Get the free No - Forms and Procedures - Fullerton College - formsandprocedures fullcoll

Show details

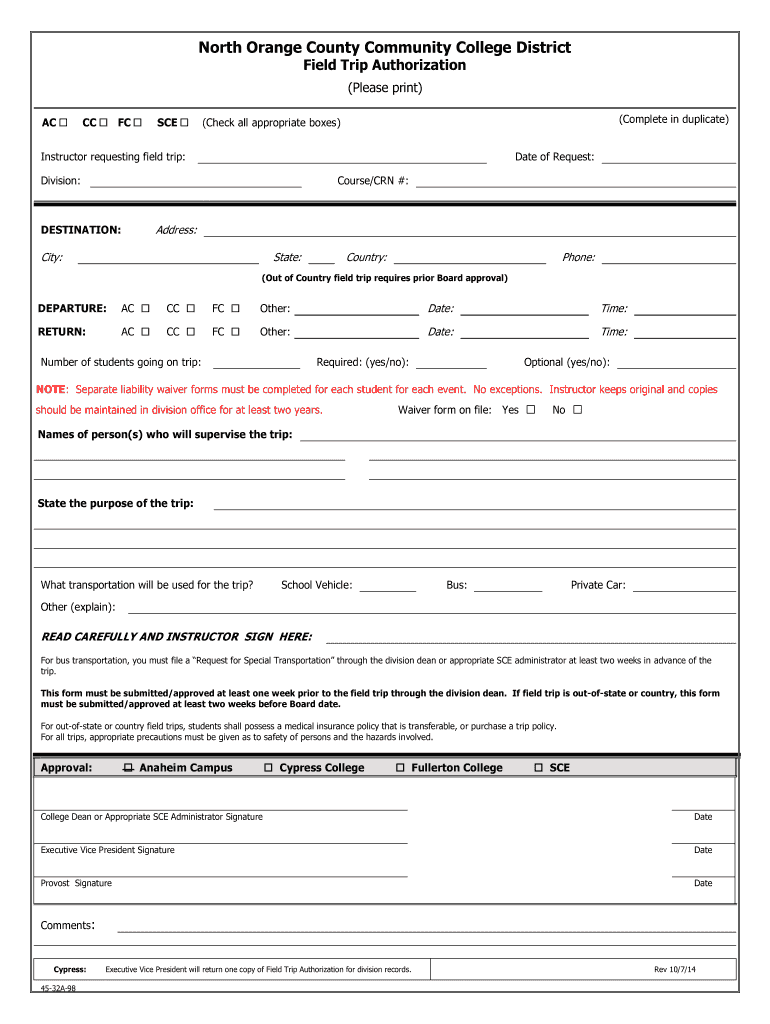

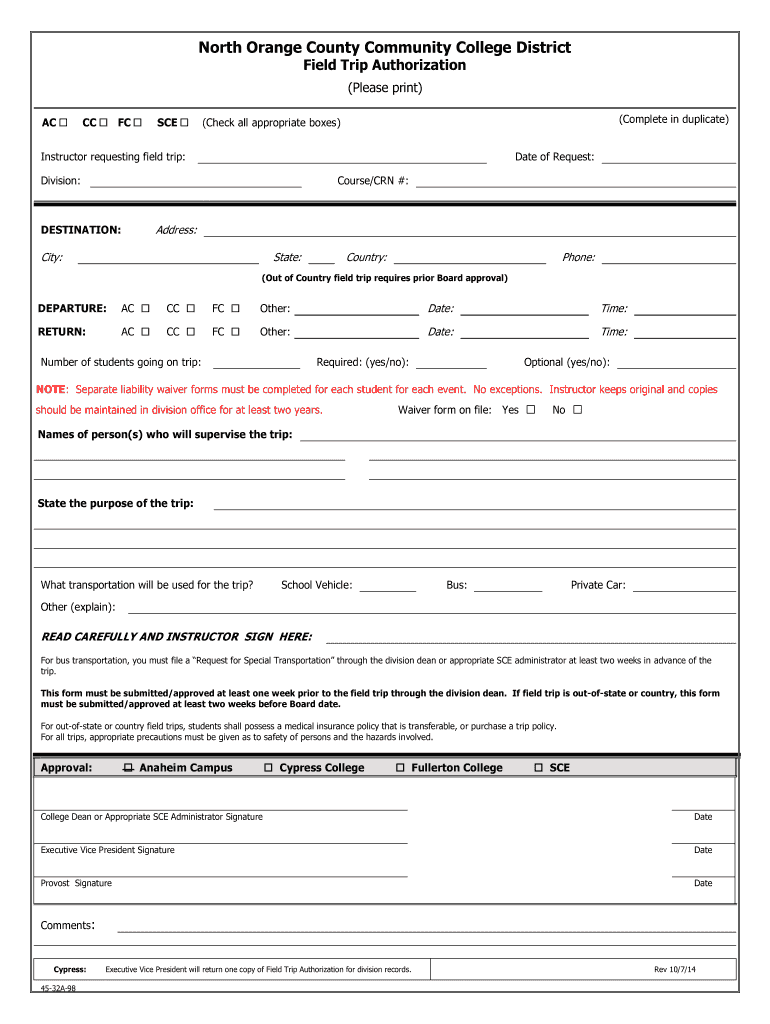

NorthOrangeCountyCommunityCollegeDistrict FieldTripAuthorization (Please print) AC CC FC (Completeinduplicate) SHE (Checkallappropriateboxes) Instructorrequestingfieldtrip: DateofRequest: Division:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no - forms and

Edit your no - forms and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no - forms and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing no - forms and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit no - forms and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no - forms and

How to fill out no - forms and?

01

Gather all necessary information: Before filling out a no - form, make sure you have all the required information at hand. This may include personal details, contact information, tax identification numbers, and any supporting documentation related to the purpose of the form.

02

Read the instructions carefully: Every no - form comes with its own set of instructions. Take the time to read and understand them thoroughly before you start filling out the form. The instructions will provide guidance on how to complete each section correctly.

03

Use black ink and write legibly: Most no - forms require you to fill them out using black ink. This ensures that the information is clear and can be easily read when processed. Write legibly and avoid any unnecessary markings or stray notes that could confuse the person reviewing your form.

04

Provide accurate information: It is crucial to provide accurate information when filling out no - forms. Double-check all the details you enter, such as names, addresses, and numbers, to ensure there are no mistakes or discrepancies.

05

Follow the format and structure: Many no - forms have specific formats and structures that need to be followed. Pay attention to the order of sections or questions and fill them out accordingly. This helps streamline the processing of your form and reduces the chances of errors.

Who needs no - forms and?

01

Individuals applying for government benefits: No - forms are often required when applying for various government benefits such as unemployment benefits, food assistance programs, or subsidized housing. These forms help gather essential information to determine eligibility and facilitate the application process.

02

Employers and employees for tax purposes: Both employers and employees may need to fill out no - forms related to taxation. Employers use forms like the W-4 to collect information about their employees' federal income tax withholding, while employees may need to complete forms like the W-9 to provide their taxpayer identification number for reporting income.

03

Contractors and freelancers: Independent contractors and freelancers often need to fill out no - forms such as the 1099-MISC to report their income earned from clients or businesses. These forms are essential for taxation and documentation purposes.

04

Individuals involved in legal matters: No - forms are also required in legal matters, such as filing petitions, divorce forms, or estate planning documents. These forms help ensure that all relevant information is properly recorded and presented in legal proceedings.

05

Students applying for financial aid: Students seeking financial aid for college or university often have to complete no - forms, such as the Free Application for Federal Student Aid (FAFSA). These forms collect financial information and are used to determine eligibility for different types of financial assistance.

By following the proper procedures for filling out no - forms, individuals can ensure accuracy and efficiency in their applications or submissions. Whether it is for government benefits, tax purposes, legal matters, or educational funding, understanding the specific requirements of each form and providing accurate information is crucial.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send no - forms and to be eSigned by others?

When you're ready to share your no - forms and, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I edit no - forms and on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing no - forms and right away.

How do I fill out the no - forms and form on my smartphone?

Use the pdfFiller mobile app to fill out and sign no - forms and on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is no - forms and?

No - forms and is a form used to report that no forms and were filed during a specific period of time.

Who is required to file no - forms and?

Any individual or entity who did not file any forms and during the reporting period is required to file a no - forms and.

How to fill out no - forms and?

To fill out a no - forms and, you would need to provide your basic information and certify that no forms and were filed during the specific reporting period.

What is the purpose of no - forms and?

The purpose of the no - forms and is to inform the relevant authorities that no forms and were filed by the individual or entity during the reporting period.

What information must be reported on no - forms and?

The information to be reported on a no - forms and typically includes the individual or entity's name, address, and a certification that no forms and were filed.

Fill out your no - forms and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No - Forms And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.