Get the free ANNUITY DISCLOSURE STATEMENT

Show details

This document outlines the terms of an annuity contract including a bonus rate affecting the first year interest rate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annuity disclosure statement

Edit your annuity disclosure statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity disclosure statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annuity disclosure statement online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit annuity disclosure statement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

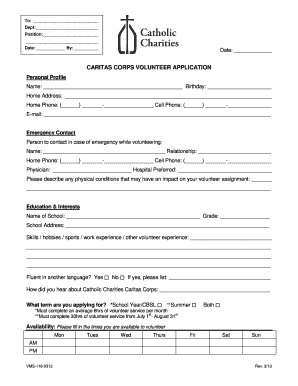

How to fill out annuity disclosure statement

How to fill out ANNUITY DISCLOSURE STATEMENT

01

Read the instructions carefully before starting.

02

Provide your personal information including name, address, and contact details.

03

Specify the type of annuity being disclosed.

04

Fill in the details about the financial institution offering the annuity.

05

Include information about the annuity contract, such as the terms and conditions.

06

Disclose any fees, charges, or penalties associated with the annuity.

07

Review the completed form for accuracy.

08

Sign and date the statement.

Who needs ANNUITY DISCLOSURE STATEMENT?

01

Individuals considering purchasing an annuity.

02

Financial advisors and agents selling annuities.

03

Regulatory bodies overseeing financial products.

04

Investors seeking to understand the terms of an annuity.

Fill

form

: Try Risk Free

People Also Ask about

Do annuities send statements?

When you purchase an annuity, you'll receive these statements at regular intervals — usually once per year for fixed annuities or once per quarter for variable annuities. Annuity owners receive regular statements containing updates on the annuity's performance and value.

What is an example of an annuity?

Defined benefit pensions and Social Security are two examples of lifetime guaranteed annuities that pay retirees a steady cash flow until they pass away.

How much does a $10,000 annuity pay per month?

Defined Benefit Supplement 100% beneficiary annuity estimates Defined Benefit Supplement account balanceAge 50Age 60 $10,000 $61 $64 $15,000 $91 $95 $20,000 $121 $127 $25,000 $152 $1596 more rows

What is the meaning of annuity statement?

An annuity statement is a snapshot of your annuity's performance over time, produced by the company that issued the annuity. You'll receive regular updates of the value of your annuity and any interest or dividends you've earned along with other important information for tax purposes.

What is an annuity document?

An annuity is a written contract typically between you and a life insurance company in which the insurance company makes a series of regularly spaced payments to you in return for a premium or premiums you have paid. An annuity is not life insurance. A life insurance policy provides benefits to your family if you die.

How do I get an annuity statement?

How to access your monthly annuity payment statement Sign in to your online account. Go to OPM Retirement Services Online. Click Annuity Statements in the menu. Select the payment period you would like to view from the dropdown menu. Click the save or print icon to download or print your statement.

What is an annuity statement?

Annuity statements tell you how your retirement accounts are performing. They show how your money is performing, how much your savings have grown, and what you might expect to earn in a certain timeframe. By reading and analyzing your annuity statement, you can make more intelligent choices about your future savings.

What is the meaning of an annuity?

An annuity is a written contract typically between you and a life insurance company in which the insurance company makes a series of regularly spaced payments to you in return for a premium or premiums you have paid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ANNUITY DISCLOSURE STATEMENT?

An Annuity Disclosure Statement is a document that provides essential information about an annuity product, including its features, benefits, risks, and costs. It is designed to help consumers make informed decisions regarding their investment in annuities.

Who is required to file ANNUITY DISCLOSURE STATEMENT?

Insurance companies and other financial institutions that offer annuity products are required to file the Annuity Disclosure Statement. This ensures that all relevant information is disclosed to potential buyers.

How to fill out ANNUITY DISCLOSURE STATEMENT?

To fill out the Annuity Disclosure Statement, the issuer must provide specific information about the annuity contract, including its terms, fees, the projected performance, surrender charges, and any applicable riders. It's essential to ensure all information is accurate and comprehensive.

What is the purpose of ANNUITY DISCLOSURE STATEMENT?

The purpose of the Annuity Disclosure Statement is to ensure transparency and protect consumers by providing them with clear and comprehensive information about annuity products, enabling them to make informed investment choices.

What information must be reported on ANNUITY DISCLOSURE STATEMENT?

The Annuity Disclosure Statement must report information including, but not limited to, the annuity's terms, benefits, fees, surrender charges, investment risks, and the projected growth of the annuity. It also should include the suitability standards for customers.

Fill out your annuity disclosure statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annuity Disclosure Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.