Get the free Private Trust Companies in Bermuda

Show details

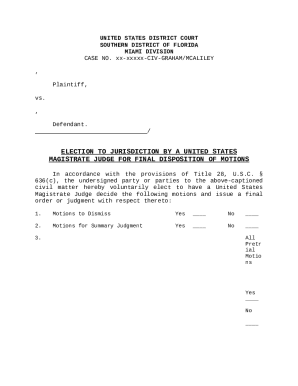

This document provides an overview of the framework for Private Trust Companies (PTCs) in Bermuda, discussing their purpose, setup processes, legal requirements, advantages, and the services offered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private trust companies in

Edit your private trust companies in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private trust companies in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private trust companies in online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit private trust companies in. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private trust companies in

How to fill out Private Trust Companies in Bermuda

01

Understand the regulatory framework governing Private Trust Companies in Bermuda.

02

Gather necessary documentation, including proof of identity and source of funds.

03

Draft the trust's governing instrument, clearly outlining its purpose and structure.

04

Appoint qualified trustees who meet Bermuda's legal requirements.

05

Submit an application to the Bermuda Monetary Authority (BMA) for approval.

06

Pay the applicable fees associated with the application and registration process.

07

Create a compliance plan that addresses anti-money laundering (AML) and financial regulations.

08

Once approved, register the Private Trust Company with the BMA and comply with ongoing regulatory obligations.

Who needs Private Trust Companies in Bermuda?

01

High-net-worth individuals seeking bespoke estate planning solutions.

02

Families desiring a dedicated entity to manage family wealth across generations.

03

Trust professionals looking to establish a specialized trust company for private clients.

04

Entities needing a tailored vehicle for holding investments and assets in a compliant manner.

Fill

form

: Try Risk Free

People Also Ask about

What are examples of trust companies?

Some of the larger trust companies are Northern Trust, Bessemer Trust, and U.S. Trust, which is part of Bank of America Corporation. These trust companies generally charge fees that are based on a percentage of assets, which may range from 1.00% to 2.0%, depending on the size of the trust.

What is considered a personal trust?

A personal trust is a trust that an individual creates, formally naming themselves as the beneficiary. Personal trusts are separate legal entities that have the authority to buy, sell, hold, and manage property for the benefit of their trustors.

What is a private trust company?

Marketing Disclosure. Share. A private trust company or family trust company is an estate planning tool that can be used to preserve wealth. This type of trust entity is most often used by high-net-worth and ultra-high-net-worth individuals.

How do I set up a trust in Bermuda?

To establish a trust in Bermuda, you must first define the trust fund, which includes the assets you wish to protect. You, as the settlor, will transfer legal title of these assets to a trustee, who will manage them on behalf of your designated beneficiaries.

What is the difference between a trust and a private trust?

As a result, transparency is both necessary and important for a Public Trust, since at any time anyone with an interest in the Trust has the right to demand he or she knows specifics about the management of the Trust. By contrast, a Private Trust is set up to benefit one or more specific people.

What are the 4 types of trusts?

Trusts can be broadly categorized into four main types: Living Trusts, Testamentary Trusts, Revocable Trusts, and Irrevocable Trusts.

What is a private trust?

a legal arrangement in which you give a person or organization the right to manage your money for the person or group of people that you have chosen to receive the money: create/set up a private trust We can advise you on the benefits of creating a private trust to protect your family's wealth for the next generation.

Are trusts private?

When you create a living trust, the document itself is not filed with any court or public agency. Instead, it is a private agreement between you (the grantor) and the trustee (who may also be you during your lifetime).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Private Trust Companies in Bermuda?

Private Trust Companies in Bermuda are entities established to act as a trustee for a specific family's trusts and estates, providing a tailored approach to trust management.

Who is required to file Private Trust Companies in Bermuda?

Individuals or entities intending to operate as Private Trust Companies in Bermuda are required to file registration with the Bermuda Monetary Authority (BMA).

How to fill out Private Trust Companies in Bermuda?

To fill out the Private Trust Companies application, one must complete the requisite forms provided by the BMA, ensuring all details about the company's purpose and compliance with regulations are provided.

What is the purpose of Private Trust Companies in Bermuda?

The purpose of Private Trust Companies in Bermuda is to manage and administer trusts on behalf of a specific group, usually a family, allowing for greater control and privacy over the trust assets.

What information must be reported on Private Trust Companies in Bermuda?

Private Trust Companies in Bermuda must report information such as the identity of the directors, the purpose of the company, beneficiary details, and compliance with statutory requirements to the Bermuda Monetary Authority.

Fill out your private trust companies in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Trust Companies In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.