Get the free Annuity and Life Insurance Sales Practice Class Actions BY ...

Show details

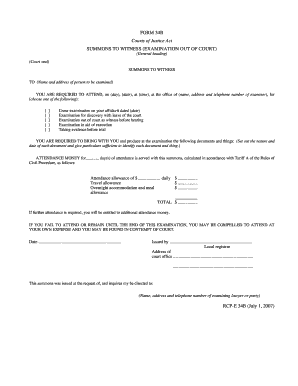

Annuity and Life Insurance Sales Practice Class Actions: Joseph H. Jay Aught man Beasley, Allen, Crow, Melvin, Ports & Miles, P.C. Montgomery, Alabama I. Annuity Sales sale of various forms of annuity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annuity and life insurance

Edit your annuity and life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity and life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annuity and life insurance online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annuity and life insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annuity and life insurance

How to fill out annuity and life insurance:

01

Start by gathering all relevant personal information, including your name, address, date of birth, and social security number.

02

Research different types of annuity and life insurance policies to determine which ones align with your financial goals and needs.

03

Contact insurance companies or agents to request quotes and compare the costs and benefits of various policies.

04

Read the policy documents carefully to understand the terms, conditions, and exclusions.

05

Fill out the application form accurately and provide all necessary details, such as your medical history, lifestyle habits, and financial information.

06

Attach any required supporting documents, such as medical reports or financial statements.

07

Review your completed application thoroughly to ensure no errors or omissions.

08

Sign the application form and submit it along with any required payment or premiums.

Who needs annuity and life insurance:

01

Individuals who want to secure their financial future and protect their loved ones financially in case of their demise.

02

People who have dependents or debts that they wish to cover, such as mortgages, student loans, or credit card bills.

03

Individuals who want to supplement their retirement income and ensure a steady stream of income during their golden years.

04

Business owners who want to safeguard their business against key personnel loss or to fund a buy-sell agreement.

05

Those with estate planning goals to preserve wealth and minimize estate taxes.

06

Individuals who want to take advantage of potential tax benefits offered by annuities and life insurance products.

07

People with health conditions that make it difficult to obtain traditional life insurance may consider annuities with guaranteed lifetime income options.

Note: It's important to consult with a qualified financial advisor or insurance professional to determine the most suitable annuity and life insurance options for your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send annuity and life insurance for eSignature?

annuity and life insurance is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in annuity and life insurance?

The editing procedure is simple with pdfFiller. Open your annuity and life insurance in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit annuity and life insurance straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing annuity and life insurance, you need to install and log in to the app.

What is annuity and life insurance?

Annuity is a financial product that provides a fixed stream of payments to the holder at regular intervals. Life insurance is a contract between an individual and an insurance company, where the insurer guarantees to pay a designated beneficiary a sum of money upon the death of the insured person.

Who is required to file annuity and life insurance?

Individuals who have purchased annuity plans or life insurance policies are required to file their annuity and life insurance accounts.

How to fill out annuity and life insurance?

To fill out annuity and life insurance, you need to gather the necessary information related to your annuity or life insurance policy and accurately complete the required forms provided by the insurance company. It is recommended to consult with a tax professional for guidance on correctly completing the forms.

What is the purpose of annuity and life insurance?

The purpose of annuity is to provide a steady income stream during retirement, while life insurance serves to provide financial protection to the insured's beneficiaries in the event of their death.

What information must be reported on annuity and life insurance?

The information that must be reported on annuity and life insurance includes policy details, such as the policy number, premium amounts, beneficiary information, and any changes or updates to the policy throughout the year.

Fill out your annuity and life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annuity And Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.