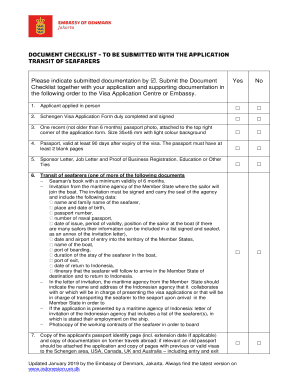

Get the free Guidelines on the Prevention & Detection of Money Laundering for Licensees

Show details

This document outlines the guidelines established by The Central Bank of The Bahamas for the prevention and detection of money laundering by banks and trust companies. It includes required procedures,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidelines on form prevention

Edit your guidelines on form prevention form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidelines on form prevention form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guidelines on form prevention online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guidelines on form prevention. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidelines on form prevention

How to fill out Guidelines on the Prevention & Detection of Money Laundering for Licensees

01

Read the Guidelines thoroughly to understand the requirements.

02

Gather necessary documentation relevant to your business operations.

03

Assess your current procedures for detecting and preventing money laundering.

04

Identify any gaps in your current practices compared to the Guidelines.

05

Develop or update your anti-money laundering (AML) policies and procedures.

06

Train staff on the new policies and ensure they understand their roles in compliance.

07

Implement monitoring systems to detect suspicious activities.

08

Regularly review and update your procedures to reflect changes in regulations.

Who needs Guidelines on the Prevention & Detection of Money Laundering for Licensees?

01

Financial institutions including banks and credit unions.

02

Gaming establishments such as casinos.

03

Insurance companies.

04

Real estate firms and agents.

05

Law firms dealing with financial transactions.

06

Businesses engaged in high-value goods trading.

07

All entities licensed to operate in sectors prone to money laundering.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Guidelines on the Prevention & Detection of Money Laundering for Licensees?

The Guidelines on the Prevention & Detection of Money Laundering for Licensees provide a framework to help entities implement effective measures to prevent and detect money laundering activities, ensuring compliance with legal and regulatory obligations.

Who is required to file Guidelines on the Prevention & Detection of Money Laundering for Licensees?

Licensees operating in regulated sectors, such as financial institutions, real estate agencies, and other businesses susceptible to money laundering, are required to file and adhere to these guidelines.

How to fill out Guidelines on the Prevention & Detection of Money Laundering for Licensees?

Entities should fill out the guidelines by assessing their risk exposure, establishing internal policies and procedures, documenting compliance efforts, and ensuring that all relevant information is captured and reported accurately.

What is the purpose of Guidelines on the Prevention & Detection of Money Laundering for Licensees?

The purpose of the guidelines is to safeguard the financial system from being used for money laundering purposes, enhance transparency in transactions, and ensure that licensees fulfill their responsibilities in identifying and reporting suspicious activities.

What information must be reported on Guidelines on the Prevention & Detection of Money Laundering for Licensees?

Licensees must report information including but not limited to suspicious transaction reports, customer due diligence information, and the implementation of risk assessment measures related to money laundering activities.

Fill out your guidelines on form prevention online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidelines On Form Prevention is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.