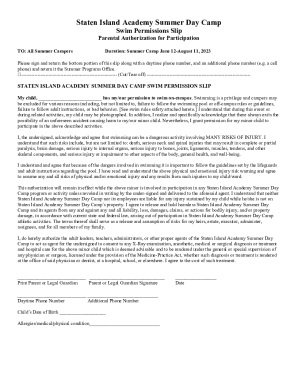

Get the free Trading-cum-Clearing Membership Undertaking

Show details

This document contains instructions for filling out the Trading-cum-Clearing Membership Undertaking required by the Ace Derivatives and Commodity Exchange Limited, detailing the obligations and agreements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trading-cum-clearing membership undertaking

Edit your trading-cum-clearing membership undertaking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trading-cum-clearing membership undertaking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trading-cum-clearing membership undertaking online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit trading-cum-clearing membership undertaking. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trading-cum-clearing membership undertaking

How to fill out Trading-cum-Clearing Membership Undertaking

01

Obtain the Trading-cum-Clearing Membership Undertaking form from the relevant regulatory authority.

02

Carefully read all instructions and guidelines provided with the form.

03

Fill in your personal details, including your name, address, and contact information.

04

Provide details of your trading experience and any relevant qualifications.

05

Specify the type of trading products you intend to deal in.

06

Attach any required documentation, such as identity proof and financial statements.

07

Review the completed form for accuracy and completeness.

08

Sign and date the undertaking to confirm your commitment.

09

Submit the form to the designated authority by the specified deadline.

Who needs Trading-cum-Clearing Membership Undertaking?

01

Individuals or entities looking to trade and clear securities on a trading platform.

02

Brokerage firms that wish to operate in a specific market.

03

New market participants who require official permission to engage in trading activities.

04

Institutional investors wanting to participate in trading and clearing operations.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between clearing member and professional clearing member?

Professional Clearing Member (PCM) are clearing members who are not trading members. They are typically banks, custodians etc. who clear and settle trades executed for their clients (individuals, institutions etc.). In such an event, the functions and responsibilities of the PCM would be similar to Custodians.

What are the different types of membership in NSE?

Ans: Trading member, Trading clearing member, Trading self-clearing member, Professional Clearing member.

What is a professional clearing member?

Professional Clearing Member (PCM): This category of membership entitles a member to clear and settle trades of such members of the Exchange who choose to clear and settle their trades through this member.

What is the difference between general clearing member and direct clearing member?

A direct clearing member is able to settle only its own obligations. A general clearing member is able to settle its own obligations as well as those of clients. Variations of these two types of clearing member may also exist.

How many types of clearing members are there?

In general, Clearing Members may be General Clearing Members and Individual Clearing Members.

How to become a clearing member?

Clearing Member Eligibility Norms Net worth of at least Rs. 300 lakhs. Deposit of Rs. 50 lakhs to NSE CLEARING which forms part of the security deposit of the CM. Additional incremental deposits of Rs. 10 lakhs to NSE CLEARING for each additional TM in case the CM undertakes to clear and settle deals for other TMs.

What is the difference between a clearing member and a clearing broker?

For instance, a general clearing member facilitates trade settlement by matching buy and sell prices and ensuring regulatory compliance in trading parties. On the other hand, an executing broker is in charge of, well, you guessed it, executing trades on behalf of clients.

What is the role of a trading member?

Trading Member (TM): ): A member with rights to trade on its own account as well as on account of its clients, but has no right to clear and settle such trades itself.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Trading-cum-Clearing Membership Undertaking?

The Trading-cum-Clearing Membership Undertaking is a formal agreement that allows a member to engage in both trading and clearing activities within a financial market, ensuring compliance with regulatory requirements.

Who is required to file Trading-cum-Clearing Membership Undertaking?

Entities or individuals seeking to operate as members in a trading and clearing capacity in a financial market are required to file the Trading-cum-Clearing Membership Undertaking.

How to fill out Trading-cum-Clearing Membership Undertaking?

The Trading-cum-Clearing Membership Undertaking should be completed by providing relevant personal or business information, including details about the trading activities, compliance measures, and financial standings as stipulated in the guidelines provided by the governing regulatory body.

What is the purpose of Trading-cum-Clearing Membership Undertaking?

The purpose of the Trading-cum-Clearing Membership Undertaking is to establish a legal and regulatory framework for members to conduct trading and clearing operations while ensuring they adhere to market regulations and protect the interests of investors.

What information must be reported on Trading-cum-Clearing Membership Undertaking?

Information that must be reported includes the applicant's identity, operational procedures, risk management strategies, financial statements, compliance policies, and any other data as required by the regulatory authority overseeing the trading and clearing activities.

Fill out your trading-cum-clearing membership undertaking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trading-Cum-Clearing Membership Undertaking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.