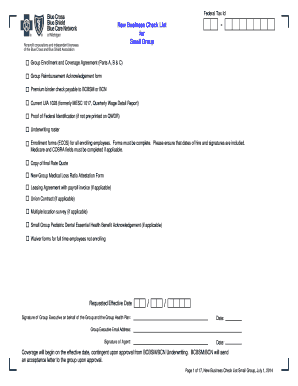

Get the free RBC LIFESHIELD TERM AND RBC LIFESHIELD TERM PLUS POINT OF SALE CHECKLIST

Show details

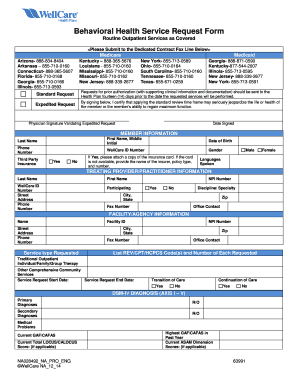

This document serves as a checklist for agents to ensure all necessary application materials are collected for life insurance policies in Nevada.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rbc lifeshield term and

Edit your rbc lifeshield term and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rbc lifeshield term and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rbc lifeshield term and online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rbc lifeshield term and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rbc lifeshield term and

How to fill out RBC LIFESHIELD TERM AND RBC LIFESHIELD TERM PLUS POINT OF SALE CHECKLIST

01

Obtain the RBC LIFESHIELD TERM and RBC LIFESHIELD TERM PLUS forms.

02

Review the documentation requirements listed on the first page of the checklist.

03

Gather necessary personal information, including identification and contact details.

04

Fill out the personal information section completely, ensuring accuracy.

05

Answer all health-related questions honestly and to the best of your ability.

06

Review the premium payment options and select your preferred method.

07

Sign and date the application where indicated.

08

Attach any required supplementary documents as per the checklist.

09

Submit the completed checklist along with the application to your RBC representative.

Who needs RBC LIFESHIELD TERM AND RBC LIFESHIELD TERM PLUS POINT OF SALE CHECKLIST?

01

Individuals seeking life insurance coverage through RBC.

02

Families looking to secure financial support in case of unforeseen events.

03

New clients interested in RBC's life insurance products for protection and peace of mind.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim my life insurance money?

Here's how to file a life insurance claim and apply for the death benefit payout: Figure out which life insurance company holds the policies. Get the policyholder's certified death certificate. File the claim with the insurer. Choose how you'll receive the payout. Receive the death benefit payout.

What is the best life insurance in Canada?

What is the best life insurance in Canada? Best for seniors: CPP. Best for children: Desjardins. Best for smokers: Empire Life. Best for business owners: Ivari. Best for lifelong coverage: Manulife. Best term life insurance: PolicyMe. Runner-up for term life: RBC. Best for estate planning: Sun Life.

Is RBC life insurance good?

RBC has some decently priced coverage options, with premiums just slightly lower than many other Canadian insurance companies. Their term life insurance policies have guaranteed renewability. You can convert your policy to a permanent life insurance policy.

What does RBC home protector insurance cover?

Benefit maximums: life coverage — the outstanding balance of your mortgage to a maximum of $750,000, disability coverage — your regular mortgage payment to a maximum of $3,000 monthly for up to 24 months, critical illness coverage — the outstanding balance of your mortgage to a maximum of $300,000.

How do I claim my RBC insurance?

Make a claim by phone Canada & U.S. 1-800-769-2526. (Toll Free) Make a claim 24/7. On a Rogers cell phone. #722. Make a claim 24/7. Outside Canada & U.S. 905-608-8945. (Collect) Make a claim 24/7.

How long does it take to get money from a life insurance claim?

Most life insurance payouts are issued within 14 to 60 days, depending on when the claim is filed, the cause of death and policy-specific requirements. Find out if you're overpaying for life insurance below.

How do I claim on my life insurance after death?

Mandatory documents required for claim registration: Copy of Death Certificate of the Life Assured, issued by government authority. Claimant photo identity proof. Claimant address proof(Any one of the following: Aadhar Card, Valid Passport or Driver's License, Voters ID are considered as proofs)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RBC LIFESHIELD TERM AND RBC LIFESHIELD TERM PLUS POINT OF SALE CHECKLIST?

The RBC LIFESHIELD TERM and RBC LIFESHIELD TERM PLUS Point of Sale Checklist is a document used in the insurance industry to streamline the application and underwriting process for term life insurance products offered by RBC. It ensures that all necessary information and documentation are collected at the time of sale.

Who is required to file RBC LIFESHIELD TERM AND RBC LIFESHIELD TERM PLUS POINT OF SALE CHECKLIST?

Insurance agents or brokers who are selling the RBC LIFESHIELD TERM or TERM PLUS policies are required to file the Point of Sale Checklist to ensure compliance with regulatory standards and to facilitate the underwriting process.

How to fill out RBC LIFESHIELD TERM AND RBC LIFESHIELD TERM PLUS POINT OF SALE CHECKLIST?

To fill out the checklist, the insurance agent must gather relevant client information, including personal details, policy preferences, medical history, and any necessary disclosures. Each section of the checklist should be completed accurately and signed by the client where required.

What is the purpose of RBC LIFESHIELD TERM AND RBC LIFESHIELD TERM PLUS POINT OF SALE CHECKLIST?

The purpose of the checklist is to ensure that all required information is collected during the sale of life insurance products, to provide a transparent process for clients, and to assist in the efficient underwriting and approval of insurance applications.

What information must be reported on RBC LIFESHIELD TERM AND RBC LIFESHIELD TERM PLUS POINT OF SALE CHECKLIST?

The information required on the checklist includes the applicant's identification details, policy type, coverage amount, medical history, and any representations regarding the applicant's health status. It may also require signatures from both the agent and the applicant.

Fill out your rbc lifeshield term and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rbc Lifeshield Term And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.