Get the free CORPORATION or PARTNERSHIP - rrcc lacounty

Show details

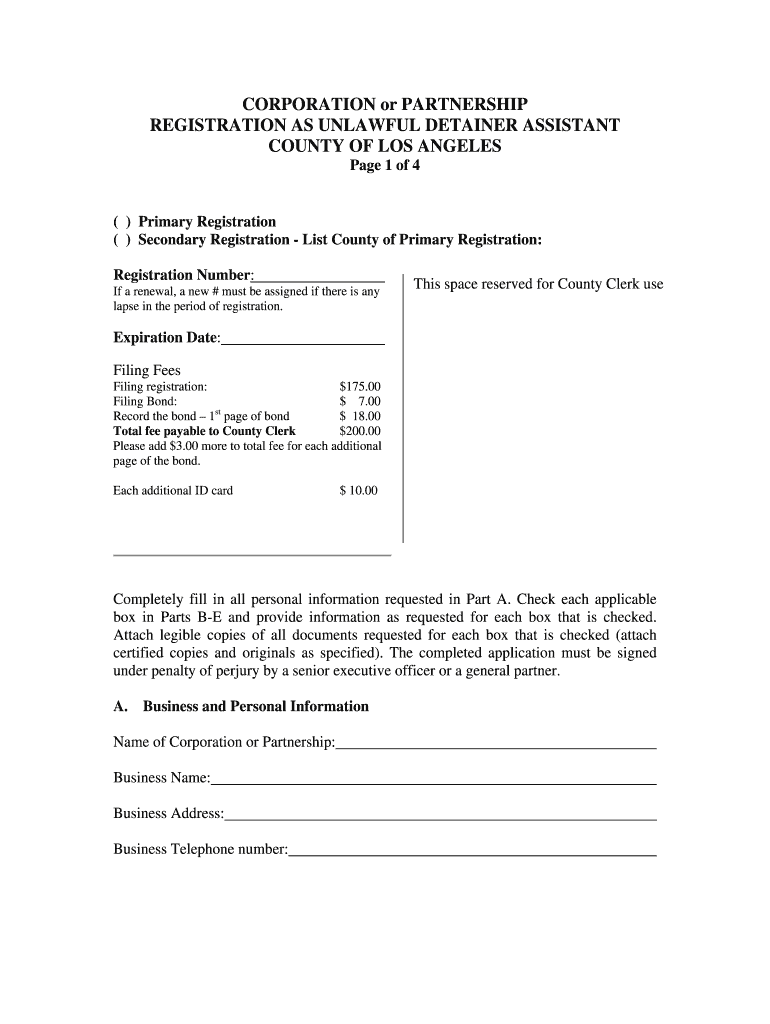

CORPORATION or PARTNERSHIP REGISTRATION AS UNLAWFUL DETAINED ASSISTANT COUNTY OF LOS ANGELES Page 1 of 4 () Primary Registration () Secondary Registration List County of Primary Registration: Registration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporation or partnership

Edit your corporation or partnership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporation or partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporation or partnership online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporation or partnership. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporation or partnership

How to fill out a corporation or partnership:

01

Research and decide on the type of entity: Determine whether you want to establish a corporation or partnership based on the unique needs and goals of your business. Consider factors such as ownership structure, liability protection, and taxation.

02

Choose a name: Select a unique and distinguishable name for your corporation or partnership. Ensure that the chosen name complies with the legal requirements of your jurisdiction and is not already in use by another entity.

03

File necessary paperwork: Prepare and file the required documents with the appropriate government agency. This typically includes filing articles of incorporation for a corporation or a partnership agreement for a partnership. These documents outline important information about the entity, such as its name, purpose, owners, and registered address.

04

Obtain necessary licenses and permits: Determine whether your business requires any specific licenses or permits to operate legally. Research the requirements for your industry and make sure to obtain all the necessary authorizations before commencing your operations.

05

Register for taxes: Contact the relevant tax authorities to register your corporation or partnership for taxation purposes. This may include obtaining a federal employer identification number (EIN) in the United States or registering for GST/HST in Canada.

06

Develop corporate bylaws or partnership agreements: Establish internal rules and regulations that govern how your entity will operate. For corporations, this involves creating corporate bylaws that outline procedures for shareholder meetings, voting rights, and other important matters. Partnerships typically require a partnership agreement that defines the roles, responsibilities, and profit-sharing arrangements between the partners.

Who needs a corporation or partnership:

01

Entrepreneurs and startups: Many entrepreneurs choose to establish a corporation or partnership as a formal legal structure for their business. This provides them with liability protection, flexibility in ownership structure, and potential tax advantages.

02

Small businesses: Corporations and partnerships can be beneficial for small businesses seeking to separate personal and business liabilities. By forming an entity, owners can protect their personal assets from business-related debts and legal issues.

03

Professionals and service providers: Many professionals, such as lawyers, doctors, or consultants, prefer to operate through a corporation or partnership. This allows them to limit personal liability while providing services and also enables them to benefit from potential tax advantages.

Remember, consulting with a legal professional or business advisor can provide valuable guidance specific to your situation and jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit corporation or partnership online?

The editing procedure is simple with pdfFiller. Open your corporation or partnership in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I edit corporation or partnership on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing corporation or partnership, you need to install and log in to the app.

How do I fill out the corporation or partnership form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign corporation or partnership and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is corporation or partnership?

A corporation is a legal entity that is separate from its owners and is formed to conduct business. A partnership is a business structure in which two or more individuals manage and operate a business in accordance with the terms and objectives set out in a Partnership Deed.

Who is required to file corporation or partnership?

All corporations and partnerships are required to file with the appropriate government authorities in accordance with the laws and regulations of the jurisdiction in which they operate.

How to fill out corporation or partnership?

To fill out a corporation or partnership, you will need to gather all relevant information about the business, including its legal structure, ownership details, financial information, and any other required documentation. You can then file the necessary forms with the appropriate government agency.

What is the purpose of corporation or partnership?

The purpose of a corporation or partnership is to provide a legal structure for conducting business activities, managing liabilities, and distributing profits among owners.

What information must be reported on corporation or partnership?

Information that must be reported on a corporation or partnership includes details about the business structure, ownership, financial performance, tax filings, and any other information required by government authorities.

Fill out your corporation or partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporation Or Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.