Get the free Michigan Owner Occupant Sales Package

Show details

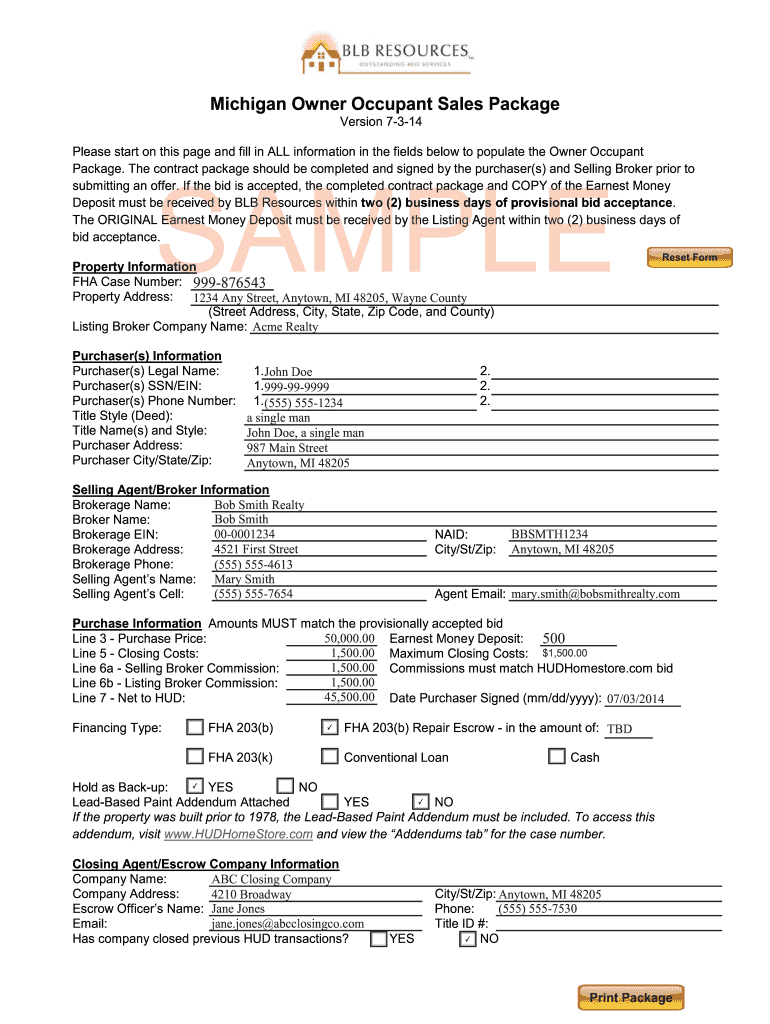

This document outlines the sale process for owner-occupants purchasing HUD-acquired properties in Michigan, detailing required forms, guidelines for closing, and necessary disclosures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan owner occupant sales

Edit your michigan owner occupant sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan owner occupant sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing michigan owner occupant sales online

Follow the steps below to benefit from the PDF editor's expertise:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit michigan owner occupant sales. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out michigan owner occupant sales

How to fill out Michigan Owner Occupant Sales Package

01

Gather necessary documentation, such as proof of income and identification.

02

Complete the application form provided in the Michigan Owner Occupant Sales Package.

03

Provide accurate details regarding the property you intend to purchase.

04

Sign all required declarations and confirm your intent to occupy the property as your primary residence.

05

Submit the application along with all required documentation to the designated office or authority.

Who needs Michigan Owner Occupant Sales Package?

01

Individuals or families looking to purchase a home in Michigan as their primary residence.

02

First-time homebuyers seeking assistance or specific financing options.

03

People who meet eligibility requirements for owner-occupant status in real estate transactions.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for the MI 1040cr?

You may claim a property tax credit if all of the following apply: Your homestead is located in Michigan • You were a Michigan resident at least six months of 2024 • You own your Michigan homestead and property taxes were levied in 2024, or you paid rent under a rental contract.

Who is exempt from sales tax in Michigan?

Tax-exempt customers Some customers are exempt from paying sales tax under Michigan law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Who pays sales tax in Michigan?

Individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price of their taxable retail sales to the State of Michigan.

What is the threshold for sales tax in Michigan?

What is the Michigan economic nexus threshold? Out-of-state merchants that make $100,000 in total retail sales or processed 200 orders in the state during the previous calendar year must collect, file and remit Michigan state sales tax.

How to avoid capital gains tax in Michigan selling a house?

Primary residence exemption: If you sell your primary residence, you may be able to exclude up to $250,000 of the gain if you're single, or $500,000 for married couples filing jointly, provided you've lived in the home for at least two of the past five years.

Who is exempt from Michigan state tax?

For the 2024 income tax returns, the individual income tax rate for Michigan taxpayers is 4.25 percent, and the personal exemption is $5,600 for each taxpayer and dependent. An additional personal exemption is available if you are the parent of a stillborn child delivered in 2024.

Who needs to register for sales tax in Michigan?

Businesses, who sell tangible personal property in addition to providing labor or a service, are required to obtain a sales tax license.

How much tax do you pay when you sell your house in Michigan?

In Michigan, the transfer tax for real estate transactions is composed of both a state and a county component. The state transfer tax rate is $3.75 for every $500 of the property's value. The county transfer tax rate is $0.55 for every $500 of the property's value.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Michigan Owner Occupant Sales Package?

The Michigan Owner Occupant Sales Package is a form required by the state of Michigan for property owners who occupy their homes. It is used to provide necessary information related to the sale of a home, ensuring compliance with state regulations.

Who is required to file Michigan Owner Occupant Sales Package?

Homeowners who are selling their primary residence in Michigan and claim it as their homestead are required to file the Michigan Owner Occupant Sales Package.

How to fill out Michigan Owner Occupant Sales Package?

To fill out the Michigan Owner Occupant Sales Package, you need to provide personal details such as your name, address, and property information. Follow the instructions outlined in the package, ensuring all sections are completed accurately before submission.

What is the purpose of Michigan Owner Occupant Sales Package?

The purpose of the Michigan Owner Occupant Sales Package is to verify the residency status of the seller and to ensure that the property has been used as a primary residence for tax assessment purposes.

What information must be reported on Michigan Owner Occupant Sales Package?

Information required includes the homeowner's name, address, date of sale, purchase price, and a declaration that the property was occupied as a primary residence.

Fill out your michigan owner occupant sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Owner Occupant Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.