Get the free New Build Mortgage Guarantee Scot Doc - boneaccountbbcomb

Show details

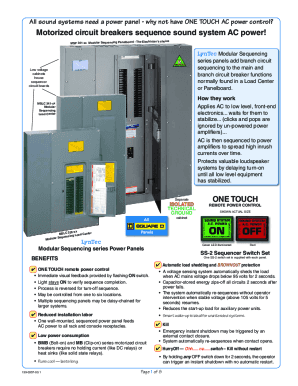

Clear Dated: (1) The Royal Bank of Scotland plc (2) (3) Purchaser Guarantee The property known as: FA1148DI4.09-Page 1 of 9 CONTENTS Clause 1 2 3 4 5 6 7 8 RECITALS GUARANTEE FURTHER BORROWING, SECURITY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new build mortgage guarantee

Edit your new build mortgage guarantee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new build mortgage guarantee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new build mortgage guarantee online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new build mortgage guarantee. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new build mortgage guarantee

How to fill out a new build mortgage guarantee:

01

Gather all necessary documents: Collect all relevant documents such as identification, proof of income, bank statements, and any other documentation required by the lender or mortgage guarantee scheme.

02

Research and choose a mortgage guarantee scheme: Look into the different mortgage guarantee schemes available in your country or region, and select the one that best suits your needs and eligibility criteria.

03

Contact a lender: Reach out to a lender who participates in the chosen mortgage guarantee scheme and ask for an application form.

04

Complete the application form: Fill out the application form accurately and provide all requested information. Be sure to double-check your answers for any errors before submitting.

05

Provide supporting documents: Include all the necessary supporting documents along with your application form. This may include proof of income, bank statements, credit reports, and any other relevant paperwork.

06

Submit the application: Send your completed application form and supporting documents to the lender, either electronically or through traditional mail, as specified by the lender or guarantee scheme.

07

Wait for a response: Once your application has been submitted, you will need to wait for a response from the lender. This may take some time, so it's important to be patient during the review process.

08

Follow up if needed: If you haven't heard back from the lender within a reasonable timeframe, you can contact them to inquire about the status of your application.

09

Review and sign the mortgage guarantee agreement: If your application is approved, carefully review the mortgage guarantee agreement provided by the lender. Ensure that you understand all terms and conditions before signing the agreement.

10

Fulfill any remaining requirements: Follow any further instructions provided by the lender or mortgage guarantee scheme, such as additional documentation or actions required to finalize the mortgage guarantee.

Who needs a new build mortgage guarantee?

New build mortgage guarantees are usually required by individuals or families looking to purchase a newly constructed property. It is especially beneficial for first-time buyers or those who may have difficulty securing a mortgage on their own due to a lack of deposit or credit history. Additionally, developers may also seek a new build mortgage guarantee to provide reassurance to lenders and potential buyers, thus facilitating the sale of their newly built properties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new build mortgage guarantee to be eSigned by others?

Once your new build mortgage guarantee is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit new build mortgage guarantee on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit new build mortgage guarantee.

How do I edit new build mortgage guarantee on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute new build mortgage guarantee from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is new build mortgage guarantee?

New build mortgage guarantee is a type of insurance that protects a lender in the event that a borrower defaults on a mortgage for a newly constructed property.

Who is required to file new build mortgage guarantee?

Lenders or financial institutions providing mortgage loans for new build properties are required to file new build mortgage guarantee.

How to fill out new build mortgage guarantee?

To fill out a new build mortgage guarantee, lenders need to provide the necessary information about the borrower, property details, loan amount, and other relevant details as requested by the insurance provider.

What is the purpose of new build mortgage guarantee?

The purpose of new build mortgage guarantee is to protect lenders from financial loss in case of borrower default on the mortgage for a new construction property.

What information must be reported on new build mortgage guarantee?

Information such as borrower details, property information, loan amount, terms of the mortgage, and other relevant data must be reported on new build mortgage guarantee.

Fill out your new build mortgage guarantee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Build Mortgage Guarantee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.