Get the free TRUST RECEIPT

Show details

This document serves as a trust receipt for shipping documents representing goods hypothecated as collateral for payment of bills/drafts to KASIKORNBANK PUBLIC COMPANY LIMITED.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust receipt

Edit your trust receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

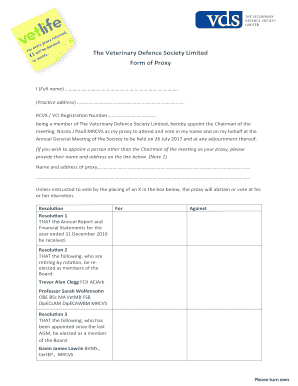

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

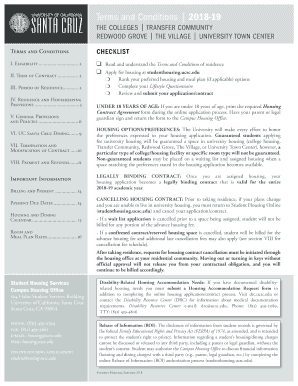

How to edit trust receipt online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit trust receipt. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

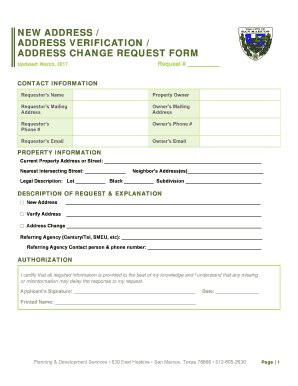

How to fill out trust receipt

How to fill out TRUST RECEIPT

01

Begin by obtaining the TRUST RECEIPT form from your financial institution.

02

Fill in the date at the top of the form.

03

Provide your personal or business name and address.

04

Include the details of the collateral, such as description and value.

05

Indicate the lender's name and address.

06

State the purpose of the loan or credit facility.

07

Sign and date the form to confirm your understanding of the terms.

Who needs TRUST RECEIPT?

01

Businesses seeking financing with collateral.

02

Individuals applying for loans secured by specific assets.

03

Lenders requiring a legal document for secured loans.

Fill

form

: Try Risk Free

People Also Ask about

What is a trust receipt?

Trust Receipt (TR) for Importers or Buyers The TR is a method of financing whereby the Bank retains the legal title to the goods but relinquishes physical possession to the buyer / importer of the goods who acts as the trustee or bank agent.

When to use a trust receipt?

Trust receipts are used to facilitate short-term trade financing, allowing importers to take possession of goods without immediate full payment. Obligation to sell or use for intended purpose. The importer (borrower) is required to sell the goods or use them for the specific business purpose agreed upon with the bank.

What is the difference between LC and trust receipt?

A Letter of Credit assures the sellers of payment when issued an LC according to stipulated terms while a Trust Receipt Loan is a form of financing for the buyers whereby the bank makes an advance to the buyers to settle an import bill.

What is the difference between trust receipt and invoice financing?

A business can borrow money against its unpaid invoices. Trust receipt serves as a promissory note for the bank, which indicates the buyer will pay after the sale. Usually, the risk is assumed by the financing company. The bank assumes majority of the credit risk.

Is a trust receipt a loan?

A trust receipt (T/R) financing is a short-term loan of up to 180 days in which SCB pays for the import of goods by stating in the T/R document that the ownership of the goods still belongs to SCB, and the importer is only an agent who gets the items to sell instead.

What is a trust invoice?

Trust Receipt. A business can borrow money against its unpaid invoices. Trust receipt serves as a promissory note for the bank, which indicates the buyer will pay after the sale. Usually, the risk is assumed by the financing company.

What is the difference between a letter of credit and a trust receipt?

A Letter of Credit assures the sellers of payment when issued an LC according to stipulated terms while a Trust Receipt Loan is a form of financing for the buyers whereby the bank makes an advance to the buyers to settle an import bill.

What is a trust receipt in LC?

Trust Receipt (T/R) is a short-term financing facility offered to importers who buy goods or raw materials from abroad under different types of payment terms such as Letter of Credit (L/C), Bill for Collection (B/C), or Outward Remittance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TRUST RECEIPT?

A Trust Receipt is a document used in finance and banking that allows the borrower to obtain goods from a lender while agreeing that the goods are held in trust for the lender until the borrower repays the loan.

Who is required to file TRUST RECEIPT?

Typically, importers or businesses that are seeking financing for the purchase of goods are required to file a Trust Receipt.

How to fill out TRUST RECEIPT?

To fill out a Trust Receipt, you need to provide details such as the borrower's information, lender's information, description of the goods, loan amount, repayment terms, and signatures of both parties.

What is the purpose of TRUST RECEIPT?

The purpose of a Trust Receipt is to secure the lender's interest in the goods while allowing the borrower to take possession and use them during the term of the loan.

What information must be reported on TRUST RECEIPT?

The information that must be reported on a Trust Receipt includes the names and addresses of the borrower and lender, a detailed description of the goods, the loan amount, applicable terms and conditions, and signatures of the involved parties.

Fill out your trust receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.