Get the free Appendix B to Part 103--Recertification Regarding Correspondent Accounts for Foreign...

Show details

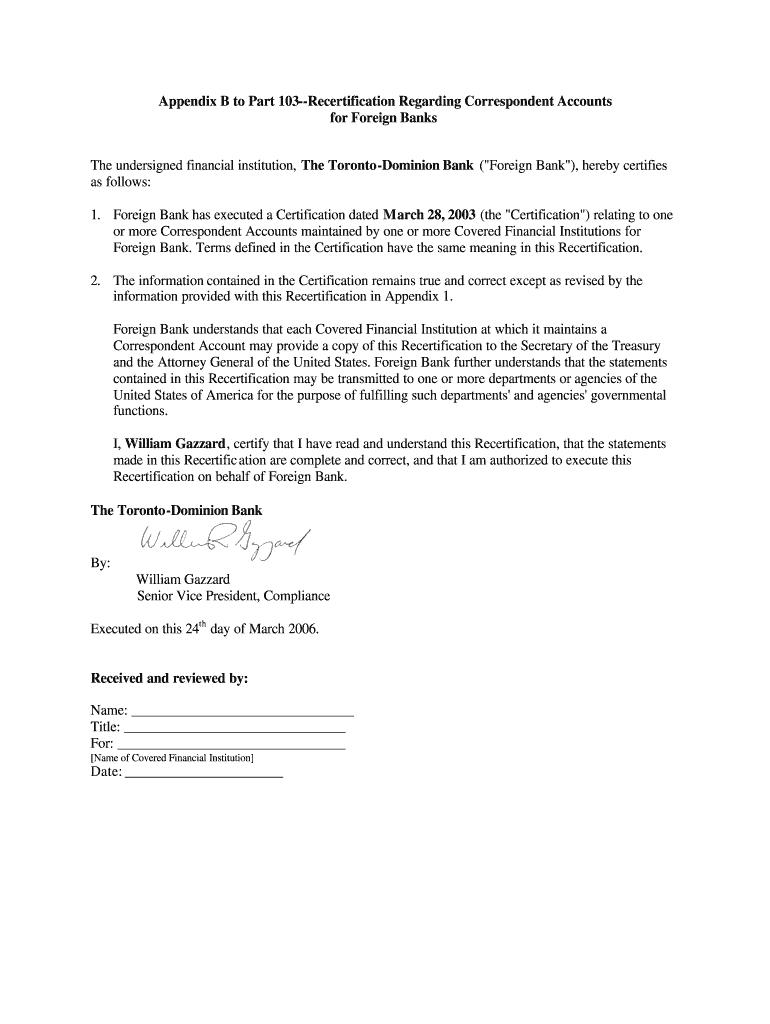

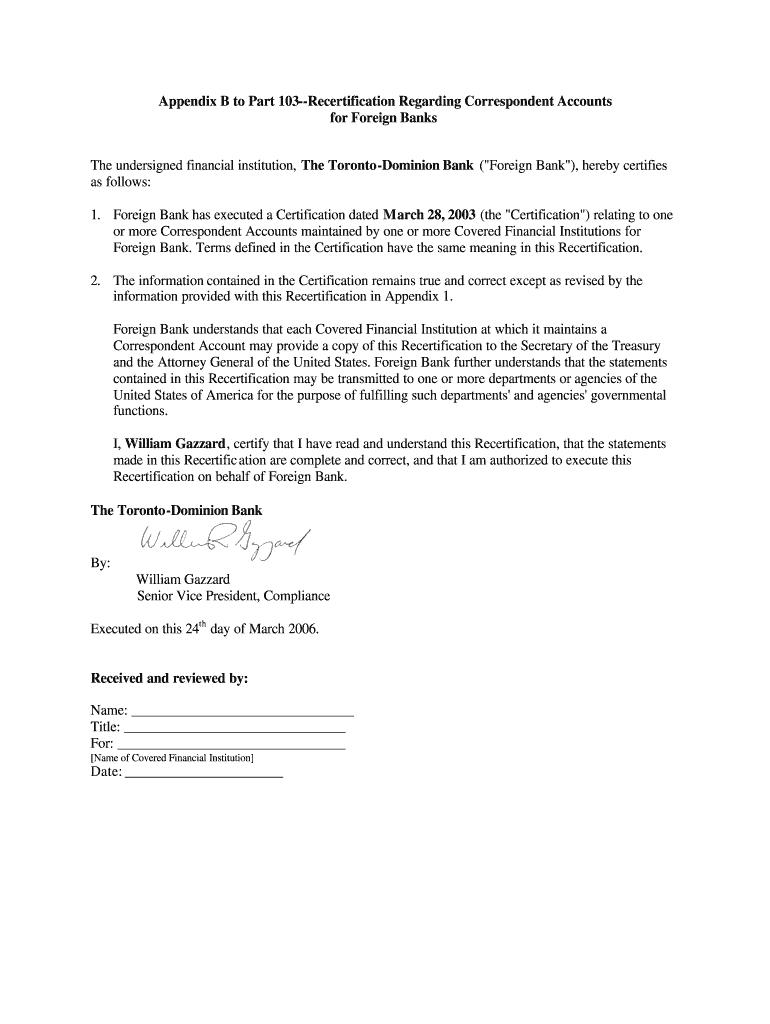

This document serves as a recertification by The Toronto-Dominion Bank regarding correspondent accounts maintained by covered financial institutions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appendix b to part

Edit your appendix b to part form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appendix b to part form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit appendix b to part online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

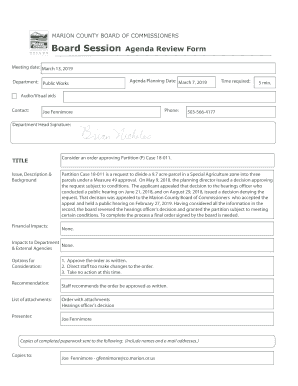

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit appendix b to part. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

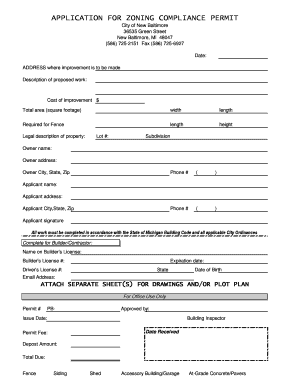

How to fill out appendix b to part

How to fill out Appendix B to Part 103--Recertification Regarding Correspondent Accounts for Foreign Banks

01

Gather all necessary documentation regarding correspondent accounts for foreign banks.

02

Review the requirements laid out in Appendix B to Part 103 to ensure compliance.

03

Complete the form by providing accurate information regarding the correspondent accounts.

04

Detail the necessary information about each foreign bank's identity, including names and locations.

05

Include any relevant transaction information associated with the correspondent accounts, as required.

06

Sign and date the form to certify its accuracy before submitting it to the relevant authority.

Who needs Appendix B to Part 103--Recertification Regarding Correspondent Accounts for Foreign Banks?

01

Financial institutions that maintain correspondent accounts for foreign banks.

02

Banks and financial entities required to comply with regulations under Part 103.

Fill

form

: Try Risk Free

People Also Ask about

How often must US banks recertify each foreign bank for which they maintain correspondent accounts?

As noted above, a covered financial institution is required to obtain an initial certification and a recertification once every subsequent three years from each foreign bank for which it maintains a correspondent account.

What is a foreign correspondent bank account?

A correspondent account for a foreign bank is any account to receive deposits from, make payments or other disbursements on behalf of a foreign bank, or handle other financial transactions related to the foreign bank.

What is required information in a bank's due diligence for a foreign correspondent bank account?

With regard to foreign correspondent accounts, each bank's due diligence program must include policies and procedures to assess risks posed by a foreign financial institution and consider all relevant factors including the foreign financial institution's business and markets; the type, purpose and anticipated activity

Is Swift a correspondent bank?

Correspondent banks are most commonly used when funds need to be transferred to a foreign country. This is done through SWIFT or the Society for Worldwide Interbank Financial Telecommunication. SWIFT is the largest network of correspondent banks worldwide.

Which information must a United States financial institution retain for having foreign correspondent accounts as part of the USA Patriot Act record keeping requirements?

A covered financial institution that maintains a correspondent account in the United States for a foreign bank shall maintain records in the United States identifying the owners of each such foreign bank and the name and address of a person who resides in the United States and is authorized, and has agreed to be an

What is the difference between a bank and a correspondent bank?

Correspondent banks are financial institutions that provide services on behalf of other banks, especially in countries where the originating bank does not have a physical presence.

What is the meaning of correspondent bank account?

For a bank, correspondent banking means opening an account in a foreign bank to carry out operations in a local currency (dollar, yen, etc). In fact, international regulations state that a currency must be held in its country of origin (excluding fiat currency).

What are foreign correspondent banks?

Correspondent banking involves financial institutions providing services on behalf of other banks, usually in different countries. These services include conducting transactions, processing wire transfers, and document collection.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Appendix B to Part 103--Recertification Regarding Correspondent Accounts for Foreign Banks?

Appendix B to Part 103 outlines the recertification process that U.S. financial institutions must follow regarding their correspondent accounts with foreign banks to ensure compliance with anti-money laundering regulations.

Who is required to file Appendix B to Part 103--Recertification Regarding Correspondent Accounts for Foreign Banks?

U.S. financial institutions that maintain correspondent accounts for foreign banks are required to file Appendix B to Part 103 as part of their compliance obligations.

How to fill out Appendix B to Part 103--Recertification Regarding Correspondent Accounts for Foreign Banks?

To fill out Appendix B, institutions must provide detailed information about the correspondent accounts, including the identity of the foreign bank, the nature of the account, and confirm compliance with regulatory requirements.

What is the purpose of Appendix B to Part 103--Recertification Regarding Correspondent Accounts for Foreign Banks?

The purpose of Appendix B is to ensure that U.S. financial institutions continuously assess and verify the legitimacy and compliance of foreign banks with which they maintain correspondent accounts to prevent money laundering and terrorist financing.

What information must be reported on Appendix B to Part 103--Recertification Regarding Correspondent Accounts for Foreign Banks?

Information required includes the name and address of the foreign bank, the account number, types of services provided, and evidences of the foreign bank's compliance with anti-money laundering practices and regulations.

Fill out your appendix b to part online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appendix B To Part is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.