Get the Banks in Virginia - Free Checking AccountBurke & Herbert ...

Show details

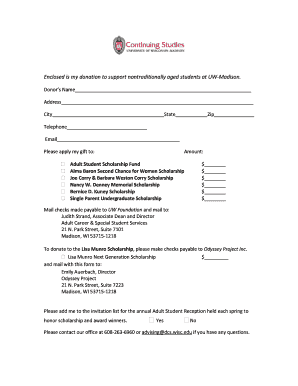

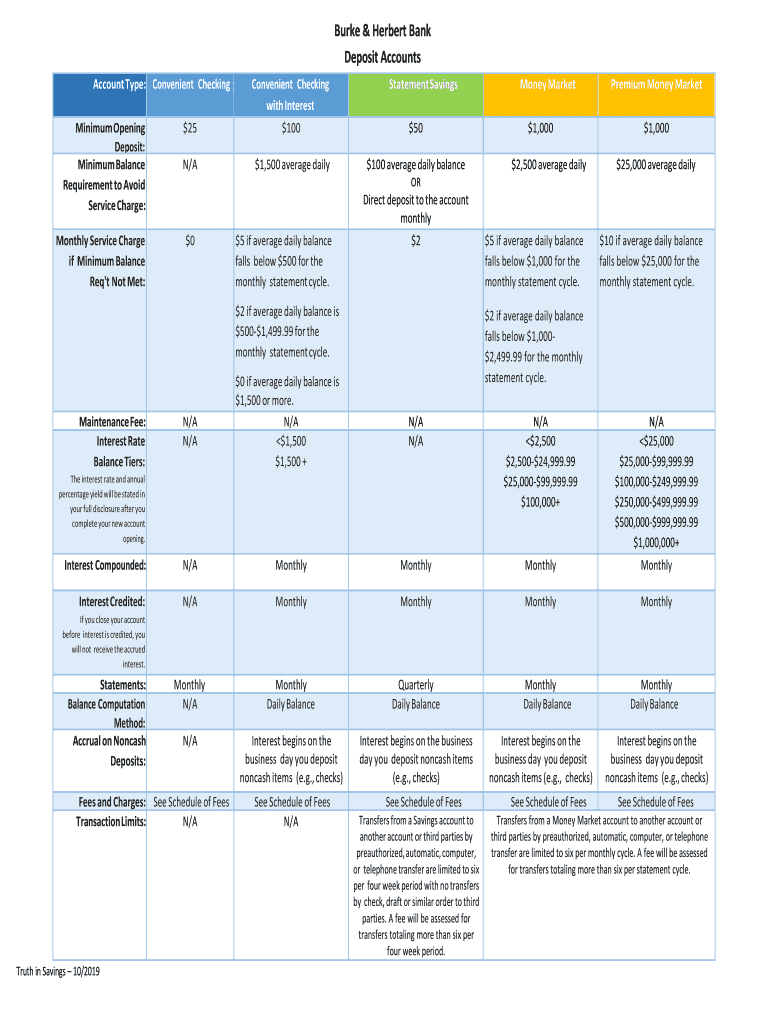

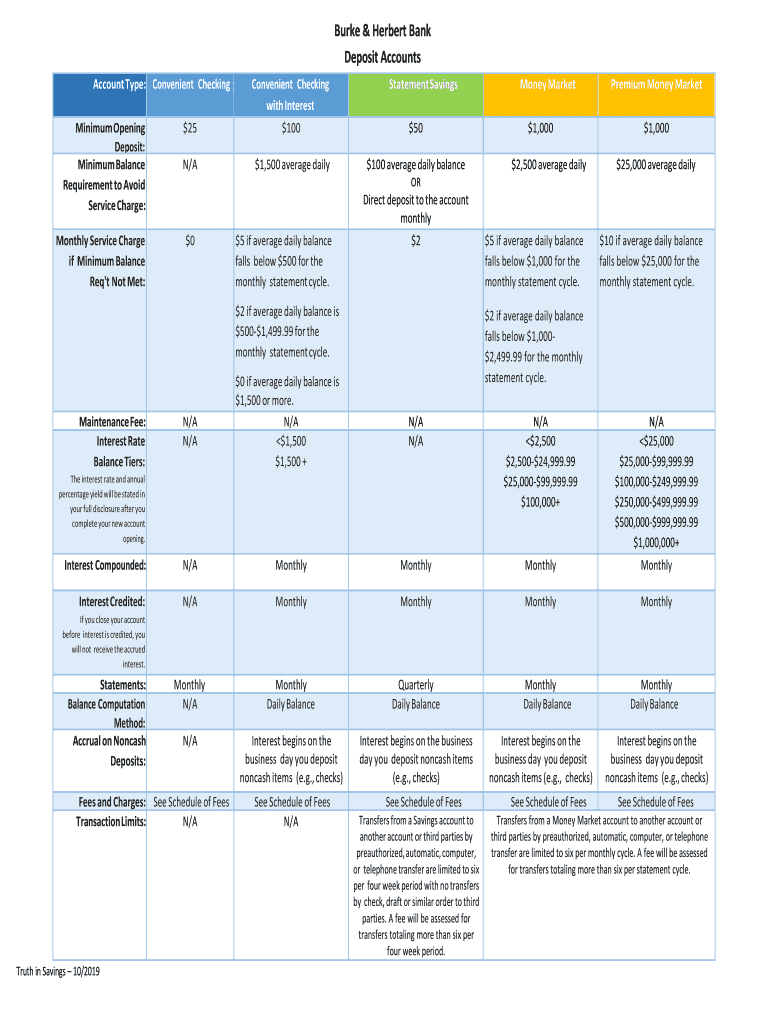

Burke & Herbert Bank Deposit Accounts Account Type: Convenient Checking Minimum Opening Deposit: Minimum Balance Requirement to Avoid Service Charge: Monthly Service Charge if Minimum Balance Req

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign banks in virginia

Edit your banks in virginia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your banks in virginia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing banks in virginia online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit banks in virginia. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out banks in virginia

How to fill out banks in Virginia:

Gather all necessary documents:

01

Identification: Bring a valid government-issued ID such as a driver's license or passport.

02

Social Security Number: Make sure you have your SSN handy.

03

Address Verification: Prepare a document that confirms your residential address like a utility bill or rental agreement.

04

Employment Information: If applicable, bring proof of your current job, such as pay stubs or a letter from your employer.

Research different banks:

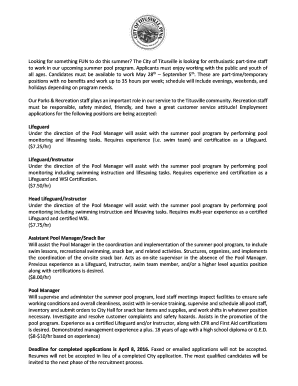

01

Look for banks that have branches or ATMs convenient for you.

02

Compare their services, fees, and account options to find the best fit for your needs.

03

Read reviews and consider recommendations from friends or relatives.

Visit the bank:

01

Choose a day and time when the bank is open and not too busy.

02

Walk into the bank branch and approach a customer service representative or teller.

03

Inform them that you want to open an account and they will guide you through the process.

Discuss account options:

01

Explain your banking needs and preferences to the representative.

02

Ask about different types of accounts, such as checking, savings, or investment accounts.

03

Inquire about any additional services the bank offers, such as online banking or mobile apps.

Provide personal information:

01

Fill out any required forms or applications provided by the bank.

02

Provide your name, address, phone number, and other details as requested.

03

Ensure that all information provided is accurate and up to date.

Submit identification and documents:

01

Present your identification, SSN, address verification, and employment information to the bank representative.

02

They will review and make copies of your documents for their records.

Choose your account:

01

Based on the information you provided and your preferences, decide on the type of account you want to open.

02

Discuss any fees, minimum balance requirements, and benefits associated with the account.

03

Once everything is clear, inform the bank representative of your account choice.

Deposit initial funds:

01

To activate your account, deposit the required amount of money specified by the bank.

02

You can submit cash, a check, or perform a transfer from another bank account.

Review and sign documents:

01

Carefully review all the terms, conditions, and agreements provided by the bank.

02

Sign any necessary paperwork to complete the account opening process.

03

If you have any questions or concerns, do not hesitate to ask the bank representative.

Who needs banks in Virginia:

Individuals:

01

Locals needing a safe place to keep their savings.

02

People looking for convenient access to money through ATMs or branches.

03

Those requiring loans or mortgages for homes, cars, or other expenses.

Businesses:

01

Companies needing a bank account to manage their finances and transactions.

02

Small businesses seeking loans or lines of credit to support their operations or expansion.

Students and scholars:

01

Students wanting to manage their finances, receive stipends or loans, and pay tuition.

02

Researchers or scholars from universities and institutions needing banking services during their stay in Virginia.

Non-profit organizations and charities:

01

Organizations requiring bank accounts to handle donations, payments, and financial operations.

02

Charities receiving funds and distributing aid to individuals or communities in need.

Investors and retirees:

01

Individuals looking for investment opportunities, such as stocks, mutual funds, or retirement accounts.

02

Retirees needing a safe place to manage and withdraw their retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is banks in virginia?

Banks in Virginia refers to the annual report required to be filed by banks and financial institutions operating in the state.

Who is required to file banks in virginia?

All banks and financial institutions operating in Virginia are required to file banks report.

How to fill out banks in virginia?

Banks in Virginia can be filled out online through the official website of the Virginia State Corporation Commission.

What is the purpose of banks in virginia?

The purpose of banks in Virginia is to provide information about the financial health and operations of banks and financial institutions in the state.

What information must be reported on banks in virginia?

Information such as financial statements, balance sheet, income statement, and other relevant financial data must be reported on banks in Virginia.

How can I send banks in virginia for eSignature?

Once you are ready to share your banks in virginia, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete banks in virginia online?

pdfFiller makes it easy to finish and sign banks in virginia online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my banks in virginia in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your banks in virginia right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your banks in virginia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Banks In Virginia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.