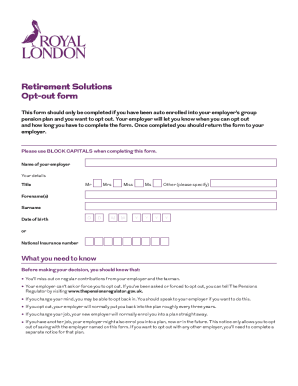

UK Royal London 14A1577 2014 free printable template

Show details

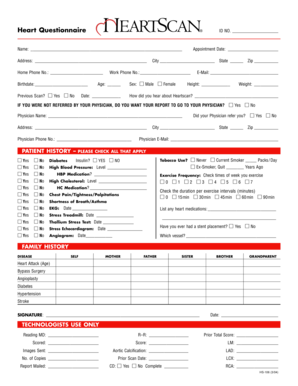

14A1577 OPT-OUT From This form should only be completed if you have been auto enrolled into your employers group pension plan, and you want to opt out. You should return this to your employer, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Royal London 14A1577

Edit your UK Royal London 14A1577 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Royal London 14A1577 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK Royal London 14A1577 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK Royal London 14A1577. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Royal London 14A1577 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Royal London 14A1577

How to fill out UK Royal London 14A1577

01

Begin by downloading the UK Royal London 14A1577 form from the official website or your account.

02

Fill in your personal details such as name, address, and contact information in the designated sections.

03

Provide your National Insurance number if applicable.

04

Indicate the type of policy or service you are applying for or updating.

05

Complete any financial or medical questions as required by the form.

06

Review all the information entered for accuracy and completeness.

07

Sign and date the form to certify that the information provided is true and accurate.

08

Submit the form according to the instructions provided, either online or by mailing it to the specified address.

Who needs UK Royal London 14A1577?

01

Individuals seeking to set up, modify, or claim benefits from a Royal London insurance policy.

02

Policyholders or beneficiaries needing to update personal information or coverage details.

03

Those applying for specific services related to their insurance, such as making a claim or reporting a change.

Fill

form

: Try Risk Free

People Also Ask about

Can I cancel my Royal London pension?

You have 30 days from when you receive your plan documents to change your mind. If you decide that you don't want the plan, you should complete and return the cancellation form provided to you.

When can I access my Royal London pension?

When you reach age 55, you'll be able to access your retirement savings – even if you're still working.

What do Royal London do?

In the UK, Royal London provides a range of pension and protection products to customers and employers primarily through independent financial advisers. We have a long-standing reputation for delivering value-for-money pension products, backed by outstanding customer service.

Can I take my money out of Royal London?

You can leave your money invested, giving it more potential to grow. If you're aged 55 or over, you can access your pension savings whenever you feel the time is right. You can buy an annuity, dip in with pension drawdown or take it all as a cash lump sum.

Who owns Royal London pension?

Mutual companies like Royal London are customer-owned. This means our profits are shared with customers, not shareholders.

What kind of pension is Royal London?

Company pension plan. A company pension plan is a type of workplace pension set up by your employer. The plan is run by trustees on your employer's behalf. You'll have an individual account with the plan.

Can I cancel my Royal London Life Insurance?

If you change your mind and cancel your Policy within 30 days of the start cate, you will be refunded any premiums you have paid. If you cancel your policy at any other time, your cover will stop and you won't be eligible for a refund.

Is Royal London a real company?

Welcome to Royal London Founded in 1861, we're the UK's largest mutual life, pensions and investment company.

How do I opt out of Royal London pension?

Opting out They have one month from their auto enrolment date or enrolment date to opt-out. They must contact the pension provider for the opt-out notice and send the completed notice to the employer. Once the employer receives a valid opt-out notice, they must: notify the pension provider of the opt-out.

How long does Royal London take to pay out?

How long does it take for the money to be paid out? As soon as the claim's been verified and we have all the paperwork we've asked for, we make the payment and funds usually clear in 3-5 working days.

How do I take myself off a pension?

You need to ask the pension provider for an opt out form so you can opt out of auto enrolment. Your employer must give you the contact details for the pension provider if you ask for them. You need to complete and sign the pension scheme opt out form, and return it to your employer (or the address given on the form).

Is Royal London a good pension provider?

We've won five stars for our service from Financial Adviser Service Awards (FASA) for 14 years running - so you can recommend us to your clients with confidence. Part of what makes our service five star is our dedicated contacts, who are there to support you at every stage.

Who is the best performing pension provider?

Interactive Investor: Best personal pension provider for large pension pots. Interactive Investor is one of the few companies that offer a flat fee, making them the most economical option for people who have already accumulated a large pension pot.

How do I withdraw money from Royal London?

Withdraw funds from your ISA Withdraw funds from your Royal London ISA. Please call us on: 0345 600 0404. Withdraw funds from your RLUM ISA or Unit Trust. Please call us on: 0345 605 7777. Withdraw funds from your Platinum Plus ISA. Please call us on: Withdraw funds from your Royal London Savings ISA. Please call us on:

Why are Royal London contacting me?

There's lots of reasons why we might need to get in touch with you. We may need to confirm your contact details so we can be sure our records are up to date, or we might be trying to reconnect you with a policy.

Can you opt out of a pension plan?

When your employer has enrolled you in a workplace pension, you can opt out if you want to. To opt out, you have to contact the pension scheme provider. They will tell you how to opt out. Your employer will provide you with their contact details.

Are Royal London a good company?

Royal London has a rating of 4.7 out of 5 stars with Feefo for its customer experience and product quality and is based on more than 200 reviews over the past year. Trustpilot reviews give Royal London 4.2 out of 5 stars based on over 1000 reviews.

Is Royal London a good company?

Royal London has a rating of 4.7 out of 5 stars with Feefo for its customer experience and product quality and is based on more than 200 reviews over the past year. Trustpilot reviews give Royal London 4.2 out of 5 stars based on over 1000 reviews.

Can I get my money back from Royal London?

If there's genuine error involved in the payment of contributions, the contributions can be returned.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UK Royal London 14A1577 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your UK Royal London 14A1577 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send UK Royal London 14A1577 for eSignature?

Once you are ready to share your UK Royal London 14A1577, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute UK Royal London 14A1577 online?

Completing and signing UK Royal London 14A1577 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

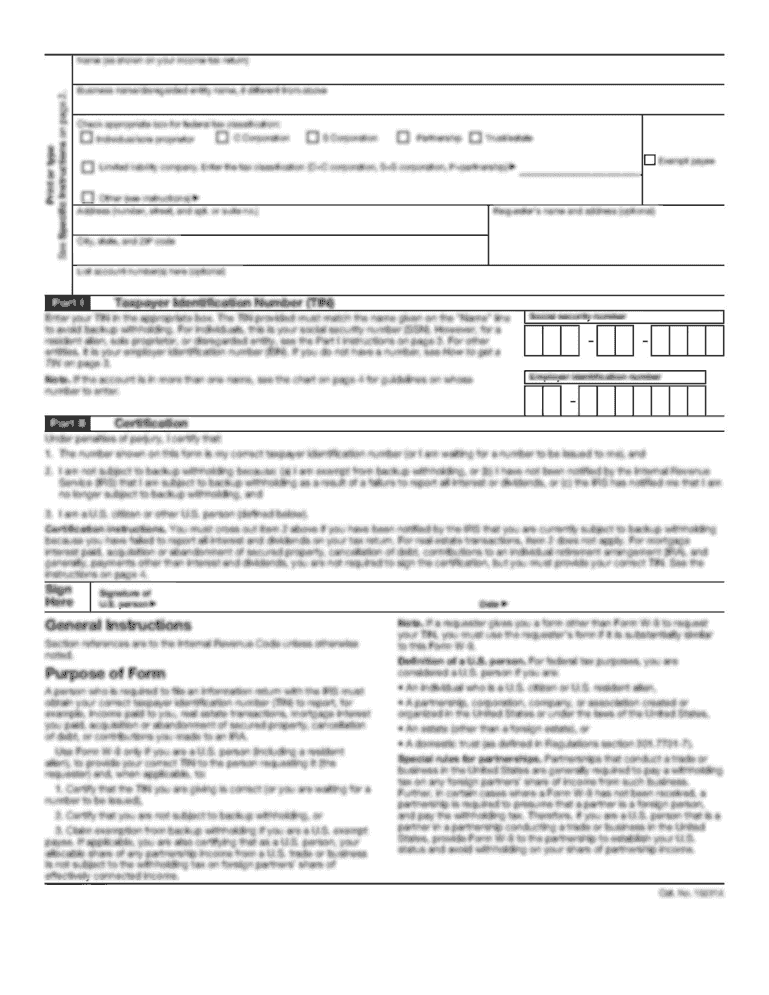

What is UK Royal London 14A1577?

UK Royal London 14A1577 is a specific form used for reporting certain financial information related to life insurance policies in the United Kingdom.

Who is required to file UK Royal London 14A1577?

Individuals or entities who hold or manage life insurance policies with Royal London and are required to report financial information must file the UK Royal London 14A1577 form.

How to fill out UK Royal London 14A1577?

To fill out the UK Royal London 14A1577 form, gather relevant information about the life insurance policy, including policyholder details, policy number, and financial data required, and follow the instructions provided with the form.

What is the purpose of UK Royal London 14A1577?

The purpose of UK Royal London 14A1577 is to ensure compliance with financial reporting regulations and to provide accurate information regarding life insurance policies to the relevant authorities.

What information must be reported on UK Royal London 14A1577?

The information that must be reported on UK Royal London 14A1577 includes policyholder details, policy number, coverage amounts, premiums paid, and any relevant financial transactions associated with the policy.

Fill out your UK Royal London 14A1577 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Royal London 14A1577 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.