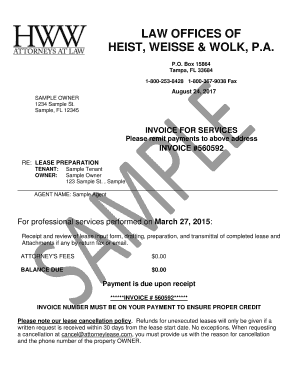

Get the free Post Office Loan Documentation Checklist

Show details

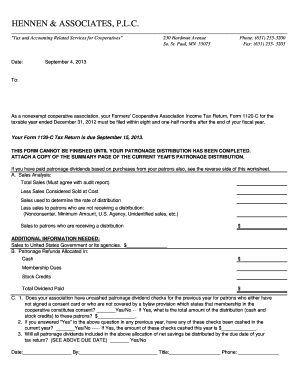

This document is a checklist to expedite the post office loan request process by outlining the necessary information and documentation required from borrowers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign post office loan documentation

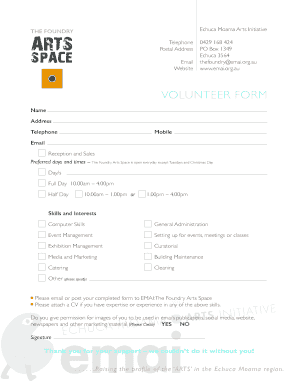

Edit your post office loan documentation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your post office loan documentation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing post office loan documentation online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit post office loan documentation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

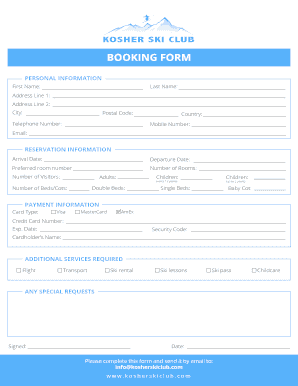

How to fill out post office loan documentation

How to fill out Post Office Loan Documentation Checklist

01

Obtain a copy of the Post Office Loan Documentation Checklist from the Post Office website or local branch.

02

Review the checklist to understand all required documentation for the loan application.

03

Gather necessary personal identification documents, such as a government-issued ID or passport.

04

Collect financial documents, including proof of income, bank statements, and tax returns for the past two years.

05

Prepare any additional documents required for the specific type of loan you are applying for, as listed in the checklist.

06

Double-check that all documents are complete, accurate, and the correct versions.

07

Organize the documents in the order specified in the checklist for easy submission.

08

Submit the completed checklist along with the gathered documents to the Post Office during your loan application process.

Who needs Post Office Loan Documentation Checklist?

01

Individuals applying for a loan through the Post Office.

02

First-time homebuyers seeking information about available loan products.

03

Borrowers looking to refinance existing loans.

04

Anyone needing financial assistance or personal loans offered by the Post Office.

Fill

form

: Try Risk Free

People Also Ask about

How will you verify loan documents?

Document verification You will generally be required to provide proof of identity, such as Aadhaar and PAN, proof of address, income documents like salary slips and bank statements, and employment details. The bank's verification team will cross-check all these documents to ensure their authenticity.

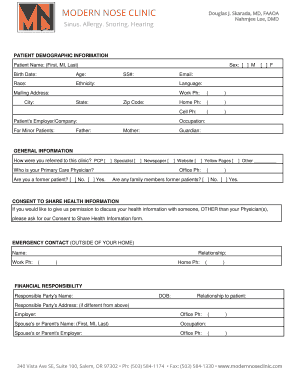

What documents are required for loan processing?

o Identity proof (PAN card, Voters ID, Passport, Aadhaar, etc.) o Address proof (Driving license, Passport, Aadhaar, etc.) For salaried individuals, provide income proof of the last 2 years' ITR/Form 16 and the latest 3 months' salary slip. Additionally, submit bank statements of the last 12 months.

What are KYC documents for a loan?

Individuals (Documents acceptable as proof of identity/address) Passport. Voter's Identity Card. Driving Licence. Aadhaar Letter/Card. NREGA Card. Letter issued by the National Population Register containing details of name and address.

What proof do you need to get a loan?

Identification: A government-issued ID, like a driver's license or passport. Proof of Income: Recent pay stubs or bank statements to demonstrate your ability to repay the loan. Personal Information: Details about your address, phone number, and possibly social security number.

What are the steps in loan processing?

Understanding the Different Stages of Loan Processing Stage 1: Application Submission. Stage 2: Documentation Verification. Stage 3: Credit Evaluation. Stage 4: Loan Underwriting. Stage 5: Loan Approval and Disbursement. Stage 6: Loan Servicing.

What is a loan documentation?

In particular, loan documents serve as a legal and binding contract between the institution and a borrower, detail the terms in which the borrower must repay the debt, and provide a way to secure collateral that is pledged on a loan.

What happens during processing of a loan?

During processing, the mortgage consultant begins verifying assets, income and employment, then orders a home appraisal to determine the value of the property if needed. Next, various compliance and eligibility checks ensure the process advances quickly and smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Post Office Loan Documentation Checklist?

The Post Office Loan Documentation Checklist is a comprehensive list of documents and information required to apply for a loan from the post office. It serves as a guide to ensure that applicants provide all necessary paperwork during the loan application process.

Who is required to file Post Office Loan Documentation Checklist?

Individuals applying for a loan from the post office are required to file the Post Office Loan Documentation Checklist. This includes personal loan applicants, housing loan applicants, and those seeking other financial assistance through post office services.

How to fill out Post Office Loan Documentation Checklist?

To fill out the Post Office Loan Documentation Checklist, applicants should carefully review each item on the checklist, gather the required documentation such as identification, proof of income, residency details, and complete the application form. Applicants should ensure that all documents are accurate and complete before submission.

What is the purpose of Post Office Loan Documentation Checklist?

The purpose of the Post Office Loan Documentation Checklist is to streamline the loan application process, ensure completeness and accuracy of submitted documents, and help applicants meet all requirements set by the post office for loan approval.

What information must be reported on Post Office Loan Documentation Checklist?

The information that must be reported on the Post Office Loan Documentation Checklist typically includes personal identification details, employment and income information, residential proof, credit history, and any other relevant financial documents that support the loan application.

Fill out your post office loan documentation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Post Office Loan Documentation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.