Get the free Traditional to Roth

Show details

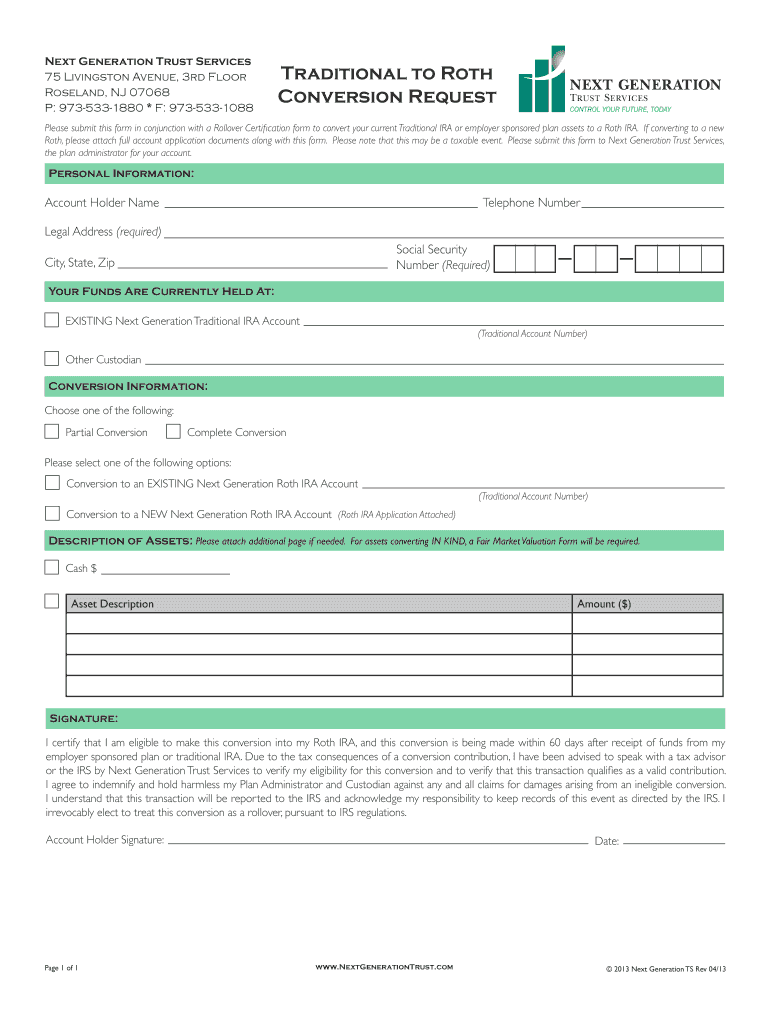

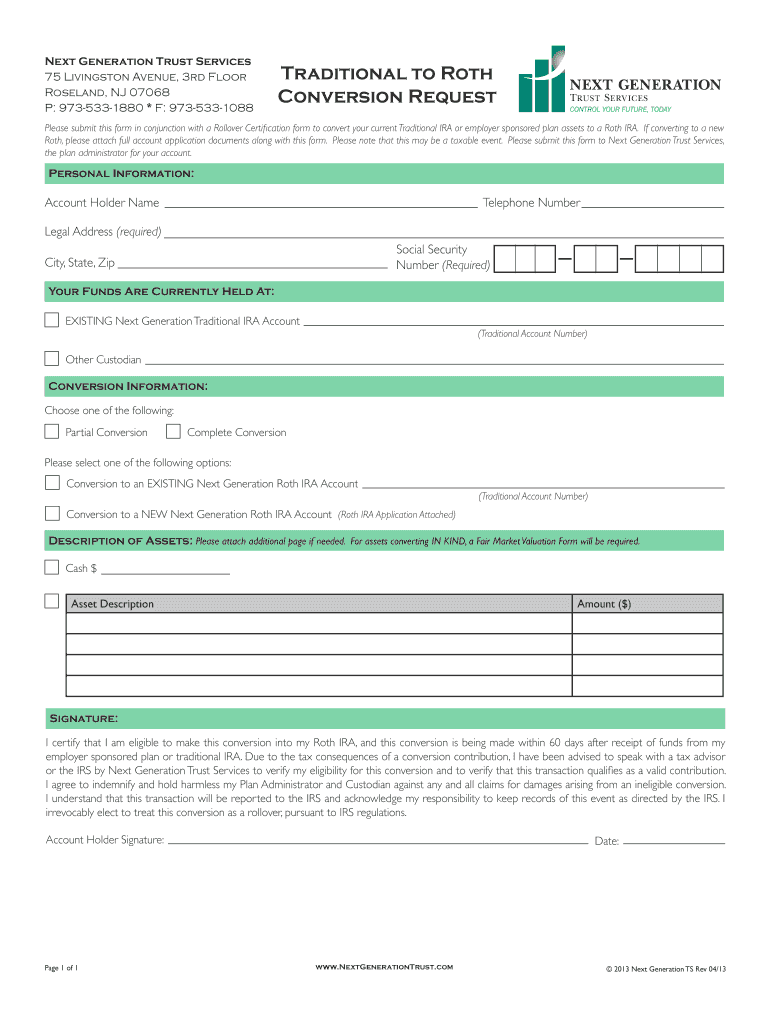

Next Generation Trust Services 75 Livingston Avenue, 3rd Floor Roseland, NJ 07068 P: 9735331880 F: 9735331088 Traditional to Roth Conversion Request Please submit this form in conjunction with a Rollover

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional to roth

Edit your traditional to roth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional to roth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing traditional to roth online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit traditional to roth. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional to roth

Steps to fill out a traditional to Roth conversion:

01

Evaluate your financial situation: Determine if converting from a traditional IRA to a Roth IRA aligns with your long-term goals. Consider factors such as your tax bracket, current and future income, and retirement plans.

02

Understand the tax implications: Traditional IRAs offer tax-deferred contributions, while Roth IRAs allow for tax-free withdrawals in retirement. Converting from traditional to Roth means paying taxes on the converted amount in the year of the conversion. Familiarize yourself with the potential tax consequences and consult a tax professional if needed.

03

Gather necessary information: Collect details about your traditional IRA account, including the account number, custodian or financial institution information, and the specific amount you intend to convert to a Roth IRA.

04

Open a Roth IRA account: If you don't already have a Roth IRA, you'll need to open one with a financial institution of your choice. Ensure the account is set up in compliance with IRS regulations and meets your investment objectives.

05

Consult with a financial advisor: Seek guidance from a financial advisor or retirement specialist to determine if a traditional to Roth conversion is appropriate for your situation. They can help you understand any potential risks, advise on investment strategies, and provide personalized recommendations based on your individual circumstances.

06

Initiate the conversion: Contact your traditional IRA custodian or financial institution and request the necessary paperwork to convert your account to a Roth IRA. Fill out the required forms accurately, providing all the requested information.

07

Consider partial or full conversion: Decide whether to convert your entire traditional IRA balance or only a portion of it. You can choose to convert a specific dollar amount or a percentage of the account balance.

08

Confirm conversion details: Review the conversion paperwork carefully before submitting it. Double-check that all information provided is accurate, including the amount to be converted and any special instructions.

09

Complete the conversion process: Follow the instructions provided by your traditional IRA custodian or financial institution to finalize the conversion. They will guide you on how to transfer the funds from your traditional IRA to your newly established Roth IRA.

10

Monitor and reassess: Keep track of your Roth IRA investments and periodically review your retirement strategy. Ensure that the conversion aligns with your financial goals and make adjustments as necessary.

Who needs traditional to Roth?

01

Individuals seeking tax diversification: Converting from a traditional to Roth IRA allows for tax diversification in retirement. By having funds in both pre-tax (traditional) and after-tax (Roth) accounts, you can strategically withdraw from different sources to optimize your tax situation.

02

Individuals planning for tax-free withdrawals: Roth IRAs offer the advantage of tax-free withdrawals in retirement. If you anticipate being in a higher tax bracket during your retirement years or want to minimize your future tax burden, a traditional to Roth conversion can be beneficial.

03

Those with a long investment horizon: Younger individuals or those with a longer time horizon until retirement can potentially benefit the most from a traditional to Roth conversion, as they have more time for their investments to grow tax-free.

04

Individuals with available cash to pay taxes: Since converting from traditional to Roth requires paying taxes on the converted amount, it is essential to have funds available to cover the tax liability without depleting retirement savings.

05

Estate planning and inheritance purposes: Individuals concerned about passing on tax-free assets to their beneficiaries may consider a traditional to Roth conversion as a part of their estate planning strategy. Roth IRAs offer potential tax advantages for heirs.

Remember, it is always recommended to consult with a financial advisor or tax professional to determine if a traditional to Roth conversion aligns with your specific financial goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit traditional to roth in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your traditional to roth, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my traditional to roth in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your traditional to roth and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit traditional to roth straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit traditional to roth.

What is traditional to roth?

Traditional to Roth is a conversion of funds from a traditional retirement account to a Roth retirement account.

Who is required to file traditional to roth?

Individuals who have a traditional retirement account and want to convert it to a Roth retirement account are required to file traditional to roth.

How to fill out traditional to roth?

To fill out traditional to roth, individuals need to complete the necessary forms provided by their financial institution or retirement account provider.

What is the purpose of traditional to roth?

The purpose of traditional to roth is to allow individuals to take advantage of the benefits offered by a Roth retirement account, such as tax-free withdrawals in retirement.

What information must be reported on traditional to roth?

Information such as the amount being converted, the source of the funds, and any applicable tax implications must be reported on traditional to roth.

Fill out your traditional to roth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional To Roth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.