Get the free our standard overdraft practices - fairfaxcu

Show details

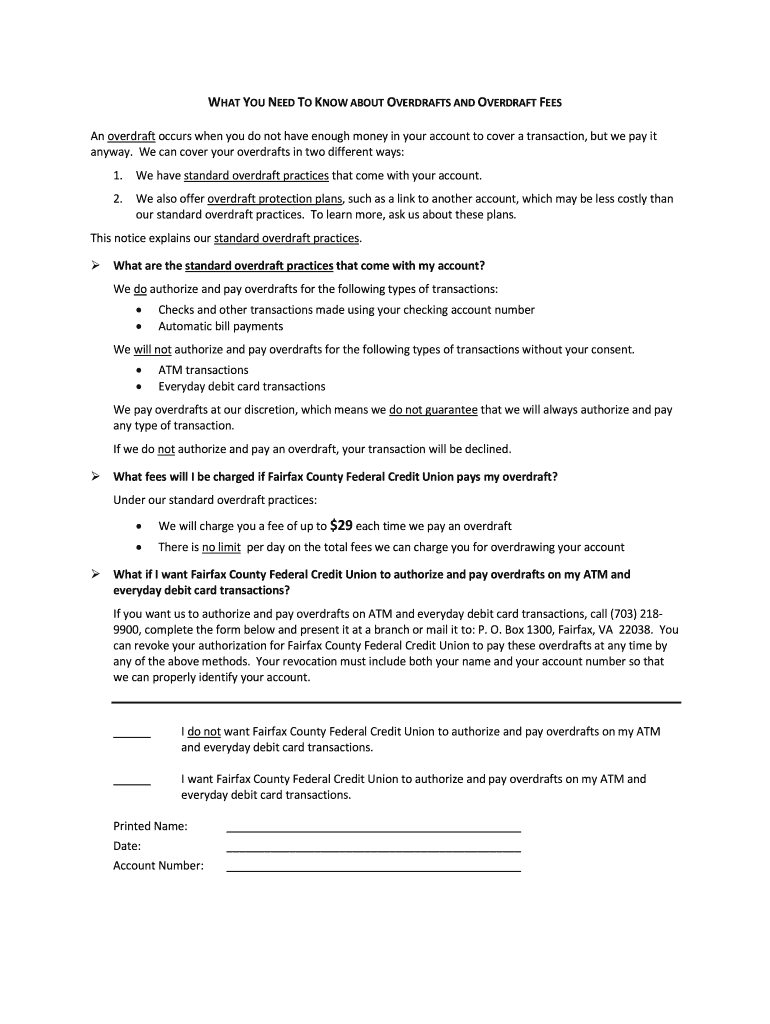

WHAT YOU NEED TO KNOW ABOUT OVERDRAFTS AND OVERDRAFT FEES An overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it anyway. We can cover your overdrafts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign our standard overdraft practices

Edit your our standard overdraft practices form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your our standard overdraft practices form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit our standard overdraft practices online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit our standard overdraft practices. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out our standard overdraft practices

To fill out our standard overdraft practices, follow these steps:

01

Begin by gathering all relevant information and documents related to your overdraft policies and practices. This may include internal policies and procedures, legal requirements, and any applicable industry guidelines.

02

Review your current standard overdraft practices to ensure they are up-to-date and aligned with regulatory requirements. This may involve assessing factors such as fees, transaction processing order, and customer communication.

03

Identify any gaps or areas for improvement in your current practices. Consider conducting a risk assessment to identify potential risks associated with your overdraft practices and develop strategies to mitigate them.

04

Update your standard overdraft practices to reflect any necessary changes. Ensure that your practices are clear, transparent, and easy for both internal staff and customers to understand.

05

Communicate the changes to relevant stakeholders, including internal staff, banking regulators, and customers. Provide training and education to your staff to ensure they understand and can implement the revised overdraft practices effectively.

06

Monitor the effectiveness of your standard overdraft practices regularly. Establish key performance indicators (KPIs) to measure the impact of your practices on customer experience, compliance, and profitability.

Who needs our standard overdraft practices?

01

Banks and financial institutions: This includes both traditional banks and online financial service providers who offer overdraft facilities to their customers. They need standard overdraft practices to ensure they comply with regulatory requirements, minimize risk, and provide transparent and fair treatment to their customers.

02

Compliance officers and risk managers: Professionals responsible for ensuring that financial institutions follow applicable laws and regulations related to overdraft practices need standard practices as a framework for their oversight and monitoring activities.

03

Customers of financial institutions: Customers who use or are eligible for overdraft facilities need to understand the standard overdraft practices of their banks or financial institutions. These practices help them make informed decisions and avoid unexpected fees or charges.

In summary, filling out our standard overdraft practices involves reviewing and updating existing practices, communicating changes to stakeholders, and monitoring effectiveness. Banks, compliance officers, risk managers, and customers of financial institutions are among those who need these practices for various reasons.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send our standard overdraft practices to be eSigned by others?

When you're ready to share your our standard overdraft practices, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete our standard overdraft practices online?

With pdfFiller, you may easily complete and sign our standard overdraft practices online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete our standard overdraft practices on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your our standard overdraft practices, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is our standard overdraft practices?

Our standard overdraft practices involve allowing customers to overdraw their accounts up to a certain limit, subject to fees.

Who is required to file our standard overdraft practices?

Our compliance team is responsible for filing our standard overdift practices.

How to fill out our standard overdraft practices?

Our standard overdraft practices can be filled out by following the guidelines provided by the compliance team.

What is the purpose of our standard overdraft practices?

The purpose of our standard overdraft practices is to provide customers with a safety net in case they accidentally overdraw their accounts.

What information must be reported on our standard overdraft practices?

Our standard overdraft practices must report the overdraft limit, fees, and terms and conditions.

Fill out your our standard overdraft practices online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Our Standard Overdraft Practices is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.