Get the free MAX LIFE INSURANCE CO LTD MOUNTAINEERING QUESTIONNAIRE - amsure

Show details

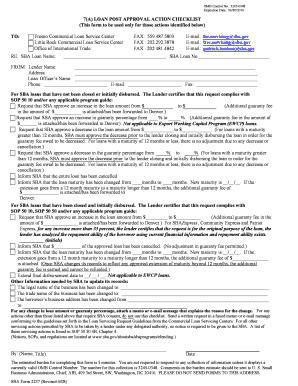

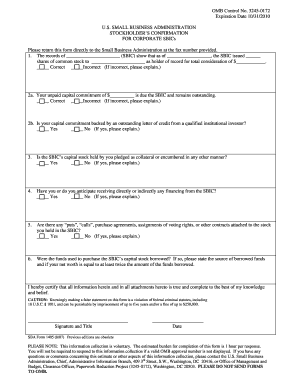

Proposal No: MAX LIFE INSURANCE CO. LTD MOUNTAINEERING QUESTIONNAIRE Life to be Insured: 1. For how many years have you been climbing regularly? 2. How often do you climb? 3. Are you a member of a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign max life insurance co

Edit your max life insurance co form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your max life insurance co form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit max life insurance co online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit max life insurance co. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out max life insurance co

How to fill out Max Life Insurance Co:

01

Start by gathering all the necessary documents and information. This may include your identification documents, proof of address, proof of income, and any existing health or medical records.

02

Visit the Max Life Insurance Co website or contact their customer service to get the application form. Alternatively, you can also visit their nearest branch office and request a physical copy of the form.

03

Carefully read the instructions provided with the application form. Make sure you understand all the terms and conditions and any specific requirements mentioned.

04

Fill out the personal details section of the application form. This may include your full name, date of birth, gender, occupation, marital status, and contact information. Ensure that all the information provided is accurate and up-to-date.

05

Provide the required information about the insurance policy you are interested in. This may include the type of plan, coverage amount, and desired policy term. If you're unsure about the specifics, you can consult with a Max Life Insurance Co representative for guidance.

06

Disclose your medical history and undergo any necessary medical examinations or tests as required by Max Life Insurance Co. This is crucial for the underwriting process to determine your eligibility and premium rates.

07

Review the completed application form to ensure accuracy and completeness. Double-check all the information provided and make any necessary corrections before submitting the form.

08

Submit the filled-out application form along with any supporting documents through the preferred method specified by Max Life Insurance Co. This could be by mailing it to their specified address, submitting it online through their website, or personally visiting their branch office.

Who needs Max Life Insurance Co:

01

Individuals who have dependents or financial responsibilities, such as spouses, children, or aging parents, may need Max Life Insurance Co. This can provide financial protection and support to their loved ones in the event of the policy owner's death.

02

People who have outstanding debts, such as mortgages, loans, or credit card debts, may consider Max Life Insurance Co. It can help cover these financial obligations, preventing the burden from falling on their family members.

03

Individuals who want to secure their family's future and ensure their loved ones are financially stable even after their demise can opt for Max Life Insurance Co. It can provide a lump sum amount or regular income to meet their family's needs.

04

Business owners or partners who have financial obligations and want to protect their business interests can benefit from Max Life Insurance Co. It can provide funds for business continuity or buy-sell agreements in case of the policy owner's death.

05

People who want to supplement their retirement savings or plan for their long-term financial goals can consider Max Life Insurance Co. Certain policies offer investment opportunities, helping individuals build a corpus over time.

Remember, it's crucial to understand your specific insurance needs and consult with a financial advisor or Max Life Insurance Co representative to determine the most suitable policy for your circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the max life insurance co electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your max life insurance co in minutes.

How do I edit max life insurance co on an iOS device?

Create, edit, and share max life insurance co from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out max life insurance co on an Android device?

Complete max life insurance co and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is max life insurance co?

Max Life Insurance Co. is a reputable insurance company that provides life insurance coverage to individuals and families.

Who is required to file max life insurance co?

Individuals who have purchased a life insurance policy from Max Life Insurance Co. are required to file the necessary paperwork and documentation.

How to fill out max life insurance co?

To fill out the forms for Max Life Insurance Co., individuals need to provide personal information, policy details, beneficiary information, and any other relevant details requested by the company.

What is the purpose of max life insurance co?

The purpose of Max Life Insurance Co. is to provide financial protection and peace of mind to policyholders and their beneficiaries in the event of unforeseen circumstances.

What information must be reported on max life insurance co?

The information that must be reported on Max Life Insurance Co. includes personal details, policy information, beneficiary details, and any changes to the policy.

Fill out your max life insurance co online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Max Life Insurance Co is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.