Get the free Capital Pension Plan Life Annuity Information Guide and Application Package

Show details

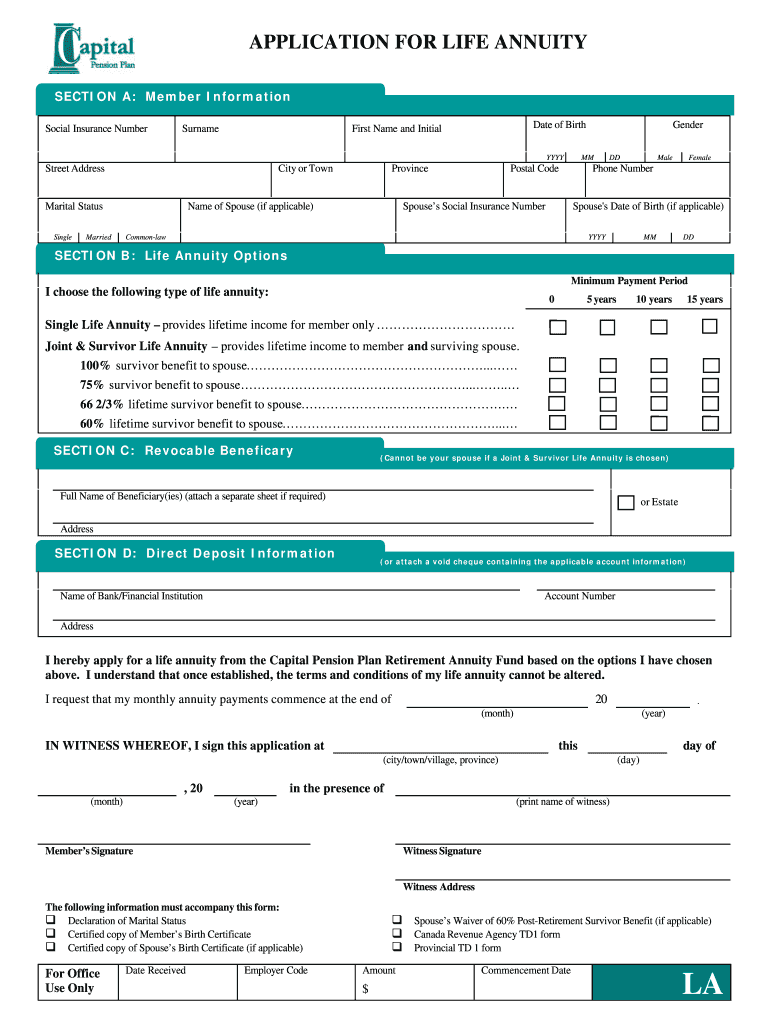

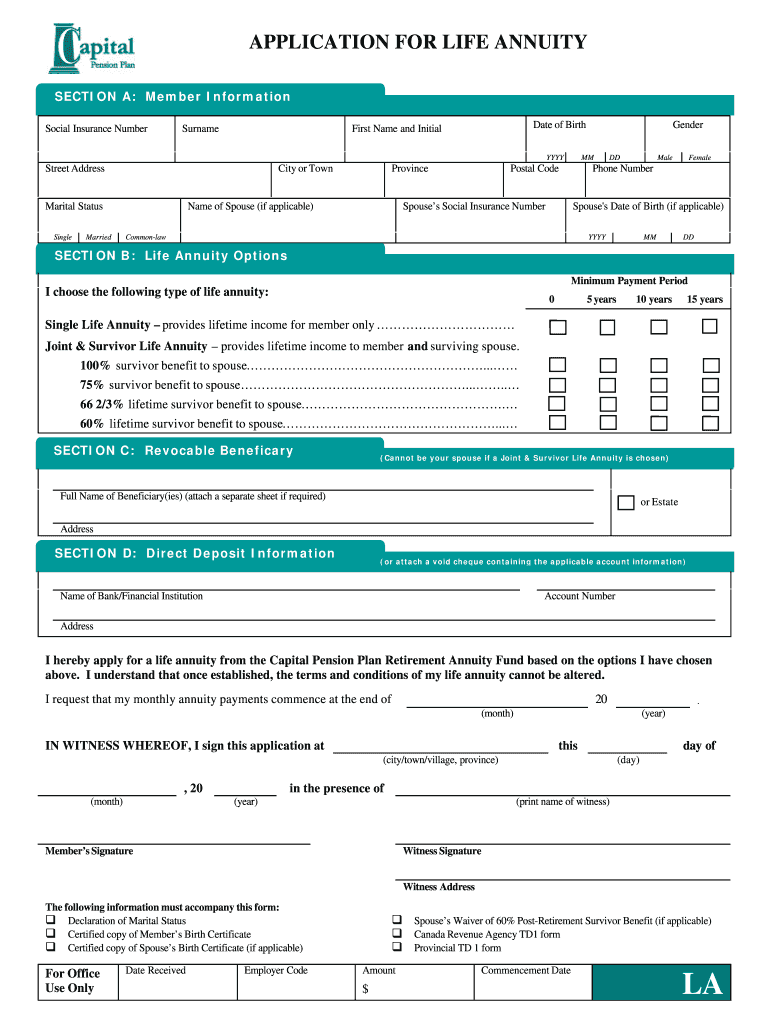

This publication describes provisions for life annuities provided by the Capital Pension Plan Retirement Annuity Fund, detailing eligibility, how life annuities work, application processes, and contact

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capital pension plan life

Edit your capital pension plan life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capital pension plan life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit capital pension plan life online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit capital pension plan life. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capital pension plan life

How to fill out Capital Pension Plan Life Annuity Information Guide and Application Package

01

Read through the Capital Pension Plan Life Annuity Information Guide to understand the benefits and terms.

02

Gather necessary personal information: your full name, date of birth, Social Security number, and contact information.

03

Review your pension plan details, including your accrued benefits and retirement age.

04

Complete the Application Package by filling in the required sections accurately.

05

Attach any necessary documentation as specified in the Application Package, such as identification and proof of retirement.

06

Double-check all information for accuracy and completeness.

07

Submit the completed Application Package to the designated address as indicated in the guide.

Who needs Capital Pension Plan Life Annuity Information Guide and Application Package?

01

Individuals who are nearing retirement age and are participants in the Capital Pension Plan.

02

Those who wish to understand their options for receiving pension benefits in the form of annuities.

03

Retirees looking to apply for or manage their pension benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is a lifetime annuity pension?

Lifetime annuities and scheme pensions are both types of secure pension, providing individuals with a known amount of regular income, usually for their lifetime. While there's usually no flexibility to vary the levels of income, market risk and investment decisions are removed.

Should you buy an annuity at age 75?

There's no perfect age to buy an annuity and the right timing depends on several key factors, including your financial goals, income needs and overall financial situation. You can buy an annuity when it's the right time for you, regardless of the “annuity age 75 rule.”

What does Suze Orman say about annuities?

While Suze Orman acknowledges the benefits of fixed annuities, she also highlights some of the potential drawbacks that investors need to be aware of: Teaser Rates: Some fixed annuities may lure investors in with a high-interest rate during the first year, only to significantly reduce the rate in subsequent years.

At what age can you withdraw from an annuity without penalty?

When should you start taking money out of your annuity? To avoid an early withdrawal penalty tax from the IRS, wait until you turn 59 ½. After you turn 73, the IRS requires you to take a required minimum distribution each year.

Can I cash in my annuity in the UK?

Your pension annuity can't be cashed in or surrendered. You can't make any changes once it's up and running. You can draw down as much money as you want, stopping and starting whenever you want to. You can buy a pension annuity at any future point.

What is the age 75 rule for annuities?

The "age 75 rule" isn't a formal regulation or even a financial industry standard. Rather, it's a commonly shared belief that annuity buyers should wait until age 75 to purchase, since payouts are typically higher at that age. Here's why people think this way: Annuity payouts are tied to life expectancy.

What is the 5 year rule for annuities?

It essentially requires that the entire value of the annuity be distributed, either all at once or in multiple withdrawals, within five years of the original owner's death.

What is the difference between a pension and a life annuity?

Annuitants pay a given amount regularly or through a single premium to receive the amount saved plus the return from the insurer as income. The main difference lies in the nature of each product: a pension plan is a saving and investment product, and a retirement annuity is an insurance contract.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Capital Pension Plan Life Annuity Information Guide and Application Package?

The Capital Pension Plan Life Annuity Information Guide and Application Package is a documentation set that provides comprehensive details about the life annuity options available under the Capital Pension Plan, including instructions on the application process and relevant terms.

Who is required to file Capital Pension Plan Life Annuity Information Guide and Application Package?

Individuals who are eligible participants of the Capital Pension Plan and wish to apply for a life annuity must file the Capital Pension Plan Life Annuity Information Guide and Application Package.

How to fill out Capital Pension Plan Life Annuity Information Guide and Application Package?

To fill out the Capital Pension Plan Life Annuity Information Guide and Application Package, applicants should follow the provided instructions step-by-step, ensuring that all required fields are completed accurately and all necessary supporting documents are attached.

What is the purpose of Capital Pension Plan Life Annuity Information Guide and Application Package?

The purpose of the Capital Pension Plan Life Annuity Information Guide and Application Package is to inform eligible participants about their annuity options, guide them through the application process, and ensure compliance with pension regulations.

What information must be reported on Capital Pension Plan Life Annuity Information Guide and Application Package?

The information that must be reported includes the applicant's personal details, pension plan identification, choice of annuity type, beneficiary information, and any other relevant financial data required to process the application.

Fill out your capital pension plan life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capital Pension Plan Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.