Get the free E & O Application

Show details

This document is an application form for Errors & Omissions (E & O) insurance, specifically detailing coverage provided by National Insurance Markets Inc. for life, accident, and health business.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign e o application

Edit your e o application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e o application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

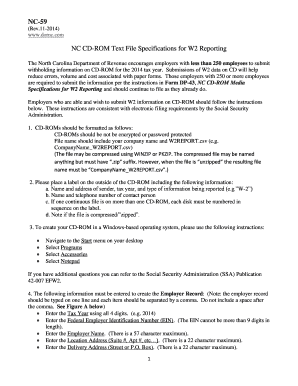

Editing e o application online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit e o application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out e o application

How to fill out E & O Application

01

Gather necessary documents: Collect any relevant information related to your business and professional activities.

02

Complete personal information: Fill in your name, address, contact information, and business details.

03

Provide business structure: Indicate whether your business is a sole proprietorship, partnership, corporation, etc.

04

Detail your professional services: Describe the services your business offers and the industries you serve.

05

Report claims history: Disclose any past claims, disputes, or legal actions relevant to your professional services.

06

Answer risk management questions: Provide information on how you manage risks and prevent claims.

07

Review the application: Thoroughly check all entries for accuracy and completeness.

08

Submit the application: Send the application to the appropriate insurance company or agent, along with any required fees.

Who needs E & O Application?

01

Individuals or businesses that provide professional services, such as consultants, real estate agents, insurance brokers, healthcare professionals, and lawyers, may need an Errors and Omissions (E&O) application to secure liability insurance that protects against claims of negligence or inadequate work.

Fill

form

: Try Risk Free

People Also Ask about

What does E&O do?

Errors and omissions insurance (E&O) is a type of professional liability insurance that protects companies and their workers or individuals against claims made by clients for inadequate work or negligent actions.

What is the meaning of E&O?

Errors and omissions insurance, also known as E&O insurance or professional liability insurance, helps protect you and your company if someone claims you made a mistake in the professional services you've provided. This coverage can help pay for costs if a customer or client files a claim against your small business.

What do the terms E&O E mean?

"Errors and omissions excepted" (E&OE) is a phrase used in an attempt to reduce legal liability for potentially incorrect or incomplete information supplied in a contractually related document such as a quotation or specification.

What does e & o mean in business?

Professional Liability insurance, also known as Errors and Omissions (E&O) coverage, is designed to protect your business against claims that professional advice or services you provided caused a customer financial harm due to actual or alleged mistakes or a failure to perform a service.

What does E&O mean?

What does errors and omissions insurance cover? Errors and omissions insurance, also known as E&O insurance or professional liability insurance, helps protect you and your company if someone claims you made a mistake in the professional services you've provided.

What does E&O inventory stand for?

Along with shortages, excess and obsolete (E&O) inventory is a good indicator of how well your supply chain is performing. Some waste is inevitable in most supply chains, since demand is unpredictable and shelf life is not infinite.

What is an example of an E&O claim?

Some errors and omissions claims examples include your: Accountant providing inaccurate financial advice to your clients. As a result, they file a claim against you. Interior designer using the wrong colors to repaint a client's room.

What does e & o mean in business?

Errors and omissions (E&O) insurance is a type of liability insurance that covers claims against a business for mistakes made while providing a professional service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is E & O Application?

E & O Application refers to an Errors and Omissions Application, which is a formal request for obtaining insurance coverage for professionals against liability for mistakes or negligence in their work.

Who is required to file E & O Application?

Professionals such as real estate agents, insurance brokers, and consultants are typically required to file an E & O Application to obtain liability insurance.

How to fill out E & O Application?

To fill out an E & O Application, provide accurate personal and business information, describe services offered, disclose any previous claims, and submit any necessary supporting documents.

What is the purpose of E & O Application?

The purpose of the E & O Application is to assess the risk of insuring a professional and to establish the terms of coverage for potential liabilities arising from their professional services.

What information must be reported on E & O Application?

The E & O Application usually requires information on the applicant's business structure, services provided, claims history, financial status, and any risk management practices in place.

Fill out your e o application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E O Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.