Get the free Employer’s Guide to the Premium Only Plan (P.O.P.)

Show details

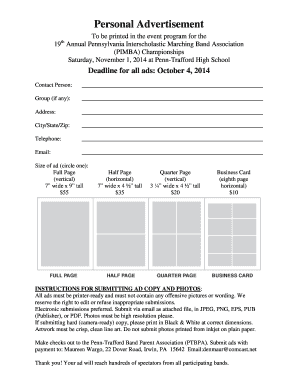

This document provides an overview of the Premium Only Plan, a payroll process change that allows employers to use pre-tax dollars to pay employee benefits, resulting in tax savings and increased

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employers guide to form

Edit your employers guide to form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employers guide to form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employers guide to form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employers guide to form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employers guide to form

How to fill out Employer’s Guide to the Premium Only Plan (P.O.P.)

01

Obtain a copy of the Employer's Guide to the Premium Only Plan (P.O.P.) from a reliable source.

02

Read the introduction and purpose of the document to understand its importance.

03

Complete the required employer information sections, including the employer name, address, and contact information.

04

Fill out the details of the Premium Only Plan, including eligibility requirements and plan features.

05

Detail the process for eligible employees to enroll in the plan.

06

Include information on the premium contributions that employees will make under the plan.

07

Outline the responsibilities of the employer regarding compliance and administration of the P.O.P.

08

Review the guide for any specific state or federal regulations that must be included.

09

Consult with legal or tax professionals if needed to ensure compliance with all applicable laws.

10

Finalize the document and distribute it to all relevant employees and stakeholders.

Who needs Employer’s Guide to the Premium Only Plan (P.O.P.)?

01

Employers who are looking to offer a Premium Only Plan (P.O.P.) as part of their employee benefits package.

02

Human Resources personnel responsible for managing employee benefits.

03

Payroll departments that manage employee contributions for health premiums.

04

Business owners aiming to enhance their employee benefits offerings.

05

Companies that wish to ensure compliance with tax regulations regarding employee benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is a pop premium?

A premium only plan (POP) is a type of Section 125 cafeteria plan that allows employees to pay their share of employer-sponsored health insurance premiums using pre-tax dollars. These plans typically cover premiums for medical, dental, vision, and certain life insurance policies.

What is a pop in insurance?

The Premium Only Plan (POP) is an initiative established by the U.S. Congress and added to IRS Code Section 125. Its purpose is to make premium payments for group benefits more affordable for employees.

What does pop mean in auto insurance?

A benefit plan allowing employees to pay for premiums with pre-tax dollars. Premium only plans (POP) offer tax savings and flexible benefits options.

What does pop mean on my paycheck?

What is a premium only plan? A premium only plan (POP) allows employers to deduct employees' health plan premiums from their paychecks on a pre-tax basis. Also known as a Section 125 or cafeteria plan, a POP can apply to premiums for medical, dental, vision, life insurance, and pre-tax HSA contributions.

What are Funko Pop Premiums?

Pop! Premium figures. These collectibles are slightly taller than standard Pop!

What does pop premium mean?

A premium only plan (POP) is a type of Section 125 cafeteria plan that allows employees to pay their share of employer-sponsored health insurance premiums using pre-tax dollars. These plans typically cover premiums for medical, dental, vision, and certain life insurance policies.

What is a pop in WWE?

In wrestling, a pop refers to the reaction of the crowd, often integrated into the show. It is measured by the amount of cheers or boos a wrestler gets during his entrance, interviews, and in-ring performance (especially when a trademark spot is performed by the wrestler).

What is a pop agreement?

POP Agreement means each license or other agreement pursuant to which a Grantor is provided access to real property of the counterparty thereto to be used and occupied for the transmission and reception of radio telecommunication signals and for the construction, installation, operation, maintenance, repair and removal

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employer’s Guide to the Premium Only Plan (P.O.P.)?

The Employer’s Guide to the Premium Only Plan (P.O.P.) is a document that provides employers with guidelines on how to implement and manage a Premium Only Plan, which allows employees to pay their health insurance premiums with pre-tax dollars.

Who is required to file Employer’s Guide to the Premium Only Plan (P.O.P.)?

Employers who offer a Premium Only Plan to their employees are required to file the Employer’s Guide to the Premium Only Plan (P.O.P.) as part of their compliance with applicable tax laws and regulations.

How to fill out Employer’s Guide to the Premium Only Plan (P.O.P.)?

To fill out the Employer’s Guide to the Premium Only Plan (P.O.P.), employers need to provide relevant information about their health insurance plans, employee participation details, and any other required tax-related information to ensure compliance.

What is the purpose of Employer’s Guide to the Premium Only Plan (P.O.P.)?

The purpose of the Employer’s Guide to the Premium Only Plan (P.O.P.) is to help employers understand the benefits and requirements of establishing a Premium Only Plan, ensuring that they can effectively manage employee health insurance premium payments on a pre-tax basis.

What information must be reported on Employer’s Guide to the Premium Only Plan (P.O.P.)?

The information that must be reported on the Employer’s Guide to the Premium Only Plan (P.O.P.) includes details about the health insurance premiums, the number of employees participating in the plan, and compliance with IRS regulations.

Fill out your employers guide to form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employers Guide To Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.