Get the free DOMESTIC BUILDING INSURANCE APPLICATION FOR ELIGIBILITY

Show details

DOMESTIC BUILDING INSURANCE APPLICATION FOR ELIGIBILITY TURNOVER GREATER THAN $5M INSURANCE BROKER RETURN COMPLETED FORMS TO HOME WARRANTY INSURANCE DIVISION: Master Builders Queensland Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign domestic building insurance application

Edit your domestic building insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your domestic building insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing domestic building insurance application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit domestic building insurance application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

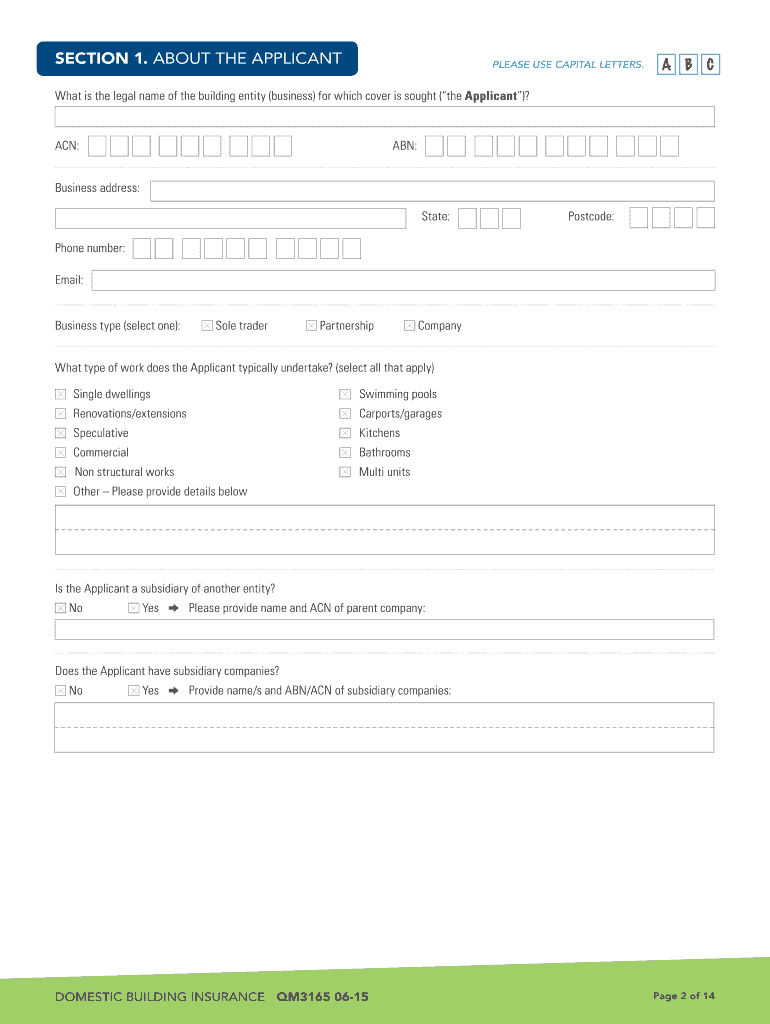

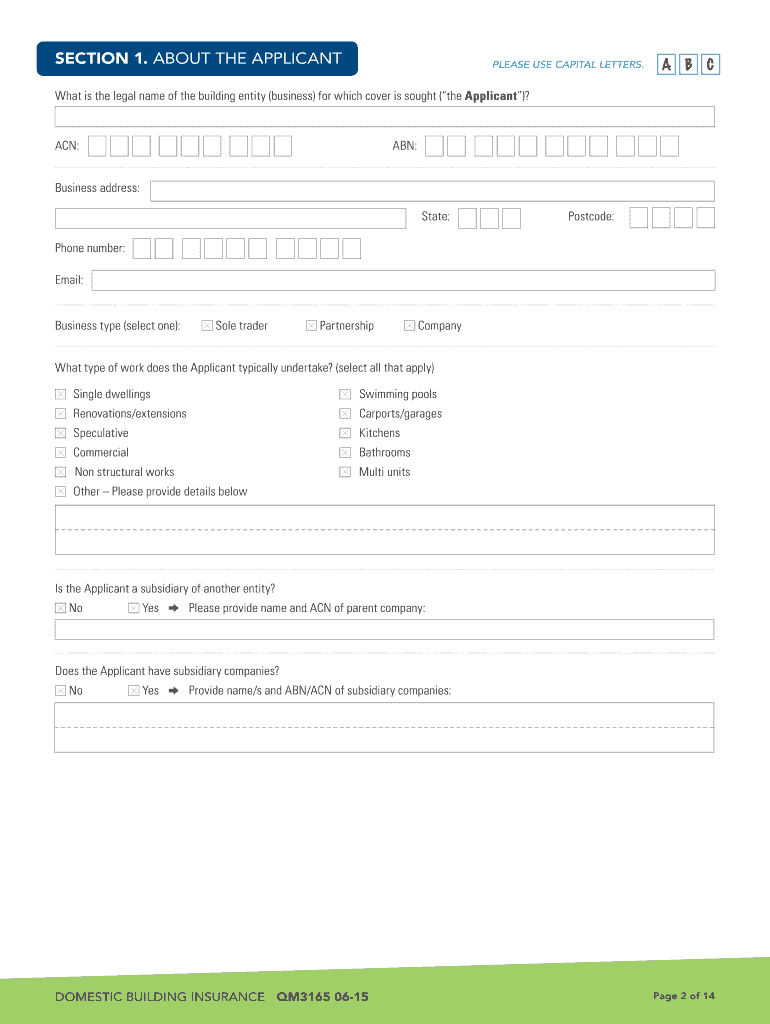

How to fill out domestic building insurance application

How to fill out domestic building insurance application:

01

Start by gathering all necessary information and documents such as identification, property details, and building plans.

02

Carefully read through the application form to understand the requirements and sections.

03

Fill in your personal information accurately, including your name, address, contact details, and any other pertinent details requested.

04

Provide the necessary details about the property being insured, including its address, size, construction type, and any additional structures or features.

05

If applicable, include information about any renovations or construction work that has been done on the property.

06

Specify the type of coverage you require, such as structural insurance, contents insurance, or liability insurance.

07

Provide information about any previous insurance claims or coverage history related to the property.

08

Answer any additional questions or provide any additional information that may be requested, such as details about any additional policies you may have.

09

Review the completed application thoroughly to ensure accuracy and completeness.

10

Sign and date the application form where required.

11

Submit the completed application form along with any supporting documents to the insurance provider.

Who needs domestic building insurance application:

01

Homeowners: Homeowners who want to protect their property from various risks such as fire, theft, or natural disasters can benefit from having domestic building insurance.

02

Property Investors: Individuals who own rental properties or investment properties can benefit from having domestic building insurance to protect their assets and rental income.

03

Builders and Contractors: Professionals involved in the construction industry often require domestic building insurance to protect themselves against potential liabilities and risks associated with their work.

04

Mortgage Lenders: Lenders who provide financing for the purchase or construction of domestic buildings often require the borrowers to have insurance coverage to protect the lender's interests.

05

Real Estate Developers: Developers who are involved in new construction projects or major renovations typically require domestic building insurance to protect their investments during the construction phase and beyond.

06

Property Managers: Managers responsible for the maintenance and upkeep of domestic buildings may need insurance to cover any damages or risks associated with their management activities.

07

Renters: While not directly responsible for insuring the building itself, renters may choose to obtain domestic contents insurance to protect their personal belongings within the rented property.

In conclusion, anyone who owns, manages, or is involved in the construction, renovation, or maintenance of domestic buildings can benefit from having a domestic building insurance application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit domestic building insurance application from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your domestic building insurance application into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete domestic building insurance application online?

pdfFiller has made filling out and eSigning domestic building insurance application easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit domestic building insurance application on an Android device?

You can edit, sign, and distribute domestic building insurance application on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is domestic building insurance application?

Domestic building insurance application is a form that property owners fill out to obtain insurance coverage for their residential construction projects.

Who is required to file domestic building insurance application?

Property owners who are undertaking residential construction projects are required to file domestic building insurance application.

How to fill out domestic building insurance application?

To fill out the domestic building insurance application, property owners must provide details about the project, construction plans, and other relevant information requested on the form.

What is the purpose of domestic building insurance application?

The purpose of domestic building insurance application is to ensure that residential construction projects have adequate insurance coverage in case of unforeseen events or damages.

What information must be reported on domestic building insurance application?

Information such as project details, construction plans, contact information, insurance requirements, and other relevant details must be reported on the domestic building insurance application.

Fill out your domestic building insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Domestic Building Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.