UK Royal London 14A1577 2021 free printable template

Show details

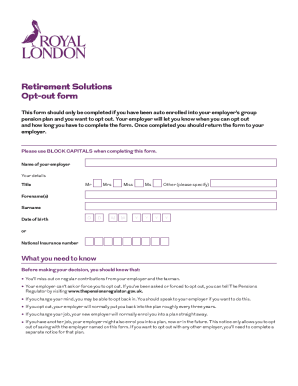

Retirement Solutions

Op tout form

This form should only be completed if you have been auto enrolled into your employers group

pension plan, and you want to opt out. Your employer will let you know

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Royal London 14A1577

Edit your UK Royal London 14A1577 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Royal London 14A1577 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK Royal London 14A1577 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK Royal London 14A1577. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Royal London 14A1577 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Royal London 14A1577

How to fill out UK Royal London 14A1577

01

Obtain a blank copy of the UK Royal London 14A1577 form.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Begin by filling out your personal details in the relevant sections, such as your name, address, and contact information.

04

Provide any necessary identification numbers or references as requested on the form.

05

Fill in details regarding your policy or account, including the policy number and type of coverage.

06

Complete any additional sections as instructed, providing detailed information where required.

07

Ensure all entries are clear and legible to avoid processing delays.

08

Review your completed form for accuracy and completeness before submission.

09

Submit the form as directed, either by mail or electronically, depending on the instructions provided.

Who needs UK Royal London 14A1577?

01

Individuals who hold a UK Royal London insurance policy or investment.

02

Policyholders needing to make changes to their existing policy or update their personal information.

03

Individuals looking to claim benefits associated with their policy or account.

04

Beneficiaries or representatives managing a deceased policyholder's estate.

Fill

form

: Try Risk Free

People Also Ask about

Can I cancel my Royal London pension?

You have 30 days from when you receive your plan documents to change your mind. If you decide that you don't want the plan, you should complete and return the cancellation form provided to you.

When can I access my Royal London pension?

When you reach age 55, you'll be able to access your retirement savings – even if you're still working.

What do Royal London do?

In the UK, Royal London provides a range of pension and protection products to customers and employers primarily through independent financial advisers. We have a long-standing reputation for delivering value-for-money pension products, backed by outstanding customer service.

Can I take my money out of Royal London?

You can leave your money invested, giving it more potential to grow. If you're aged 55 or over, you can access your pension savings whenever you feel the time is right. You can buy an annuity, dip in with pension drawdown or take it all as a cash lump sum.

Who owns Royal London pension?

Mutual companies like Royal London are customer-owned. This means our profits are shared with customers, not shareholders.

What kind of pension is Royal London?

Company pension plan. A company pension plan is a type of workplace pension set up by your employer. The plan is run by trustees on your employer's behalf. You'll have an individual account with the plan.

Can I cancel my Royal London Life Insurance?

If you change your mind and cancel your Policy within 30 days of the start cate, you will be refunded any premiums you have paid. If you cancel your policy at any other time, your cover will stop and you won't be eligible for a refund.

Is Royal London a real company?

Welcome to Royal London Founded in 1861, we're the UK's largest mutual life, pensions and investment company.

How do I opt out of Royal London pension?

Opting out They have one month from their auto enrolment date or enrolment date to opt-out. They must contact the pension provider for the opt-out notice and send the completed notice to the employer. Once the employer receives a valid opt-out notice, they must: notify the pension provider of the opt-out.

How long does Royal London take to pay out?

How long does it take for the money to be paid out? As soon as the claim's been verified and we have all the paperwork we've asked for, we make the payment and funds usually clear in 3-5 working days.

How do I take myself off a pension?

You need to ask the pension provider for an opt out form so you can opt out of auto enrolment. Your employer must give you the contact details for the pension provider if you ask for them. You need to complete and sign the pension scheme opt out form, and return it to your employer (or the address given on the form).

Is Royal London a good pension provider?

We've won five stars for our service from Financial Adviser Service Awards (FASA) for 14 years running - so you can recommend us to your clients with confidence. Part of what makes our service five star is our dedicated contacts, who are there to support you at every stage.

Who is the best performing pension provider?

Interactive Investor: Best personal pension provider for large pension pots. Interactive Investor is one of the few companies that offer a flat fee, making them the most economical option for people who have already accumulated a large pension pot.

How do I withdraw money from Royal London?

Withdraw funds from your ISA Withdraw funds from your Royal London ISA. Please call us on: 0345 600 0404. Withdraw funds from your RLUM ISA or Unit Trust. Please call us on: 0345 605 7777. Withdraw funds from your Platinum Plus ISA. Please call us on: Withdraw funds from your Royal London Savings ISA. Please call us on:

Why are Royal London contacting me?

There's lots of reasons why we might need to get in touch with you. We may need to confirm your contact details so we can be sure our records are up to date, or we might be trying to reconnect you with a policy.

Can you opt out of a pension plan?

When your employer has enrolled you in a workplace pension, you can opt out if you want to. To opt out, you have to contact the pension scheme provider. They will tell you how to opt out. Your employer will provide you with their contact details.

Are Royal London a good company?

Royal London has a rating of 4.7 out of 5 stars with Feefo for its customer experience and product quality and is based on more than 200 reviews over the past year. Trustpilot reviews give Royal London 4.2 out of 5 stars based on over 1000 reviews.

Is Royal London a good company?

Royal London has a rating of 4.7 out of 5 stars with Feefo for its customer experience and product quality and is based on more than 200 reviews over the past year. Trustpilot reviews give Royal London 4.2 out of 5 stars based on over 1000 reviews.

Can I get my money back from Royal London?

If there's genuine error involved in the payment of contributions, the contributions can be returned.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UK Royal London 14A1577 to be eSigned by others?

When you're ready to share your UK Royal London 14A1577, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the UK Royal London 14A1577 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your UK Royal London 14A1577 in seconds.

Can I edit UK Royal London 14A1577 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share UK Royal London 14A1577 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is UK Royal London 14A1577?

UK Royal London 14A1577 is a form used for specific reporting requirements related to the taxation of certain income, specifically concerning insurance products or pensions offered by Royal London.

Who is required to file UK Royal London 14A1577?

Individuals or entities that have received certain types of income from Royal London's insurance products or pension schemes are required to file the UK Royal London 14A1577 form.

How to fill out UK Royal London 14A1577?

To fill out UK Royal London 14A1577, you need to provide your personal information, details regarding the income received, and any relevant tax identifiers. Follow the instructions provided with the form carefully to ensure all sections are completed accurately.

What is the purpose of UK Royal London 14A1577?

The purpose of UK Royal London 14A1577 is to ensure that the income received from Royal London products is reported for tax purposes, helping the tax authorities to maintain accurate records and collect the appropriate taxes.

What information must be reported on UK Royal London 14A1577?

The information that must be reported on UK Royal London 14A1577 includes the recipient's personal details, a summary of the income received, any relevant tax codes, and declarations of any deductions or allowances that may apply.

Fill out your UK Royal London 14A1577 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Royal London 14A1577 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.