Determine your coverage needs: Before filling out the application, assess how much life insurance coverage you require. Consider factors such as your income, debts, and future financial obligations.

02

Gather essential information: Collect all the necessary information to complete the application accurately. This may include personal details such as your full name, date of birth, and contact information.

03

Provide health information: Uconnect universal life typically requires disclosing your health history. Be prepared to share information about any pre-existing medical conditions, medications, or previous surgeries.

04

Choose your premium and death benefit: Decide on the premium amount you are comfortable paying and select the desired death benefit amount. This will determine the cost of your life insurance policy and the coverage amount your beneficiaries will receive upon your passing.

05

Complete the application form: Fill out the uconnect universal life application form thoroughly and accurately. Double-check all the information before submitting to ensure there are no errors or omissions.

06

Review and sign: Carefully review the completed application, ensuring all sections are answered appropriately. Sign the form, indicating your agreement to the terms and conditions of the policy.

07

Submit the application: Submit the uconnect universal life insurance application to the insurance provider through the designated method, such as online submission or mailing it to their address.

Who needs uconnect universal life:

01

Individuals seeking long-term life insurance coverage: Uconnect universal life is an ideal option for those who need coverage that lasts for a specific period, typically their entire lifetime. It provides lifelong protection, making it suitable for individuals looking for comprehensive life insurance.

02

People who want flexible premiums: Uconnect universal life offers the flexibility to adjust premium payments based on personal financial circumstances. This is beneficial for individuals whose income may fluctuate or who have varying financial priorities.

03

Those looking for cash value accumulation: Uconnect universal life policies accumulate cash value over time. If you want a life insurance policy that can potentially grow in value, this type of coverage may be suitable for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete uconnect universal life online?

Easy online uconnect universal life completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the uconnect universal life in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your uconnect universal life and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit uconnect universal life on an iOS device?

Create, modify, and share uconnect universal life using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is uconnect universal life?

Uconnect universal life is a type of life insurance policy that offers both a death benefit and a savings component. The savings component allows the policyholder to accumulate cash value over time.

Who is required to file uconnect universal life?

Individuals who have purchased or own a uconnect universal life insurance policy are required to file it.

How to fill out uconnect universal life?

To fill out a uconnect universal life policy, you need to provide personal information such as your name, age, gender, and contact details. You also need to specify the coverage amount and beneficiary information. Additionally, you may need to provide information about your health and undergo a medical examination.

What is the purpose of uconnect universal life?

The purpose of uconnect universal life is to provide financial protection to the policyholder's beneficiaries in case of their death. It also offers a cash value component that can be used for various purposes, such as supplementing retirement income or paying for educational expenses.

What information must be reported on uconnect universal life?

On a uconnect universal life insurance policy, you must report personal information, such as your name, address, and Social Security number. You also need to provide details about your beneficiaries and the coverage amount. Additionally, you may need to disclose your health history and undergo a medical examination.

Fill out your uconnect universal life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uconnect Universal Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.