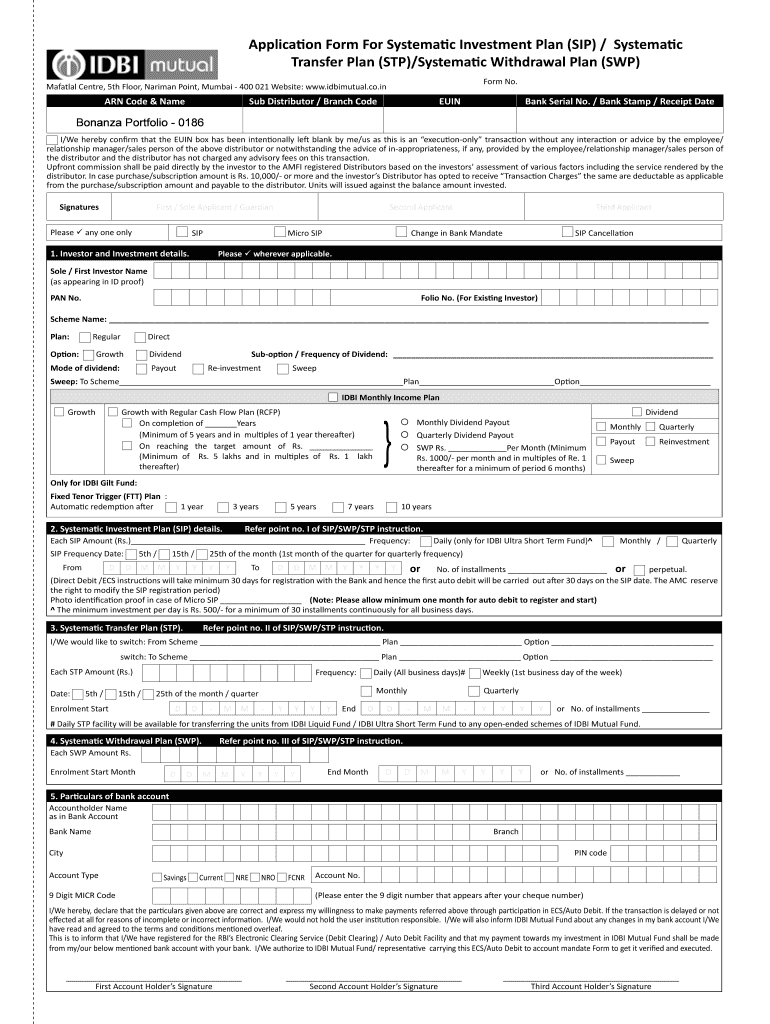

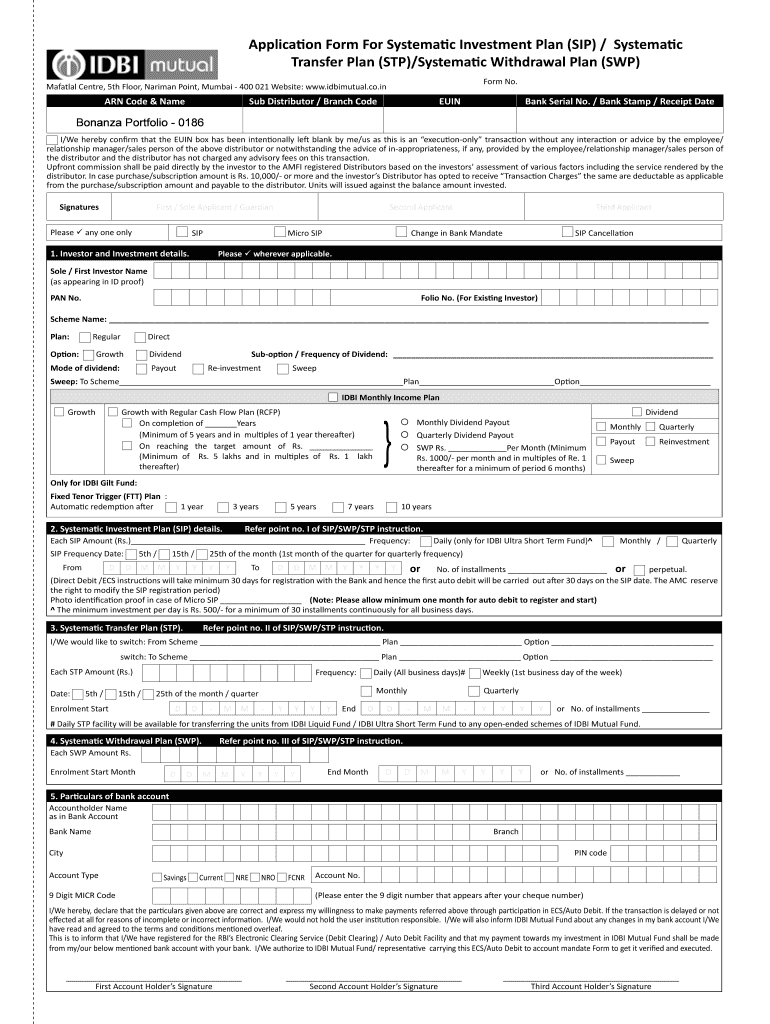

Get the free Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (ST...

Show details

This document is used to apply for various systematic investment plans and outlines the details required for investment, including options for systematic withdrawal, transfer, and investment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application form for systematic

Edit your application form for systematic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application form for systematic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application form for systematic online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application form for systematic. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application form for systematic

How to fill out Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP)/Systematic Withdrawal Plan (SWP)

01

Visit the official website of the mutual fund company or your financial advisor.

02

Download the Application Form for SIP/STP/SWP from the website or request a physical copy.

03

Fill in your personal details such as name, address, and contact information.

04

Provide your bank details for the transaction. This includes bank name, account number, and IFSC code.

05

Specify the investment amount and frequency (monthly, quarterly, etc.) for SIP/STP/SWP.

06

Select the mutual fund scheme you want to invest in.

07

Sign the form and attach any required documents, such as KYC (Know Your Customer) documents.

08

Submit the completed form to the mutual fund company or through your financial advisor.

Who needs Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP)/Systematic Withdrawal Plan (SWP)?

01

Investors looking to build wealth over time through systematic investments.

02

Individuals who want to periodically transfer funds between different mutual fund schemes.

03

Those who wish to withdraw a fixed amount from their investment at regular intervals.

Fill

form

: Try Risk Free

People Also Ask about

What is the SWP systematic withdrawal plan?

A Systematic Withdrawal Plan (SWP) is a financial facility that allows investors to withdraw a fixed amount of money from their mutual fund investment at regular intervals. This feature is particularly beneficial for those seeking a steady income stream, such as retirees or individuals requiring regular cash flow.

What is an STP systematic transfer plan?

STP or Systematic Transfer Plan is a facility offered by mutual funds that allows investors to transfer a fixed amount of money from one mutual fund scheme to another within the same fund house at regular intervals. Typically, the transfer is made from a debt or liquid fund to an equity fund.

How much is 5000 SIP per month for 5 years?

If you invest Rs. 5,000 per month through SIP for 5 years, assuming 12% return. The estimate total returns will be Rs. 1,12,432 and the estimate future value of your investment will be Rs. 4,12,431.

What is the 4 rule of SWP?

The 4% rule is a popular guideline for retirees seeking to determine how much they can safely withdraw from their retirement savings each year. This rule suggests that withdrawing no more than 4% of your retirement corpus annually can help ensure your savings last throughout your retirement.

Can I withdraw SIP anytime?

Yes, you can exit your SIP (Systematic Investment Plan) anytime without facing penalties. However, if you redeem your units before completing a specified lock-in period, you might incur exit load charges. These charges vary depending on the mutual fund scheme, typically ranging from 1% to 3%.

What is the SIP SWP strategy?

SIP is great for building wealth with regular, small investments. STP helps manage market risk when investing lump sums. SWP supports consistent income without redeeming everything at once. The best results often come from using these tools together.

What is SIP, stp, and swp?

You can choose to invest via the Systematic Investment Plan (SIP) and Systematic Transfer Plan (STP) route and you can opt to systematically withdraw your investments over a period of time through the Systematic Withdrawal Plan (SWP) route.

Is STP better than SIP?

Choose SIP if you want to invest directly from your income in small, regular amounts. It's best for first-time investors or salaried individuals. Go for STP if you have a lump sum and want to shift it slowly from a safer fund (like debt) to a more growth-focused fund (like equity).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP)/Systematic Withdrawal Plan (SWP)?

The Application Form for SIP, STP, and SWP is a document that investors use to enroll in systematic investment, transfer, or withdrawal plans offered by mutual funds. These forms facilitate the systematic management of funds by allowing investors to contribute, transfer, or withdraw amounts at regular intervals.

Who is required to file Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP)/Systematic Withdrawal Plan (SWP)?

Individuals or entities wishing to participate in SIP, STP, or SWP need to file the Application Form. This includes retail investors, institutional investors, and anyone looking to manage their investments systematically in mutual funds.

How to fill out Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP)/Systematic Withdrawal Plan (SWP)?

To fill out the Application Form, investors need to provide personal details such as name, address, and PAN, choose the type of plan (SIP, STP, or SWP), specify the frequency and amount of transactions, and sign the form. It is important to ensure all information is accurate and complete to avoid processing delays.

What is the purpose of Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP)/Systematic Withdrawal Plan (SWP)?

The purpose of the Application Form is to formalize the investor's intent to participate in systematic plans, which allow for disciplined investing, managing risk, and ensuring liquidity through regular contributions or withdrawals.

What information must be reported on Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP)/Systematic Withdrawal Plan (SWP)?

The Application Form must include investor identification details (like name and contact information), PAN (Permanent Account Number), the selected plan type (SIP, STP, or SWP), transaction frequency, amount, and signature, along with any additional documentation required by the mutual fund.

Fill out your application form for systematic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Form For Systematic is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.