Get the free CITY OF ORANGE BEACH TAX RETURN

Show details

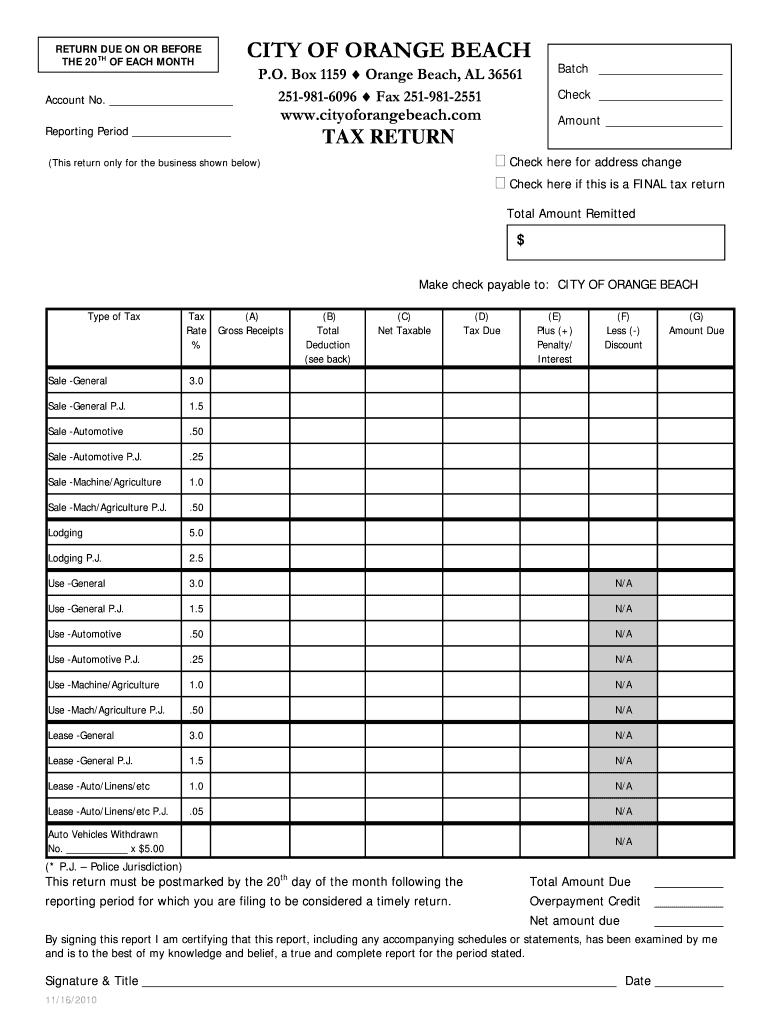

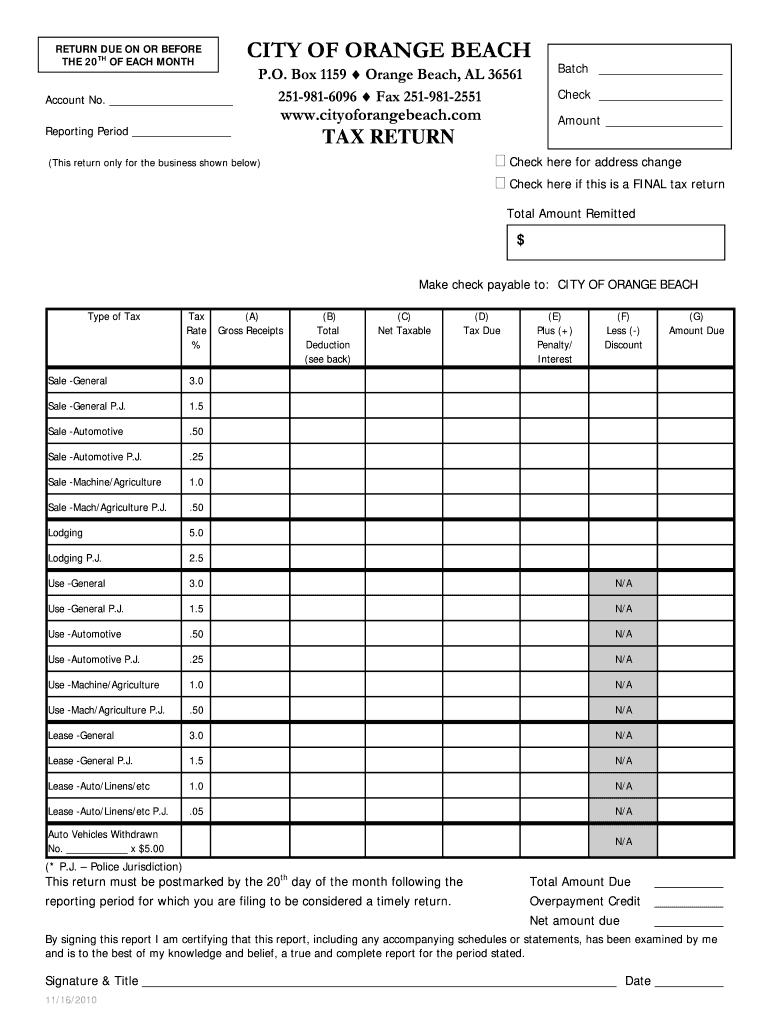

This document serves as a tax return form for businesses operating in the City of Orange Beach, detailing tax types, rates, and instructions for filling out the return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign city of orange beach

Edit your city of orange beach form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your city of orange beach form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit city of orange beach online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit city of orange beach. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out city of orange beach

How to fill out CITY OF ORANGE BEACH TAX RETURN

01

Begin by obtaining the CITY OF ORANGE BEACH TAX RETURN form from the official website or local city hall.

02

Enter your personal information at the top of the form including your name, address, and contact details.

03

Indicate the tax year for which you are filing the return.

04

Report your total income from all sources for the year in the designated section.

05

Deduct any eligible expenses that apply to your situation as per city guidelines.

06

Calculate your taxable income by subtracting total deductions from your total income.

07

Determine the tax owed based on the taxable income and applicable tax rate.

08

Include any payments made throughout the year and calculate the balance due or refund.

09

Sign and date the form to certify the accuracy of the information provided.

10

Submit the completed form by mail or in person to the specified tax office before the deadline.

Who needs CITY OF ORANGE BEACH TAX RETURN?

01

Residents of Orange Beach who earn taxable income within the city limits.

02

Non-residents who have income sourced from business activities conducted in Orange Beach.

03

Property owners who receive rental income from properties located in Orange Beach.

04

Businesses operating within the city that are subject to local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file an Alabama annual report?

Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity. State agencies do not provide consistent reminders when annual reports are due.

Do I need to file an Alabama tax return?

You must file an Alabama state income tax return if you live in Alabama and your gross income exceeds the following thresholds: Single: $4,000. Married Filing Separately: $5,250.

Who must pay Alabama state income tax?

According to Alabama Form 40 Instructions, "Individuals who are domiciled in (or residents of) Alabama are subject to tax on their entire income whether earned within or without Alabama. This is true regardless of their physical presence within Alabama at any time during the taxable year."

How much do I need to make to file taxes in Alabama?

You must file an Alabama state income tax return if you live in Alabama and your gross income exceeds the following thresholds: Single: $4,000. Married Filing Separately: $5,250. Head of Family: $7,700.

How to avoid lodging tax in Alabama?

The tax shall not apply to rooms, lodgings, or accommodations supplied: (i) For a period of 180 continuous days or more in any place; (ii) by camps, conference centers, or similar facilities operated by nonprofit organizations primarily for the benefit of, and in connection with, recreational or educational programs

How much is the tax in Orange Beach, Alabama?

Orange Beach sales tax details The minimum combined 2025 sales tax rate for Orange Beach, Alabama is 10.0%. This is the total of state, county, and city sales tax rates. The Alabama sales tax rate is currently 4.0%.

Do I have to file an Alabama state tax return?

Alabama requires people who have lived or worked in the state for a full year and earned incomes that are above the stipulated amounts for their filing statuses to file state income tax returns. People who are single and have earned over $4000 must file if they have lived in the state for a full year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CITY OF ORANGE BEACH TAX RETURN?

The CITY OF ORANGE BEACH TAX RETURN is a form that individuals and businesses must complete to report and pay local taxes imposed by the City of Orange Beach.

Who is required to file CITY OF ORANGE BEACH TAX RETURN?

All individuals and businesses that earn income or generate revenue within the City of Orange Beach are required to file the CITY OF ORANGE BEACH TAX RETURN.

How to fill out CITY OF ORANGE BEACH TAX RETURN?

To fill out the CITY OF ORANGE BEACH TAX RETURN, you need to gather your financial records, input income details, calculate applicable taxes, and submit the completed form by the designated deadline.

What is the purpose of CITY OF ORANGE BEACH TAX RETURN?

The purpose of the CITY OF ORANGE BEACH TAX RETURN is to ensure that the City collects the appropriate amount of tax revenue to fund local services and projects.

What information must be reported on CITY OF ORANGE BEACH TAX RETURN?

The information that must be reported on the CITY OF ORANGE BEACH TAX RETURN includes total income earned, deductions, tax credits, and any other relevant financial details related to the taxpayer's business or personal income.

Fill out your city of orange beach online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

City Of Orange Beach is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.