Get the free SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM

Show details

Este formulario se utiliza para registrar un Plan de Inversión Sistemático (SIP) y autorizar débitos automáticos de la cuenta bancaria del inversionista.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign systematic investment plan sip

Edit your systematic investment plan sip form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your systematic investment plan sip form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit systematic investment plan sip online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit systematic investment plan sip. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out systematic investment plan sip

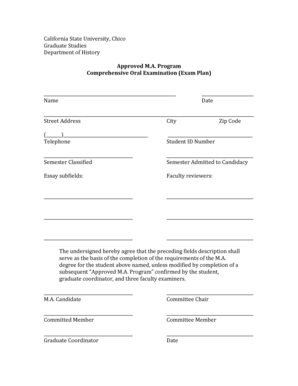

How to fill out SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM

01

Obtain the SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM from your financial institution or download it from their website.

02

Fill out your personal details such as name, address, contact number, and email at the designated sections of the form.

03

Provide your bank details, including bank name, account number, and IFSC code for the auto debit setup.

04

Specify the SIP amount you wish to invest regularly, along with the frequency (monthly, quarterly, etc.).

05

Choose the start date for the auto debit instruction, ensuring it aligns with the SIP installment schedule.

06

Sign the form at the designated signature field to authorize the auto debit.

07

Submit the completed form to your financial institution, either physically or through their online submission process.

Who needs SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM?

01

Individuals looking to invest regularly in mutual funds without manually initiating transactions each time.

02

Those who want to automate their investment process and build wealth over time through systematic investments.

03

Investors who prefer a disciplined approach to savings and investments.

Fill

form

: Try Risk Free

People Also Ask about

How to debit money from SIP investment?

Log in to your trading account, locate the section displaying your mutual fund holdings, and identify the specific SIP investment you want to withdraw, adhering to the principles of “how to withdraw SIP amount.” Follow the platform's instructions, specifying the withdrawal amount and providing any further details as

Is SIP auto-debit?

An SIP works like a recurring investment, where the amount is auto-debited from your bank account and invested in the mutual fund of your choice. Once the amount is deposited, you get a certain number of units of the mutual fund scheme where you have invested.

What happens if SIP auto-debit fails?

Consequences of missing an SIP payment Bank charges and penalties: If SIP payments are made through ECS (Electronic Clearing Service) or auto-debit, a failed transaction due to insufficient funds may attract bank penalties.

What is auto debit in SIP?

Essentially, this is an auto-pay option for an SIP through an eNACH mandate. An OTM in SIP investing is a one-time registration process in which you instruct your bank to deduct a specific amount from your savings account and credit the same to your SIP portfolio at regular intervals.

How to fill form of SIP?

Keep the Following Documents Handy. - ID proof. Complete your KYC. Completing KYC requirements is important for any financial investment. Register for an SIP. Choose a reputed Indian broker or financial advisor to register for an SIP. Choose the Right Plan. Determine the Investment Amount. Pick the SIP Date. Submit your Form.

What is an auto SIP?

Or you can choose to invest via Systematic Investment Plan or SIP. You need to start an SIP of a set amount. Say Rs 500. Then Rs 500 will be deducted from your account and auto credited to the mutual fund you want to invest in, at a certain fixed date every month. This will continue till the time period.

How to set autopay in SIP?

0:24 1:29 Select your autopay from the mandate. Drop-down during the SIP setup for existing SIPs modify yourMoreSelect your autopay from the mandate. Drop-down during the SIP setup for existing SIPs modify your SIP. And select the mandate from the drop-down.

What is meant by auto-debit?

An auto-debit is a financial arrangement that enables the automatic deduction of payments from a customer's bank account or card on a predetermined schedule. This feature is commonly used for recurring expenses such as: Utility bills (electricity, water, gas) Loan EMIs (Equated Monthly Instalments) Insurance premiums.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

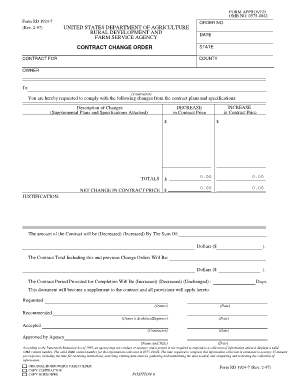

What is SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM?

The SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM is a document that allows investors to automate their investment in mutual funds by setting up periodic deductions from their bank account.

Who is required to file SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM?

Individuals who wish to invest in mutual funds through a systematic investment plan and prefer automatic deductions from their bank account are required to file the SIP Auto Debit Form.

How to fill out SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM?

To fill out the SIP Auto Debit Form, investors need to provide their personal details, bank account information, the amount to be invested, the frequency of investment, and the mutual fund scheme they wish to invest in.

What is the purpose of SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM?

The purpose of the SIP Auto Debit Form is to facilitate automatic and regular investments in mutual funds, making it easier for investors to build their wealth over time without needing to make manual transactions.

What information must be reported on SYSTEMATIC INVESTMENT PLAN (SIP) - AUTO DEBIT FORM?

The information that must be reported on the SIP Auto Debit Form includes the investor's personal details, bank details, mutual fund scheme details, investment amount, and the chosen frequency for debit transactions.

Fill out your systematic investment plan sip online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Systematic Investment Plan Sip is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.